The Ministry of Corporate Affairs (MCA) has imposed a Penalty of Rs. 40 Lakhs for Non-Filing MGT-07 and AOC-04.

Reetu | Mar 8, 2024 |

Penalty of Rs. 40 Lakhs levied u/s 137 for Non-Filing MGT-07 and AOC-04

The Ministry of Corporate Affairs (MCA) in the matter of DGR Farms and Leisures Limited imposed a Penalty of Rs. 40 Lakhs for Non-Filing MGT-07 and AOC-04.

The Company DGR Farms and Leisures Limited (CIN-U0l l 00MP2009PLC02254 7) [herein after known as company] is a registered company with this office under the provisions of Companies Act, 2013 having its registered office situated at E-3, Senior MIG, House No. 2, Near Ganesh Mandir, Arera Colony, Huzur 462016, M.P. 6- Malviya Nagar, Near IDBI Bank, Bhopal, Madhya Pradesh 462003, as per the MCA website.

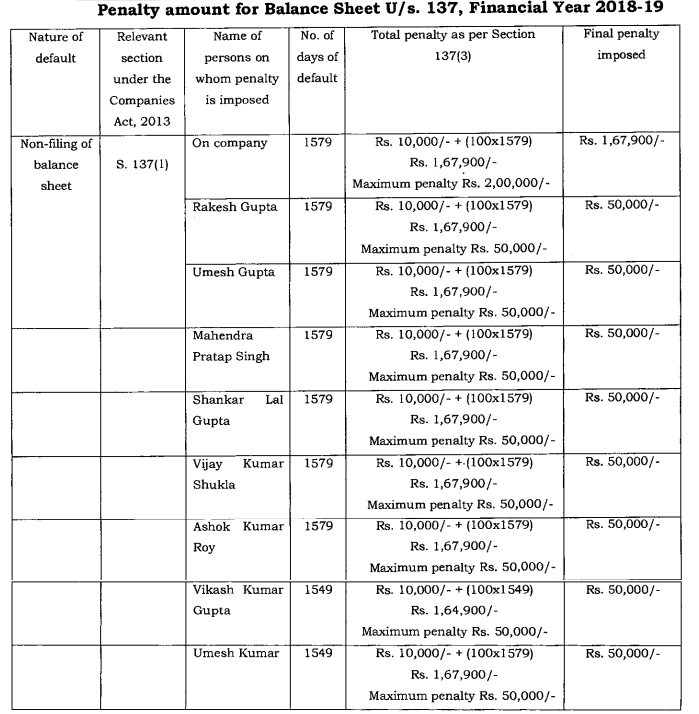

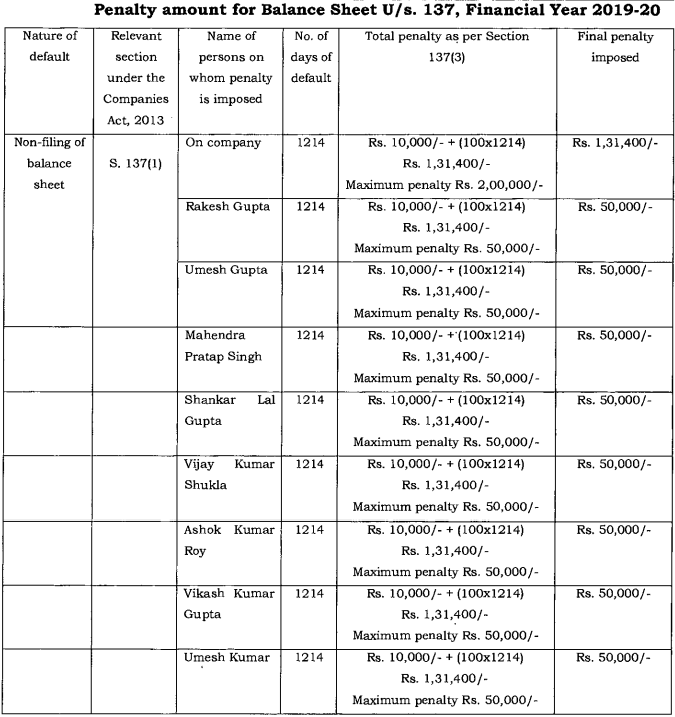

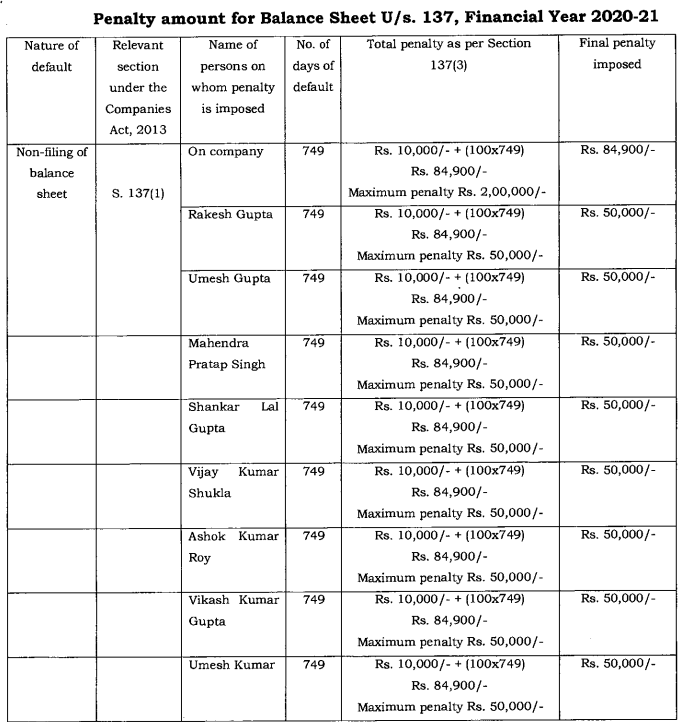

Whereas as per information available on MCA21 data base, the company has not filed its statutory document i. e. Balance Sheet since 2019 to till date under Section 137(1) of the Companies Act, 2013. Hence, it appears that the company and its officers in defaults has violated the provisions of Section 137(1) of the Companies Act, 2013 and are liable for penal action u/ s. 137(3) of the Companies Act, 2013 for financial year 2018-19 to till date.

