Reetu | Jan 3, 2024 |

![RBI designates 2 individuals as ‘Terrorists’ [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2024/01/RBI-designates-2-individuals-as-‘Terrorists.jpg)

RBI designates 2 individuals as ‘Terrorists’ [Read Notification]

The Reserve Bank of India (RBI) has designated 2 individuals as ‘Terrorists’ under Section 35 (1) (a) of the Unlawful Activities (Prevention) Act (UAPA), 1967 and their listing in Schedule IV of the Act. RBI notified this via issuing a Notification.

In terms of Section 51 read with Section 53A of our Master Direction on Know Your Customer dated February 25, 2016 as amended on October 17, 2023, “The procedure laid down in the UAPA Order dated February 2, 2021 (Annex II of this Master Direction), shall be strictly followed and meticulous compliance with the Order issued by the Government shall be ensured.”

Furthermore, Section 51(b) of the aforementioned Master Direction states, “Details of accounts resembling any of the individuals/entities on the lists shall be reported to FIU-IND in addition to advising the Ministry of Home Affairs as required under UAPA notification dated February 2, 2021 (Annex II of this Master Direction).”

In this context, it should be noted that the UAPA Order in Annex II of the MD on KYC, 2016 shall also apply to amendments made to Schedules I and IV of the UAPA, 1967, in addition to the UNSC lists listed in the Order.

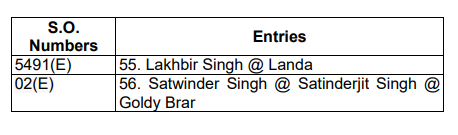

Please refer to the MHA’s Gazette notification of December 29, 2023 and January 1, 2024, about two individuals who have been declared ‘Terrorists’ and are included in Schedule IV of the UAPA 1967, under Section 35 (1) (a) of the UAPA 1967.

The Statutory Order (S.O.) numbers and the respective entries are as provided below:

Regulated Entities (REs) are advised to take note of the aforementioned Gazette notifications issued by MHA for necessary compliance. REs shall also take note of any future amendments to Schedule I and IV of the UAPA, 1967, for immediate necessary compliance.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"