CA Pratibha Goyal | May 31, 2023 |

Penalty of Rs. 1.10 Cr and 2 year ban Imposed on CA and CA Firm for Audit Lapses

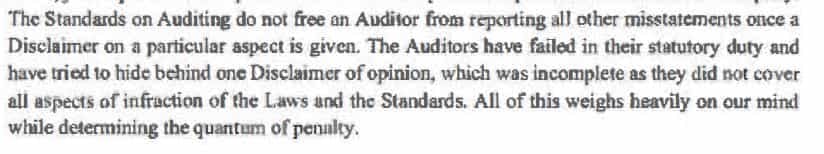

The National Financial Reporting Authority (NFRA) in the matter of GVIL against Sundaresha & Associates, CA C Ramesh, and CA Chaitanya G Deshpande under Section 132(4) of the Companies Act 2013 for the FY 2019-20 has imposed a Penalty of Rs. 1.10 Cr and 2-year ban on CA and CA Firm for Audit Lapses.

The Auditors had access to the investigation report of Mr. Ashok Kumar Malhotra which had complete details of the diversion of funds, and modus of operandi including the signing of blank cheques. Despite, this, they did not report fraudulent diversion of funds, just to preserve their professional relationship with the promoters of the auditee company.

Click here to read the complete order

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"