RBI will soon release the official notification regarding the RBI Grade B 2024, expected on July 18, 2024, along with the RBI Grade B 2024 Exam dates, check other details

Saloni | Jul 5, 2024 |

RBI Grade B 2024: Notification Out for Grade B Officers, Apply Before Due Date

RBI Grade B 2024: The Authority will soon release the official notification regarding the RBI Grade B 2024, expected on July 18, 2024. Along with the notification, the authority will release the RBI Grade B 2024 Exam dates. RBI Grade B 2024 Application forms will be released after the notification is released. The RBI Grade B 2024 recruitment is organised to select eligible and willing candidates for the post of Grade B Officers in the Combined Seniority Group (CSG) streams.

The candidates selected for the prescribed recruitment are appointed in departments such as Officers in Grade B (General), Officers in Grade B (Department of Economic and Policy Research), and Officers in Grade B (Department of Statistics and Information Management). The opportunity is open for all candidates who have cleared their graduation. If want to know more details about the RBI Grade B Exam Dates, Syllabus, Eligibility Criteria, Pattern, and many other details, refer to the below sections.

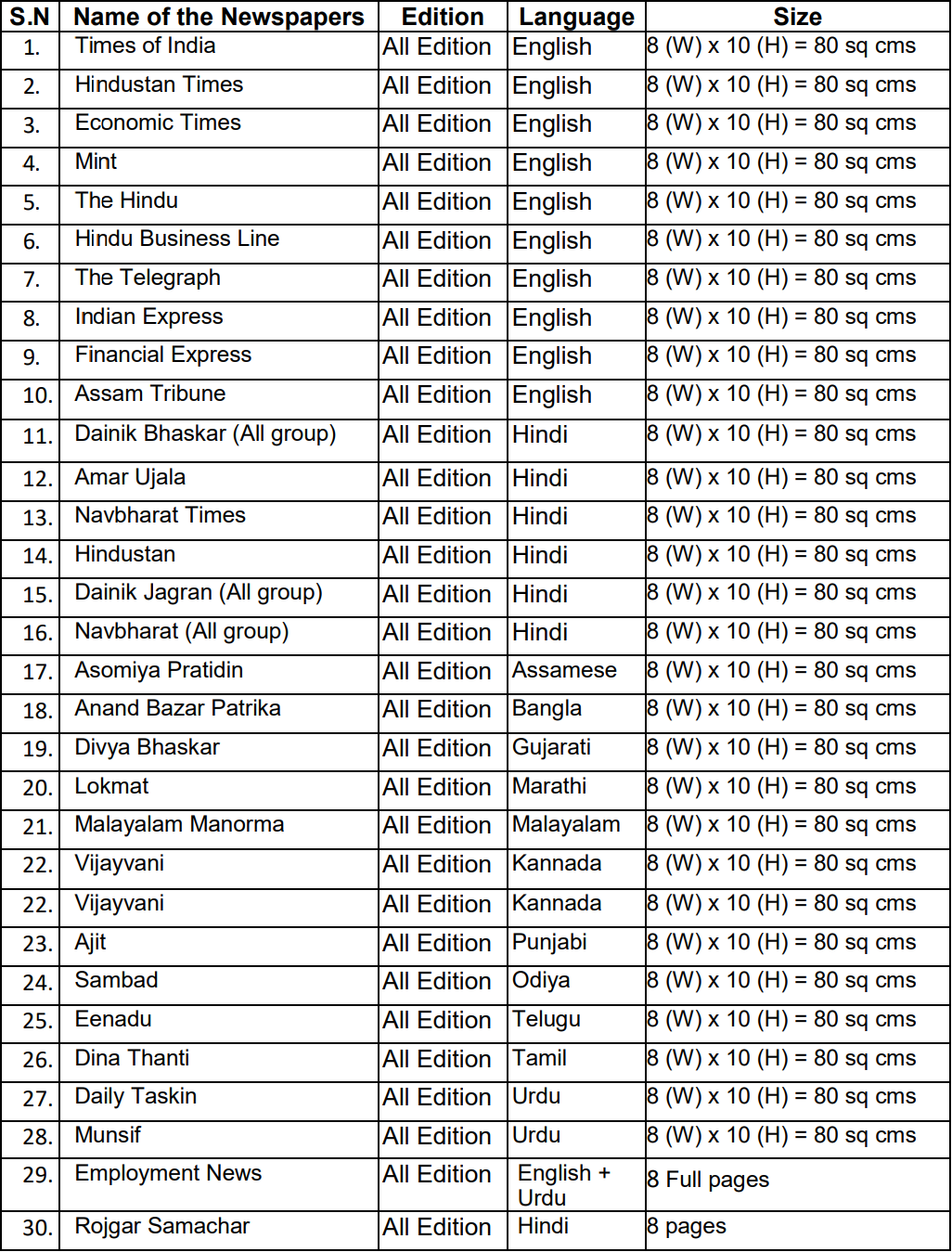

Official notice says, the Department of Communication (DoC) intends to release advertisements in leading newspapers (details attached) from Thursday, July 18, 2024 (tentatively) titled “Recruitment for the post of Grade B DR (General/DEPR/DSIM) – PY 2024”.

