CESTAT Ahmedabad Bench has decided in favour of cricketer Ajitesh Argal, a former under-19 Indian Team player, that he is not required to pay service tax on brand marketing fees received from Nike India during the IPL.

Reetu | Apr 15, 2023 |

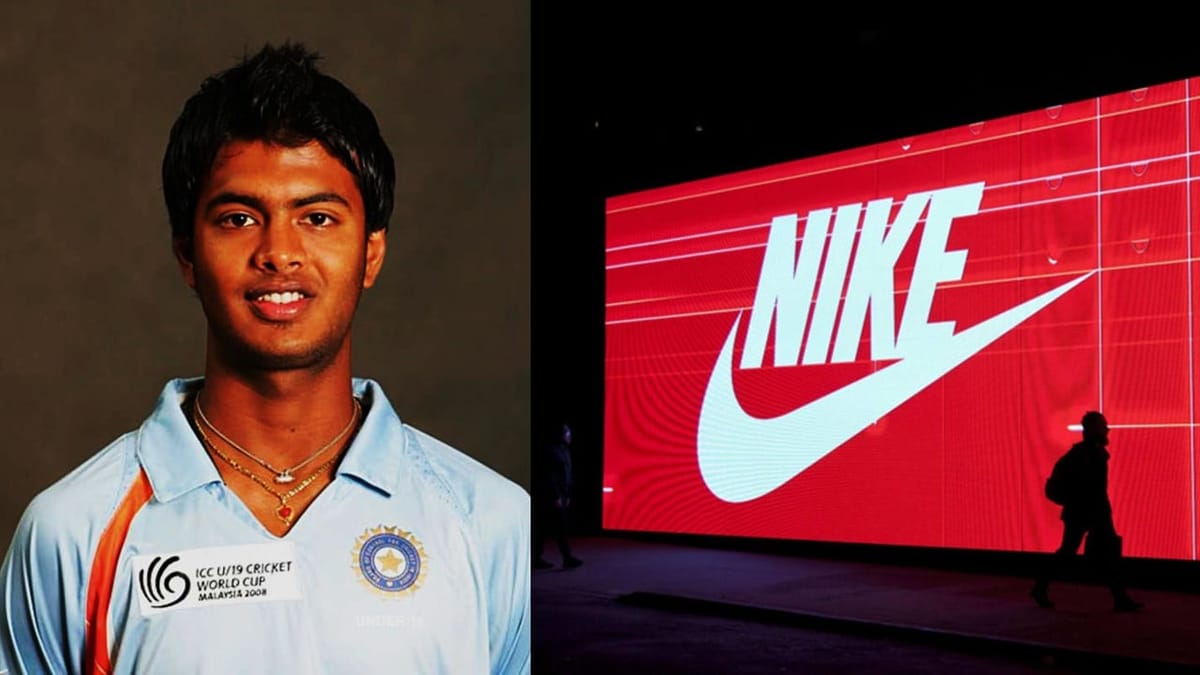

Kings XI Punjab Ex-Player Ajitesh Argal not liable to Service Tax for Nike India Brand Promotion Payments during IPL: CESTAT

The Customs, Excise and Service Tax Appellate Tribunal (CESTAT) Ahmedabad Bench has decided in favour of cricketer Ajitesh Argal, a former under-19 Indian Team player, that he is not required to pay service tax on brand marketing fees received from Nike India during the IPL.

Ajitesh Argal, the appellant, was paid to play cricket for KPH, an Indian Premier League side owned by M/s. KPH Dream Cricket Pvt. Limited. He was also compensated by M/s. Nike India Pvt. Limited for displaying their brand logo in order to promote their product.

Concerning the remuneration obtained from KPH, the department contends that the appellant performed a service of brand marketing, which falls under the category of Business Auxiliary Service and is chargeable under service tax.

Similarly, the Department raised the contested service tax demand in relation to the remuneration received from M/s. Nike India Pvt. Limited for participation in promotional activities.

Mrugesh Pandya, Counsel appearing on behalf of the appellant, stated that the agreement for playing cricket on behalf of M/s. KPH Dreams Cricket Pvt. Limited (KPH) is for the appellant’s employment with KPH and that the appellant received remuneration for the same during Indian Premier League (IPL) matches.

He also claimed that the appellant is not involved in the promotion of any Company’s brand. As a result, it was argued that the appellant’s employment arrangement with KPH should not be subject to service tax, and he cited a slew of judgements in his favour.

He further claimed that after deducting the pay received from KPH, the remuneration amount is significantly less than the threshold limit of small-scale exemption under Notification No. 06/2005-ST dated 01.05.2005, and that the entire demand is not viable. The revenue’s attorney, Rajesh K Agarwal, reaffirmed the findings of the contested order.

The Service Tax Tribunal Bench found that “the majority of the remuneration received is for KPH’s engagement of the appellant to play cricket in Indian Premier League matches.”

As a result, it was determined that “the cricket player’s activity does not fall under the category of Business Auxiliary Services.” According to this established legal position, the demand for Business Auxiliary Service does not sustain in the current instance, which also involves a comparable agreement and arrangement.”

Furthermore, the court remarked that, because the appellant’s income from KPH does not contain any service, the appellant is qualified for small-scale exemption under Notification No. 6/2005-ST dated 01.05.2005 up to the threshold level of gross value in a financial year.

The two-member tribunal bench of Ramesh Nair and C L Mahar annulled and set aside the assailed order of Service Tax demand from the now Cricketer-Turned-Income Tax Inspector Ajitesh Argal, leaving the revenue free to verify the computations for the small-scale exemption threshold limit.

To Read Official Judgment Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"