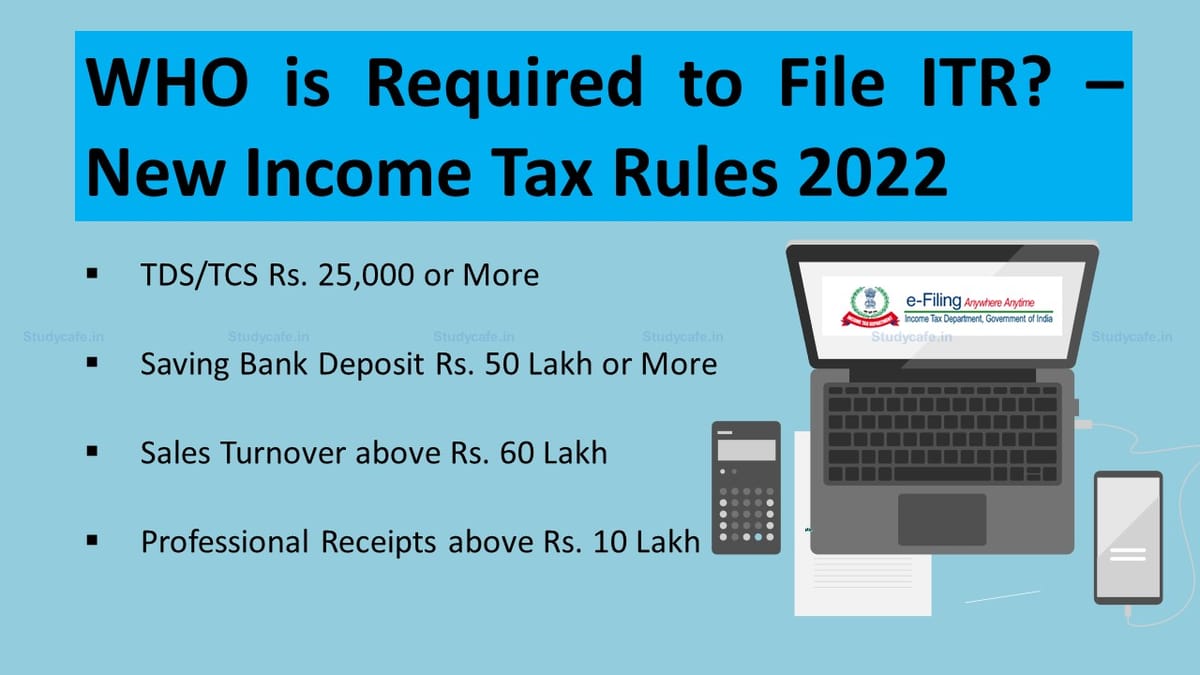

New ITR filing rules: Mandatory to file Return If your TDS is Rs 25,000 or more, otherwise there will be trouble

Deepak Gupta | Apr 23, 2022 |

New ITR filing rules: Mandatory to file Return If your TDS is Rs 25,000 or more, otherwise there will be trouble

The government has now made it mandatory for every person to file income tax return whose TDS/TCS during the financial year is Rs 25,000 or more. In case of senior citizens, this rule will be applicable if TDS/TCS exceeds Rs. 50,000. Apart from this, those people will also have to file ITR whose deposits in the savings bank account are Rs 50 lakh or more in the financial year.

Although ITR filing has to be done to claim credit of TDS/TCS, ITR filing was not mandated by the department. Through this, the government wants to reach those people who do high-value transactions, but do not file returns due to low income. This step of the government will increase the number of income tax returns filing in the country and will also bring more transparency in the system.

[Breaking] New ITR Filing Conditions notified by CBDT on 21.04.2022; Read Notification

If you are running a business and your total sales, turnover or gross receipts during the financial year is more than Rs 60 lakhs, you will still have to file the return. It does not matter whether you have loss or profit in business. Apart from this, it is mandatory to file ITR even if you are a professional and your total gross receipts in the profession is more than Rs 10 lakh during the previous year. These rules will be applicable for FY22 ITR filing.

Now ITR Filing is also made mandatory if your Savings Bank Deposit is Rs 50 Lakh or more.

Always give accurate information about your income. If you do not disclose all the sources of your income intentionally or even by mistake, then you may get a notice from the Income Tax Department and you may get in trouble. Information like interest on savings account and income from house rent is also to be given. Because these incomes also come under the purview of tax. Also keep in mind that do not try to file ITR last minute. File your return on time.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"