bsseethapathirao | Jan 6, 2020 |

Real Estate Services involving in owned or leased property under GST Scenario

Dear professional colleagues, Good morning to all of you. I have received queries from our friends on services relating to “Real Estate Services” especially services involving in owned and leased property under GST Scenario. I thought and come to the conclusion to prepare an article on the above subject with my little bit knowledge under GST Scenario and share to all of you. Kindly refer and provided your feed back and suggestion on the above subject to my what’s app no. 9848099490 or my mail i.d. sitapathirao@yahoo.co.in.

Friends before going to the subject, we have to refer the below words and know about the definitions mentioned in GST Law, 2017.

1. Supply of Services,

2. Transfer of Title of Goods,

3. Transfer of right in Goods,

4. Transfer of undivided share in Goods,

5. Transfer of property in goods at a future date,

6. Lease or Letting of Land or Building,

7. Transfer of Right to Use,

8. Tenancy ,

9. Easement,

10. License,

11. Immovable Property

12. Renting of Immovable Property,

13. Requirement of Registration under GST Law,2017,

14. Conditions for claiming of Input Tax Credit by the service provider,

15. Service Accounting Code etc.

1. Supply of service: Section 2(102) of the CGST Act,2017,define abut term” SERVICE” as “ anything other than goods , Money, Securities and includes activities relating to the use of money or its conversion by cash or by any other mode from one form , currency or denomination to another form currency, denomination for which a separate consideration is charged. Thus, exchange of currency from one form /denomination to another has been considered as service. Schedule II of the GST Act enumerate various circumstances when a given activity or transaction would be treated as SUPPLY OF GOODS OR SERVICES. Levy of GST is based upon the term ”SUPPLY”. Taxability under the GST depends upon supply of goods and /or Services.

From 1’st July, 2017 onwards the transactions specified in Schedule – II are not considered as “SUPPLY” and the purpose of Schedule –II is to determine whether any activity or transaction would be treated as supply of goods or as supply of services. Such transactions are divided as below for better understanding to all of you:

Real Estate Services involving in owned or leased property under GST Scenario

2. Transfer of title of goods:

Supply of goods: Transfer of title of goods , which has been identified to the contract of sale, asses from the seller to the buyer in any manner and on any conditions agreed upon by the parties to the contract of sale. The basic rule is that title of the goods passes when the parties intended the same to pass.

3. Transfer of right in Goods: Transfer of right in goods is a “Services” under GST Scenario. Rights in Goods may be of different types by way of as a owner, as a lessor, as a bailer, as an agent and as the holder of the goods etc., This clause is applicable where right in goods is transferred without the transfer of title thereof.

4. Transfer of undivided share in Goods: Transfer of undivided share in goods is C0-owners shares are undivided. All such persons will have either equal or certain percentage of the rights to possess and use the property. One important aspect is co-ownership is undivided share. Though all the owners own equal or a part of the whole property, their respective shares are not physically ascertainable with definitive boundaries, But the shares are undivided. The shares of co-owners of a property need not necessary be equal. It depends on their investment in the property as detailed in the purchase document. In this case there should not be transfer of title in the goods.

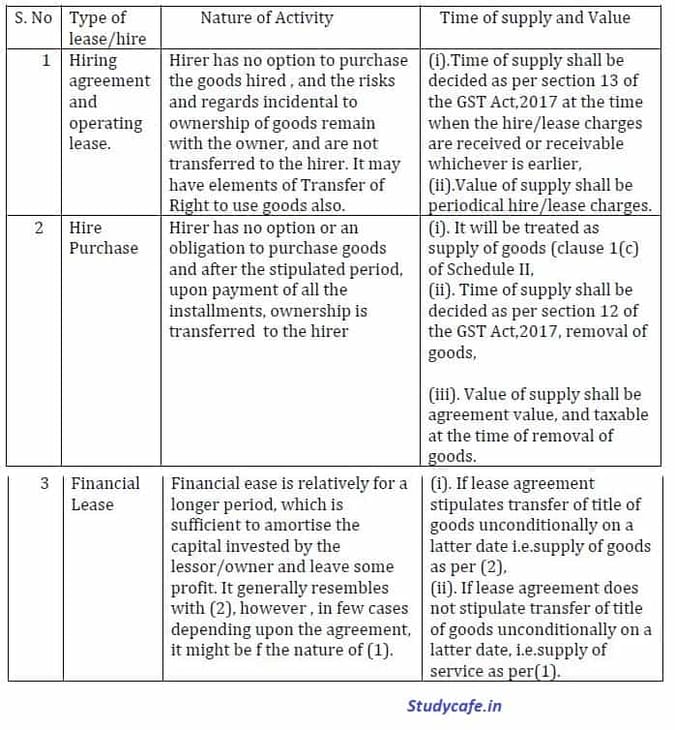

5. Transfer of property in Goods at future date: Supply of goods treated as Supply of Services. In some circumstances some of the transactions are treated as “ Transfer of Property in Goods at future date” like hire purchase and financial lease transactions where ownership is transferred at a future date upon payment of full consideration. Here with I am providing various type of lease/hire purchase transactions in tabular form for better understanding in GST Scenario:

6. Lease or Letting of Land or Building: These following activities are also treated as “SUPPLY OF SERVICES”. Transfer of Right to Use, Tenancy , Easement License. Any lease , tenancy, easement , license to occupy land, Any lease or letting out of the building including a commercial, industrial or residential complex for business or commerce, either wholly or partly.