The key highlights related to the RBI Grade B 2024 are listed in the below table:

| RBI Grade B 2024 | |

| Organization | Reserve Bank Of India |

| Exam Name | RBI Grade B |

| Exam Level | National |

| Exam Mode | Online |

| Post | Grade B |

| Vacancy | To Be Notified |

| Category | Recruitment |

| Language Of Exam | English |

| Selection Process | Phase I, Phase II, and Interview |

| Application Mode | Online |

| Age Limit | 21 to 30 Years |

| Salary | Basic Pay: Rs.55,200/- p.m |

| RBI Grade B Exam Date 2024 | Will Be Released Soon |

| Official Website | www.rbi.org.in |

| Contact Details | 011-23711333 |

Important tentative dates related to the RBI Grade B 2024 are listed below:

The RBI Grade B 2024 notification will soon be released on July 18, 2024. The official notification will be released to select candidates for the Grade B officers post. The notification will be released in PDF format and will include details related to the RBI Grade B 2024 Exam.

The candidates will be selected for the RBI Grade B 2024 recruitment based on the age limit, educational qualifications, and nationality parameters.

Candidates must possess an age limit between 21 and 30 years to apply for the RBI Grade B 2024 recruitment. For MPhil and PhD, candidates must have an age limit between 32 to 34 years. Some relaxation in the upper age limit has been provided to the candidates belonging to the reserved categories (SC/ST/PwBD).

The Educational Qualification necessary to apply for the RBI Grade B 2024 recruitment are as follows:

The RBI Grade B 2024 application form includes steps like registration, uploading of scanned documents (Photograph and Signature), filling in the details in the application form, uploading of scanned left thumb impression and written declaration and lastly paying the application fee and taking out the print out of the filling application form after checking it. Details about the RBI Grade B 2024 application form are mentioned below:

| Category | Charges | Fee (in INR) |

| SC/ST/PWD | Intimation charges only | 100 + 18 per cent GST |

| Gen/OBC | Application fees including intimation charges | 850 + 18 per cent GAT |

The RBI Grade B 2024 recruitment selection process is divided into three parts- prelims exam, mains exam, and interview. The prelims exam will include four sections, General Awareness, Reasoning, English Language, Quantitative Aptitude etc and will hold a total weightage of 200 marks. The main exam will include a total of three papers, among which the first paper will be on Economic and Social Issues, the second one on English (Writing Skills) and the third one on Finance and Management. The entire mains exam will hold a total weightage of 300 marks. Below is the exam pattern for the prelims exam and mains exam 2024:

| Structure of Phase I exam | ||

| Sections | Number of questions | Marks |

| General Awareness | 80 | 80 |

| Reasoning | 60 | 60 |

| English Language | 30 | 30 |

| Quantitative Aptitude | 30 | 30 |

| Total | 200 | 200 |

| Structure of Phase II exam | |||

| Name of the Paper | Type of Paper | Duration | Marks |

| Paper-I: Economic and Social Issues | 50 per cent Objective Type 50 per cent Descriptive, answers to be typed with the help of the keyboard | 120 Minutes | Total: 100 Marks |

| Objective: 30 | Objective: 50 | ||

| Descriptive: 90 | Descriptive: 50 | ||

| Paper-II: English (Writing Skills) | Descriptive answers are to be typed with the help of the keyboard. Candidates opting to type the answers in Hindi may do so with the help of either Inscript or Remington (GAIL) keyboard layout. | 90 Minutes | 100 |

| Paper-III: Finance and Management | 50 per cent Objective Type and 50 per cent Descriptive, answers to be typed with the help of the keyboard. Candidates opting to type the answers in Hindi may do so with the help of either Inscript or Remington (GAIL) keyboard layout | 120 minutes Objective: 30 Descriptive: 90 | Total: 100 Marks Objective: 50 Descriptive: 50 |

Below is the RBI Grade B 2024 syllabus for Phase I

| RBI Grade B Phase 1 Syllabus for DR (General) | |||

| Reasoning | Quantitative Ability | English Language | General Awareness |

| Logical Reasoning | Simplification | Reading Comprehension | Current Affairs |

| Alphanumeric Series | Profit & Loss | Cloze Test | Indian Financial Systems |

| Ranking/Direction/Alphabet Test | Mixtures & Allegations | Para jumbles | Indian Banking Systems |

| Data Sufficiency | Simple Interest & Compound Interest & Surds & Indices | Miscellaneous | Monetary Plans |

| Coded Inequalities | Work & Time | Fill in the blanks | National Institutions |

| Seating Arrangement | Time & Distance | Multiple Meaning /Error Spotting | Banking Terms |

