The Ministry of Finance has invited Applications from Officers Eligible for Post Administrative Officer On Deputation/Absorption Basis in CESC under the DoR.

Satish Chandra | Mar 14, 2023 |

Ministry of Finance Recruitment 2023: Monthly Salary 208700, Check Post, Eligibility and How to Apply

Ministry of Finance Recruitment 2023: The Ministry of Finance (MoF), Government of India has called in Applications from the Candidates Eligible for the Post Administrative Officer On Deputation (ISTC)/Absorption Basis in the Customs and Central Excise Settlement Commission (CESC), Principal Bench, under the Department of Revenue (DoR) notified through the Ministry of Finance Recruitment 2023 Official Notification Dated 23rd February 2023 (23.02.2203).

According to the Ministry of Finance Recruitment 2023 Official Notification issued there is 01 Vacancy to be filled up under Pay Scale Level 11 (Rs.67700-208700). The Willing and Eligible Candidates for the Post Administrative Officer under the Department of Revenue should apply in the Prescribed Specimen Proforma through Proper Channel mentioned in the Ministry of Finance Recruitment 2023 Notification.

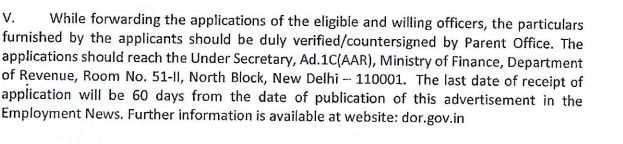

According to the Ministry of Finance Recruitment 2023 Official Advertisement issued, the Last Date for the Eligible Candidates for submission of duly completed Applications coupled with Requisite Enclosures is slated to terminate on 60th Date post-issuance of the Ministry of Finance Recruitment 2023 Official Notification in the Employment News.

Based on the Ministry of Finance Recruitment 2023 Notification, there is 01 Vacancy shall be filled up in the Department of Revenue.

Post Nomenclature: Administrative Officer On Deputation (Including Short-Term Contractual Basis)

Vacancy: 01 No.

According to the Ministry of Finance Recruitment 2023 Official Notification, the Candidate post-Appointment shall be entitled to a Monthly Salary as explained hereunder:

Pay Scale: Level 11 (Rs.67700-208700)

According to the Ministry of Finance Recruitment 2023, the Candidate as on the Closing Date should be aged as hereunder:

Maximum Age: 56 Years

Note: The Officers from only Central Government/State Government shall be Eligible for consideration for Absorption.

A) The Officers under the Central Government/State Governments/Union Territory Administration/Public Sector Undertakings/Semi-Government/ Accredited Universities/Accredited Research Institutions/Autonomous Bodies/Statutory Organizations

A-I) holding Analogous Posts on a Regular Basis in the Parent Cadre of Department; Or

II) With 05-Years’ Regular Service in the Pay Scale Band-03 (Rs.15600-39100 with Grade Pay Rs.5400) in the Pay Level 10 Matrix Or Equivalent rendered Appointment thereto on a Regular Basis in the Parent Cadre or Department; With

III) With 07-Years’ Regular Service in the Pay Scale Band-02 (Rs.9300-34800 with Grade Pay Rs.4600) in the Pay Level 07 Matrix Or Equivalent rendered Appointment thereto on a Regular Basis in the Parent Cadre or Department; With

B) Educational Qualifications in possession

I) Bachelor’s Degree from any Duly Recognized University; with

II) 05-Years’ Experience in Accounts, Administration, and Establishment Work in any Government Office or Public Sector Undertaking or Autonomous Body Or Statutory Organization.

Selection on the Administrative Officer Post shall be carried out through Interview.

Deputation Tenure: The Deputation Tenure (Including Short-Term Contractual) including the Deputation (ISTC) Period in another Ex-Cadre Post held immediately preceding this Appointment in Similar/some other Organization/Department of the Central Government shall ordinarily not exceed 04 (Four) Years.

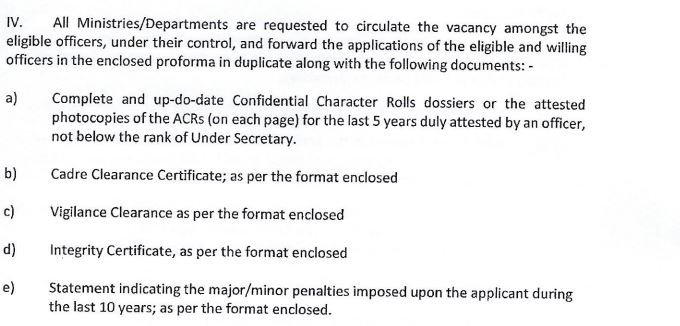

According to the Ministry of Finance Recruitment 2023 Notification, the Candidates Eligible for the Administrative Officer Post should apply in the Prescribed Application Format through Proper Channel both through Email and to the Address notified therein.

MoF AOR How to Apply Recruitment 2023

MoF Recruitment Administrative Officer Where to Apply

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"