Subsequently, this office had issued show cause notice U/s. 137(1) to the company and its officers in default vide No. ROC-G/Adj.Pen./u/s. 137(1)/DGR Farms/3301 to 3309 dated 18.01.2024.

Thereafter, “Notices of Inquiry” vide No. ROC-G/ Adj. Pen.ju/ s. 137(1)/DGR Farms/3424 to 3432 dated 30.01.2024 were issued to the company and its officers in default. As per [Rule 3(3), companies (Adjudication of Penalties) Rules, 2014 and the date of hearing was fixed on 09.02.2024 at 12 Noon in the office of Registrar of Companies, Madhya Pradesh, Sanjay Complex, A-Block, 3rd Floor, Jayendraganj, Gwalior.

On the date of hearing 1.e. 09.02.2024, office has received a e-mail dated 09.02.204 from director Shri Umesh Gupta therein had requested to provide 15-20 days more as the company has already started preparing necessary documents and forms related with Section of the Companies Act, 2013.

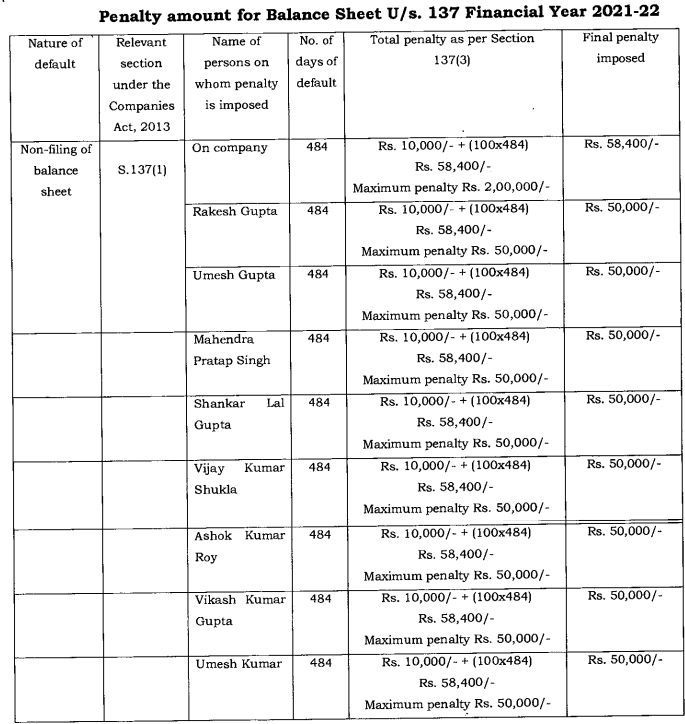

Having considered the facts and circumstances of the case and after taking into account the factors above and letter dated 18.01.2024 and 30.01.2024 issued by ROC, Gwalior were duly received by the office of the company, it is concluded that the company and its officers in default are liable for penalty as prescribed under Section 137(3) of the Act for default is made in complying with the requirements of Section 137(1) of the Act of the company viz. DGR Farms & Leisures Limited for financial year 2018-19 to 2021-22, in terms of Section 137(1) of the Act.

Accordingly, a penalty Rs.40 Lakhs is imposed as prescribed under Sub-section 3 of section 137 of the Companies Act, 2013.

The opinion is that the penalty is commensurate with the aforesaid failure committed by the notice and penalty so imposed upon the officers-in-default shall be paid from their personal sources/income. It is further directed that penalty imposed shall be paid through the Ministry of corporate Affairs portal only as mentioned under Rule 3(14) of Company (Adjudication of Penalties) (Amendment) Rules, 2019 under intimation to this office for the financial year 2018-19 to 2021-22.

The penalty amount shall be remitted by the company through MCA21 portal within 60 days from the date of order. The company needs to file INC- 28 as per the provisions of the act attaching the copy of adjudication order alongwith payment challans.

The company may approach to compounding for the period not covered under this order.

Any person aggrieved by the order of adjudicating authority under Section 3 of Section 454 may prefer an appeal to the Regional Director having jurisdiction in the matter.

Every appeal under sub-section (5) of section 454 shall be filed within 60 days from the date on which the copy or order made by the adjudicating authority is received by the aggrieved person and shall be in such form, manner and be accompanied by such fee as may be prescribed.

As per Section 454(8) (i) where a company fails to comply with the order made under sub-section (3) or sub-section (7) as the case may be within a period of 90 days from the date of receipt of the copy of the copy of the order, the company shall be punishable with fine which shall not be less than twenty five thousand but which may extend to five lakh rupees.

Where an officer of a company or any other person who is in default fails to comply with the order made under sub-section (3) or sub-section (7) as the case may be within a period of 90 days from the date of receipt of the order such officer shall be punishable with imprisonment which may extend to six months or with the fine which shall not be less ·than twenty five thousands rupees but which may extend to one lakh or with both.

For Official Order Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"