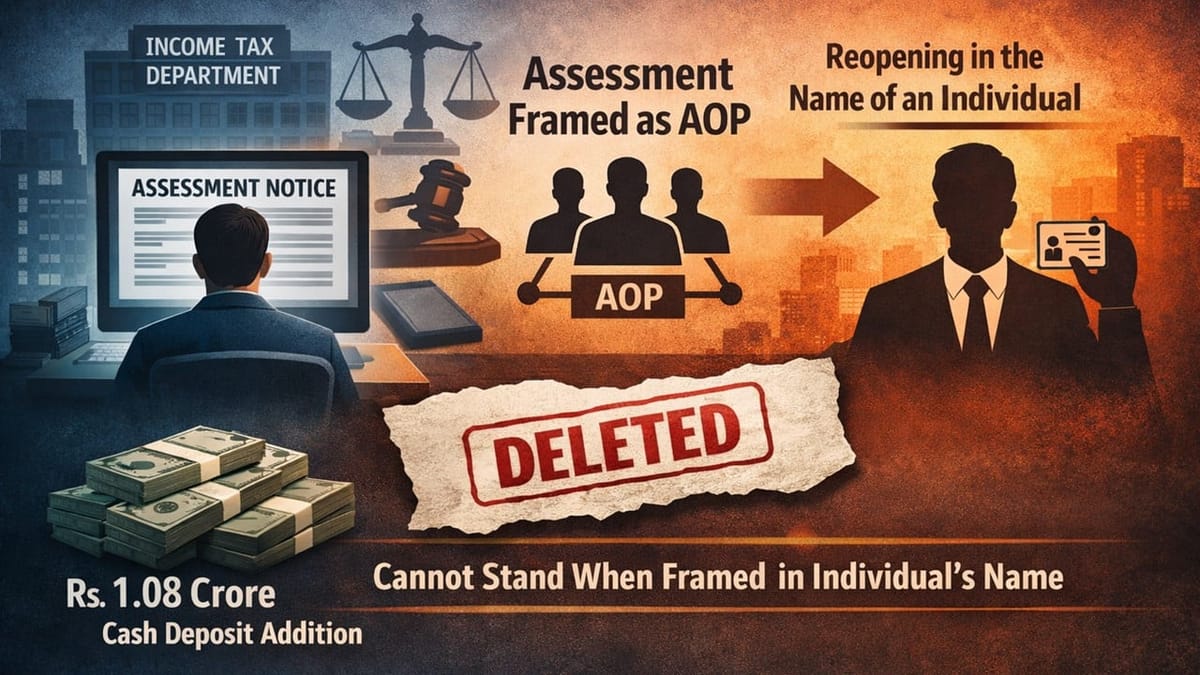

ITAT deleted Rs.1.08 crore cash deposit addition after holding that an assessment framed as an AOP cannot stand when reopening was initiated in the name of an individual.

Saloni Kumari | Jan 20, 2026 |

ITAT Holds Reassessment Invalid for Changing Status from Individual to AOP; Quashes Rs. 1.08 Crore Addition

The current appeal has been filed by Late Shri Duleechanda in ITAT Delhi against the Income Tax Department, challenging an order dated December 04, 2024, passed by the CIT(A)/NFAC. The case is related to the Assessment Year 2010-11.

Previously, the Assessing Officer (AO), through an order dated December 18, 2017, passed under Section 144/147 of the Income Tax Act, 1961, had made an addition of Rs. 1.08 crore to the assessee’s income on the grounds that late Shri Duleechanda had deposited Rs. 10,800,000 in cash in the SB account during the year in consideration. The CIT(A), through the impugned order dated December 04, 2024, upheld the reassessment made by the Assessing Officer (AO) involving a cash deposit addition of Rs. 1.08 crore.

The aggrieved assessee thereafter filed an appeal before the ITAT Delhi, where the assessee challenged the validity of the reassessment proceedings under sections 147 and 144 of the Income Tax Act. Secondly, they objected that the AO did not have proper jurisdiction, the reasons for reopening the assessment were defective, and the approval under section 151 was mechanical. Another key argument raised was that the case of the assessee was reopened under Section 147, and the reason recorded for reopening was under the status of an individual. However, the assessment order was passed under the status of an AOP, which is legally not permitted.

When the tribunal examined the case, it noted that the reopening of the case under section 147 was done in the name of Late Shri Duleechanda in the status of an individual. However, while completing the reassessment, the AO treated the income as pertaining to an AOP consisting of Shri Duleechanda and Shri Dharmender Chaudhary. The tribunal further noted that no reassessment proceedings were ever initiated against Shri Dharmender Chaudhary in the past.

Hence, issuing an assessment order in the status of an AOP when the reopening was done only in the name of an individual was not allowed as per the law. In conclusion, the tribunal held the entire reassessment proceedings as legally invalid. Accordingly, deleted the Rs. 1.08 crore addition. Finally, allowed the assessee’s appeal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"