Make sure your Landlord files ITR if you are giving rent and claiming HRA

Deepak Gupta | Jan 4, 2022 |

Make sure your Landlord files ITR if you are giving rent and claiming HRA

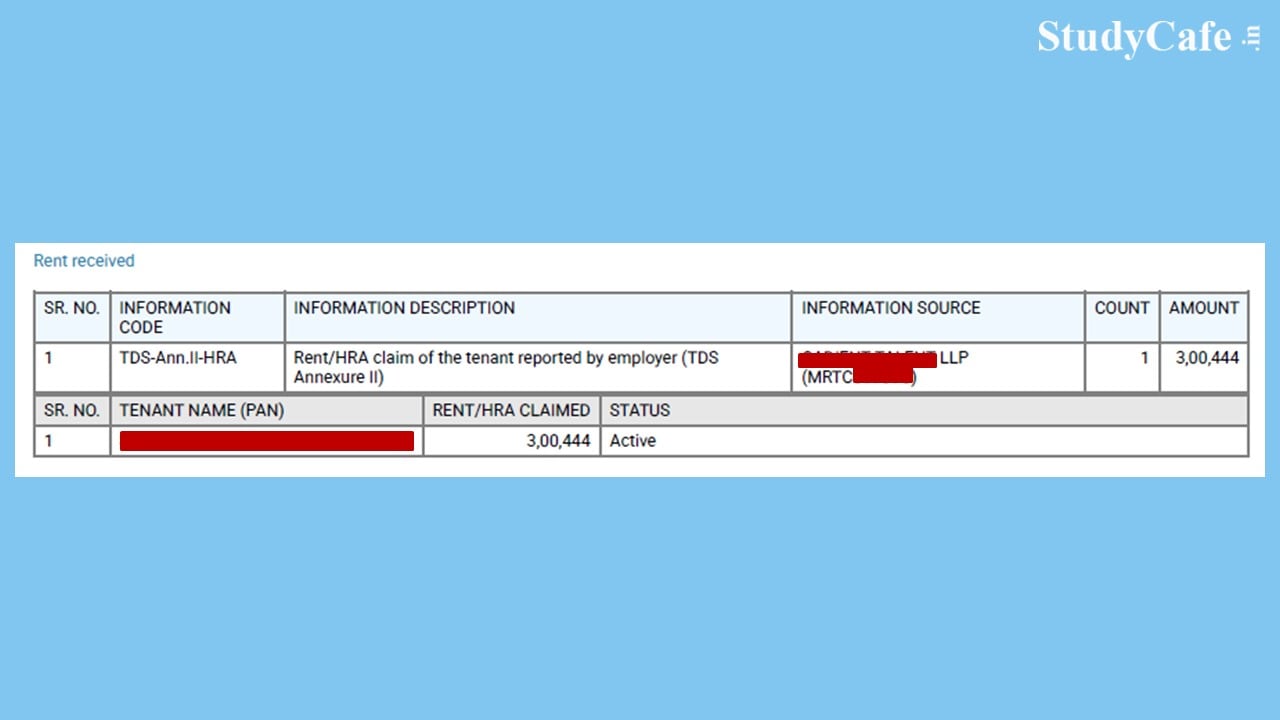

Many of the salaried employees give rent to their landlord and claim HRA for the same. While computing your HRA, your company asks for the PAN of the Landlord. The same is reported with Income Tax Department when your TDS return of salary is filed by your employer. Now the rent which is paid by you is reflected in the AIS [Annual Information Statement] of your Landlord as well.

Make sure your Landlord files ITR if are giving rent and claiming HRA

In this case, if the rent and other Income of the rent receiver exceed the Slab limit, you should make sure that the landlord is filing his/her ITR and showing rent paid by you as “Rental Income”.

Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems) or any person authorized by him are authorized to upload in the registered account of the assessee an annual information statement in Form No. 26AS.

Information to be reported:

According to section 10 (13A) of Income Tax Act, 1961 read with rule 2A of Income Tax Rules, House Rent Exemption will be least of following three:

1. Actual HRA received

2. Rent paid in excess of 10% of salary (Basic + Dearness Allowance + Commission (as % of turnover achieved by the employee))

3. 40% of salary (50% if residing in a metro i.e., New Delhi, Kolkata, Chennai or Mumbai)

Salary for the above purpose means “Basic + Dearness Allowance + Commission (as % of turnover achieved by the employee)”. However, private sector organizations, usually, don’t provide Dearness Allowance to employees.

For Example, suppose your HRA is Rs. 360,000, and your Basic Salary is Rs. 1100,000 and you live in Delhi and are paying monthly rent of Rs. 40000.

So in this case your complete HRA would be exempt

Know more about HRA Exemption | House Rent Exemption U/S 10(13A)

Use HRA Calculator from Income Tax website to calculate HRA

In case the monthly rent exceeds Rs. 50000, you need to deduct TDS u/s 194-IB. You do not need to apply for a Tax Deduction Account Number [TAN] for that. The payment of TDS and Return filing would be through a PAN-based System.

Know more about TDS on Rent under section 194IB of Income Tax Act

Please note that if your income exceeds the slab limit, and you are not filing your ITR, you will be considered as an assessee in default. Further, the due date for filing ITR for FY 2020-21 was, 31st December 2021, you can still file your return by paying Late Fees.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"