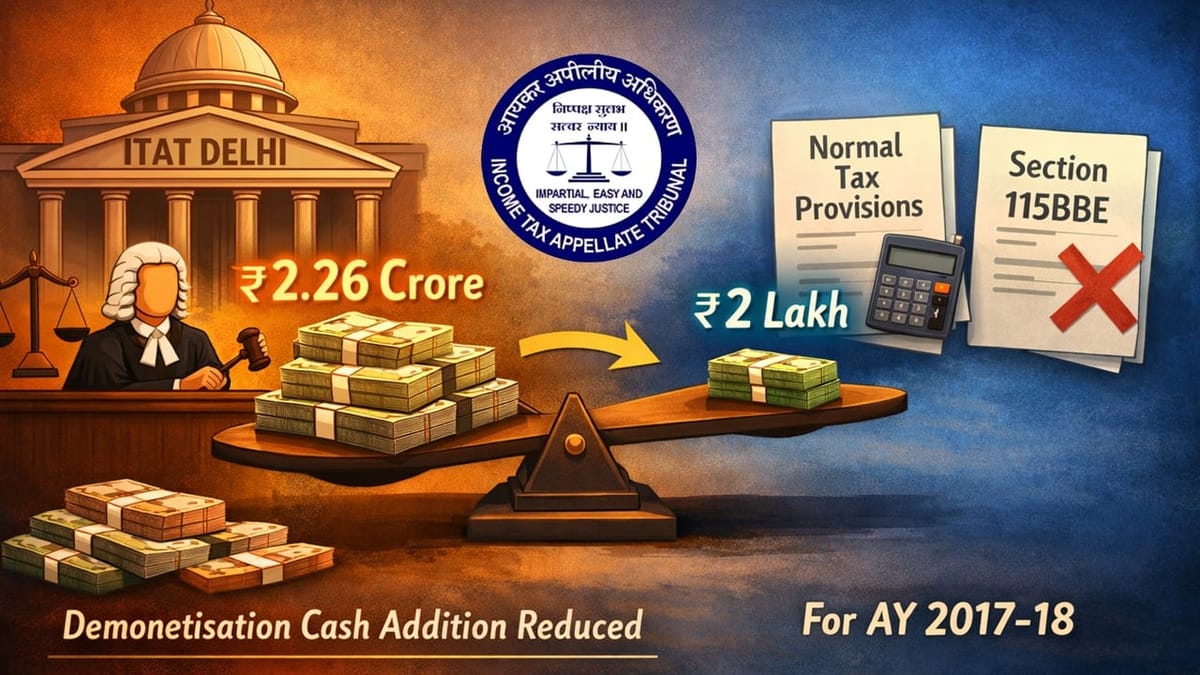

ITAT reduces the demonetisation cash addition from Rs. 2.26 crore to Rs. 2 lakh and held that normal tax provisions, not section 115BBE, apply for AY 2017-18.

Saloni Kumari | Jan 20, 2026 |

ITAT Reduces Demonetisation Cash Addition from Rs. 2.26 Crore to Rs. 2 Lakh; Section 115BBE Ruled Out

ITAT Delhi partly allowed the assessee’s appeal for AY 2017-18, reducing the demonetization cash addition from Rs. 2.26 crore to Rs. 2 lakh. Tribunal held deposits largely from sales and ruled normal tax applies, not section 115BBE, for the relevant assessment year.

The present appeal has been filed by a company named Gandaram and Sons Jewellers Private Limited in the ITAT Delhi against the Income Tax Department, challenging an order dated May 26, 2025, passed by the NFAC. The case is related to the Assessment Year 2017-18.

The assessee declared its total income at Rs. 42,56,460 during the year in consideration. The Assessing Officer (AO) selected the case for scrutiny through CASS. The AO noticed that the assessee had made some cash deposits amounting to Rs. 37,142,500 in its bank account during the demonetization period. When asked for evidence proving the source of the deposit, the assessee could not explain the genuineness of Rs. 27,901,079. In conclusion, the AO made an addition of Rs. 22,568,159 to the assessee’s income under section 68 of the Act, on the grounds of unexplained cash credit during the demonetization period.

The aggrieved assessee filed an appeal before the CIT(A). The CIT(A), after analysing the case in-depth, upheld the Rs. 22,568,159 addition made by the AO. The assessee thereafter approached the ITAT Delhi. When the tribunal examined the arguments of both sides and all relevant documents, it noted that cash deposits made by the assessee during the demonetization period were entirely from business sales.

Considering the facts, the Tribunal felt that a small part of the cash deposits remained unexplained. Therefore, in the interest of justice, it decided to make a lump-sum addition of Rs. 2 lakh. This addition is case-specific and will not be treated as a precedent. Hence, the assessee’s ground on this issue was partly allowed.

On the grounds of imposing tax at a higher section 115BBE, the earlier Madras High Court ruling was cited based on a similar issue. Where the high court ruled that section 115BBE applies only to transactions on or after 01.04.2017. Since the year involved is prior to this date, the Tribunal directed the AO to tax the Rs. 2 lakh addition under the normal provisions of the Act and not under section 115BBE. Accordingly, this additional ground of the assessee was allowed. In conclusion, the assessee’s appeal for Assessment Year 2017-18 was partly allowed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"