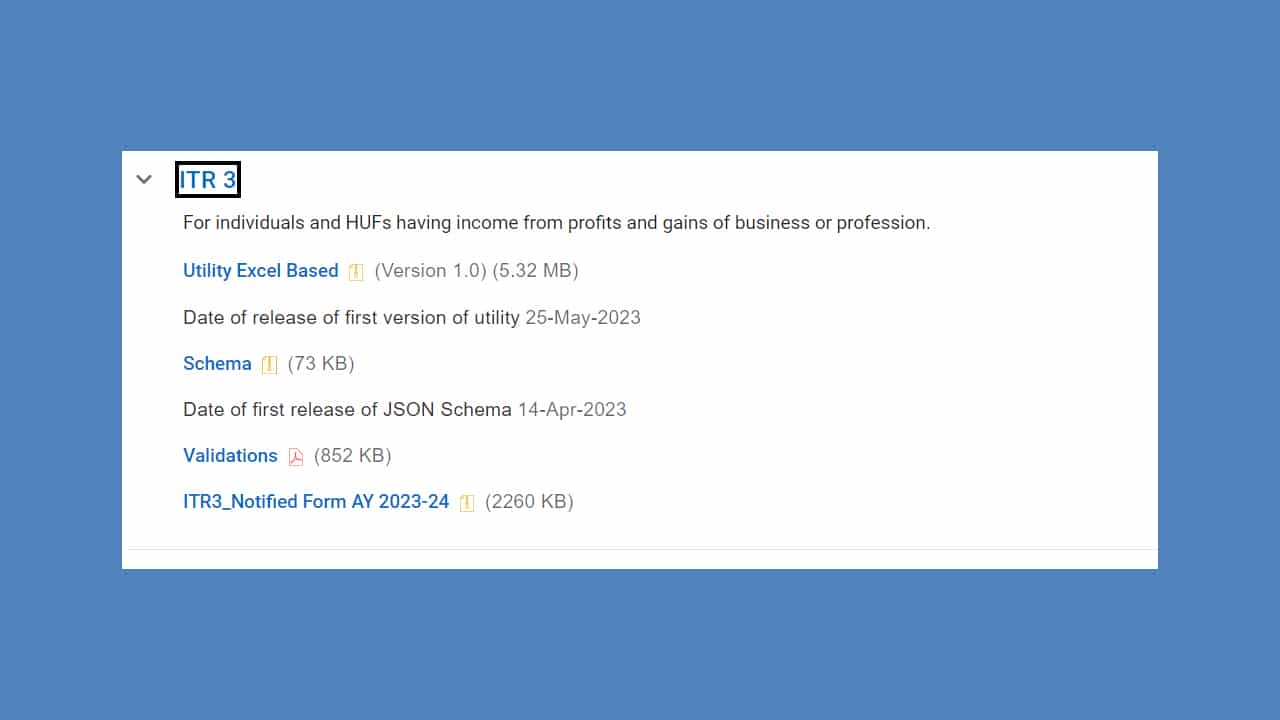

Excel Utility for ITR-3 has been released on 25th May 2023.

CA Pratibha Goyal | May 25, 2023 |

ITR Filing AY 2023-24: ITR-1, 2, 3 and 4 Excel Utility now available on Income Tax Portal; Online Utility also Live

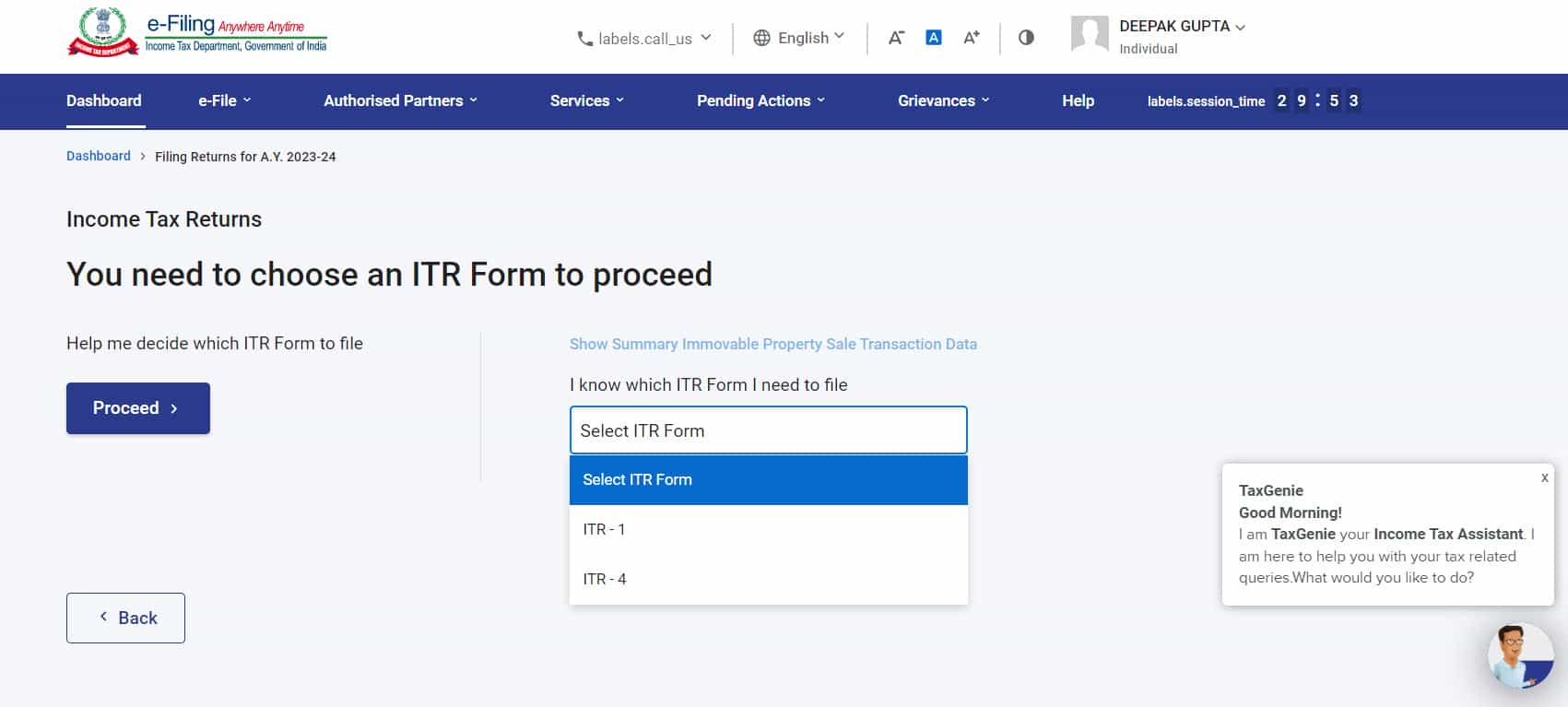

This is good news for Income Tax Return (ITR) Fillers. Excel Utility now available on Income Tax Portal for ITR-1, 2, 3, and 4 Forms are now available on Income Tax Portal.

Excel Utility for ITR-1 and ITR-4 was released on 25-Apr-2023. The ITR-2 Excel utility was released on 11-May-2023. Now ITR-3 Form has also been released. This Means Individuals can now start filing their ITR Forms.

The Online versions of the ITR-1 and ITR-4 Forms are also available.

Here is the list of documents that will help you in Filing Income Tax returns.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"