CA Pratibha Goyal | Dec 26, 2022 |

No Proposal to reduce Turnover Limit to Rs 5 Crore for E-Invoicing: CBIC Clarifies

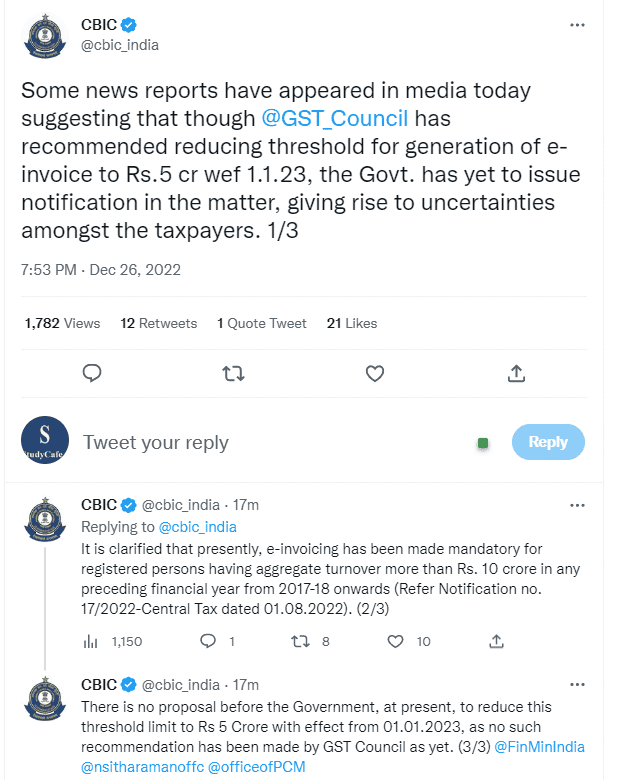

Central Board of Indirect Taxes and Customs took it’s Twitter handle to clarify that currently there is no proposal to reduce E-Invocing Turnover from Rs. 10Cr to Rs. 5 Cr.

CBIC said that Some news reports have appeared in the media suggesting that though GST Council has recommended reducing the threshold for generation of e-invoice to Rs.5 cr wef 01.01.23, the Government has yet to issue the notification in the matter, giving rise to uncertainties amongst the taxpayers.

CBIC clarified that presently, e-invoicing has been made mandatory for registered persons having aggregate turnover of more than Rs. 10 crores in any preceding financial year from 2017-18 onwards (Refer Notification no. 17/2022-Central Tax dated 01.08.2022).

further, there is no proposal before the Government, at present, to reduce this threshold limit to Rs 5 Crore with effect from 01.01.2023, as no such recommendation has been made by GST Council as yet.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"