The GST e-Invoice System issued an update stating that sub-users can now access e-Invoices created by the primary user and perform View/Cancel/Generate EWB.

Reetu | Aug 9, 2023 |

Now sub-users can access e-Invoices generated by main user and perform View/Cancel/Generate EWB

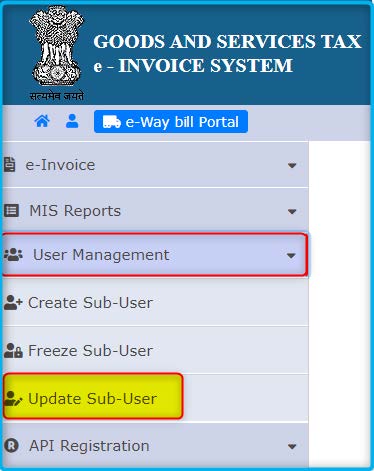

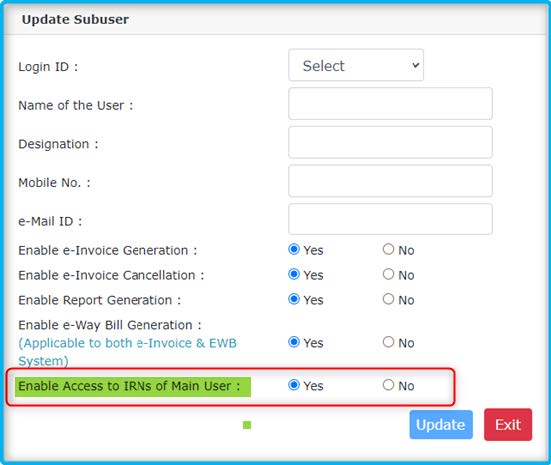

The Goods and Services Tax (GST) e-Invoice System issued an update stating that sub-users can now access e-Invoices created by the primary user and perform View/Cancel/Generate EWB. As illustrated in the screenshot below, the primary user can pick the Update Sub-user option. Choose the sub-user from the list.

Select the sub-user from the list. A new option ‘Access to the Invoice Reference Number (IRNs) of the Main User’ is provided. In case, the main user wants to give access to IRNs generated by him to the sub-user then he can select ‘Yes’ to this option. Note that along with this, one or all options such as Cancel, View report and e-Waybill generation need to be provided. For example, if Enable Access to IRNs of main user is selected as ‘Yes’ and Enable e-Invoice Cancellation is selected as Yes then sub-user can cancel the IRNs generated by Main user also.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"