| Puzzle | Mensuration– Cylinder, Cone, Sphere | Paragraph Completion | |

| Tabulation | Data Interpretation | ||

| Syllogism | Ratio & Proportion, Percentage | ||

| Blood Relations | Number Systems | ||

| Input Output | Sequence & Series | ||

| Coding Decoding | Permutation, Combination &Probability | ||

Below is the RBI Grade B 2024 syllabus for Phase II

| Subject | Syllabus |

| Paper 1- Economic & Social Issues | 1. Growth and Development |

| Measurement of growth- National Income and per capita income | |

| Poverty Alleviation and Employment Generation in India | |

| Sustainable Development | |

| Environmental issues | |

| 2. Indian Economy | |

| Economic History of India | |

| Changes in Industrial and Labour Policy | |

| Monetary and Fiscal Policy since the reforms of 1991 | |

| Priorities and Recommendations of Economic Survey and Union Budget | |

| Indian Money and Financial Markets: Linkages with the Economy | |

| Role of Indian banks and Reserve Bank in the development process | |

| Public Finance | |

| Political Economy | |

| Industrial Developments in India | |

| Indian Agriculture | |

| Services sector in India | |

| 3. Globalization | |

| Opening up of the Indian Economy | |

| Balance of Payments | |

| Export-Import Policy | |

| International Economic Institutions | |

| IMF and World Bank | |

| WTO | |

| Regional Economic Cooperation | |

| International Economic Issues | |

| 4. Social Structure in India | |

| Multiculturalism | |

| Demographic Trends | |

| Urbanisation and Migration | |

| Gender Issues | |

| Social Justice: Positive Discrimination in favour of the underprivileged | |

| Social Movements | |

| Indian Political System | |

| Human Development | |

| Social Sectors in India | |

| Health and Education | |

| Paper 2- English | To analyse the writing skills of the candidates including the expression and understanding of the topic |

| Paper 3 (a) Finance | 1. Financial System |

| Regulators of Banks and Financial Institutions | |

| Reserve Bank of India- functions and conduct of monetary policy | |

| Banking System in India – Structure and concerns, Financial Institutions – SIDBI, EXIM Bank, NABARD, NHB, etc, Changing landscape of the banking sector. | |

| Impact of the Global Financial Crisis of 2007-08 and the Indian response | |

| 2. Financial Markets | |

| Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, and recent developments. | |

| 3. General Topics | |

| Risk Management in the Banking Sector | |

| Basics of Derivatives | |

| Global Financial Markets and International Banking – broad trends and latest developments. | |

| Financial Inclusion | |

| Alternate source of finance, private and social cost-benefit, Public-Private Partnership | |

| Corporate Governance in the Banking Sector, the role of e-governance in addressing issues of corruption and inefficiency in the government sector. | |

| The Union Budget – Concepts, approach, and broad trends | |

| Inflation: Definition, trends, estimates, consequences, and remedies (control): WPI, CPI – components and trends; striking a balance between inflation and growth through monetary and fiscal policies. | |

| FinTech | |

| Paper 3 (b)- Management | 1. Fundamentals of Management & Organizational Behaviour |

| Introduction to management | |

| Evolution of management thought | |

| Scientific, Administrative, Human Relations | |

| Systems approach to management | |

| Management functions and Managerial roles | |

| Nudge theory | |

| Meaning & concept of organizational behaviour | |

| Personality: meaning, factors affecting personality, Big five model of personality | |

| Concept of reinforcement | |

| Perception: concept, perceptual errors | |

| Motivation: Concept, importance | |

| Content theories (Maslow’s need theory, Alderfers’ ERG theory, McCllelands’ theory of needs, Herzberg’s two-factor theory) | |

| Process theories (Adams equity theory, Vroom’s expectancy theory). | |

| Leadership: Concept, Theories (Trait, Behavioural, Contingency, Charismatic, Transactional and Transformational Leadership | |

| Emotional Intelligence: Concept, Importance, Dimensions. | |

| Analysis of Interpersonal Relationship: Transactional Analysis, Johari Window | |

| Conflict: Concept, Sources, Types, Management of Conflict | |

| Organizational Change: Concept, Kurt Lewin’s Theory of Change | |

| Organizational Development (OD): Organisational Change, Strategies for Change, Theories of Planned Change (Lewin’s change model, Action research model, Positive model). | |

| 2. Ethics at the Workplace and Corporate Governance | |

| Meaning of ethics, why ethical problems occur in the business | |

| Theories of ethics: Utilitarianism: weighing social cost and benefits, rights and duties, Justice and fairness, ethics of care, integrating utility, rights, justice and caring | |

| An alternative to moral principles: virtue ethics, teleological theories, egoism theory, relativism theory | |

| Moral issues in business: Ethics in Compliance, Finance, Human Resources, Marketing, etc | |

| Ethical Principles in Business: introduction, Organization Structure and Ethics, Role of Board of Directors, Best Practices in Ethics Programme, Code of Ethics, Code of Conduct, etc. | |

| Corporate Governance: Factors affecting Corporate Governance; Mechanisms of Corporate Governance | |

| Communication: Steps in the Communication Process; Communication Channels; Oral versus Written Communication; Verbal versus non-verbal Communication; upward, downward and lateral communication | |

| Barriers to Communication | |

| Role of Information Technology |

The details about the postponed advertisement are as follows:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"