7. Transfer of Right to Use: Sec.105 of the Transfer of Property Act, A lease of immovable property is a transfer of a right to enjoy such property , made for a certain time, express or implied or in perpetuity, in consideration of a price paid or promised or of money , a share of crops, service or any other thing of value to be rendered periodically or on specified occasions to the transferor by the transferee who accepts the transfer on such terms.

8. Tenancy: Tenancy means “tenancy is he occupancy or possession of land or premises by the lease. The occupant known as tenant must acquire control and possession of the property for the duration of the lawful occupancy. A tenancy can be created by any words that indicate the owner’s intent to convey a property interest on another individual.

9. Easement: Section 4 of the Indian Easement Act, 1882 defines that : A easement is a right which the owner or occupier of certain land possesses, as such, for the beneficial enjoyment of that land , to do and continue to do something or to prevent ad continue to prevent something being done, in or upon or in respect of certain other and not his own land.

10. License: Section 52 of the Easement Act,1882 defines that” Where one person grants to another or to a definite number of other persons a right to do or continue to do, in or upon the immovable property of the grantor. Something which would in the absence of such right, be lawful and such right does not amount to an easement or an interest in the property ,the right is called a license. The grant of a license may be express or implied fro the conduct of grantor and an agreement which purports to create an easement but is ineffectual for hat purpose, may operate to create a license.

11. Immovable Property: Section 4 As per Section 4 of the General Clauses Act, 1897, the definition of immovable property provided in Section 3(26) of the General Clauses Act will apply because in GST definition of immovable property is not mentioned, so, we have to take the definition as per General Clauses Act, 1897. The General Clauses Act define about Immovable Property as” Immovable Property” shall include and, benefits to arise out of land and things attached to the earth or permanently fastened to anything attached to the earth.” It may be noted that the definition is inclusive and thus, properties such as buildings and fixed structures on land would be covered by the definition of immovable property. The property must be attached to some part of earth even if underwater.

12. Renting of Immovable Property: As per Notification No.12/2017- CT (Rate), dated.28th June,2017,Para 2 (zz) meaning of “renting in relation to “immovable property “ means allowing, permitting or granting access, entry, occupation, use or any such facility , wholly or partly in an immovable property with or without the transfer of possession or control of the said immovable property and includes lettings, leasing, licensing or other similar arrangements in respect of immovable property. As per Schedule –II defines the activities which are to be treated as supply of goods or supply of services. Schedule –II the entry no 2 and 5 are defined as below:

Schedule –II, Entry No.2 Land and Building:

(a) any lease, tenancy, easement, license to occupy land is a supply of services;

(b) any lease or letting out of the building including a commercial, industrial or residential complex for business or commerce, either wholly or partly, is a supply of service.

Schedule –II, Entry No.5. Supply of Services: The following activates shall be treated as supply of services, namely:-

(a) renting of immovable property,

(b) Lease /Renting of vacant land,

(c) Lease/Renting of Plant & Machinery , Permanently attached to earth,

(d) Renting of residential dwelling for use as residence.

Lease or Renting of Vacant Landed Property: Schedule –III, entry no. 5 of the GST Act,2017, sale of land is neither goods nor service. However, renting or Leasing of vacant land or Licensing of land is taxable under this category.

Lease or Renting of Plant & Machinery, permanently attached to earth treated as Immovable Property: Lease of plant and machinery permanently attached to earth, has been treated as immovable property and lease thereof will be covered only in this clause. There re judicial pronouncements where he plant and machinery permanently embedded in the earth or attached to the building are termed as immovable property. Leasing of plant and machinery treated as immovable property and taxable under 9973 under GST Law, 2017.

13. Requirement of registration under GST Law, 2017:

As per Section 22 (1) of CGST Act, 2017 every supplier shall be liable to take registration in every State or UT from where he makes a taxable supply of goods /or services ,if his aggregate turnover in a financial year exceeds threshold limit of Rs. 20 Lakhs or 10 Lakhs in Easter States.

Example for aggregate turnover:

(i) If any taxable person (PAN Based) is having business turnover Rs. 15 Lakhs and Rs. 6 lakhs rental income on immovable property liable to to take GST registration.

(ii) If any taxable person (PAN Based) is having tax business turnover Rs 13 Lakhs and Rs. 6 Lakhs rental income on immovable property not require to take registration (Rs.13 plus Rs. 6 lakhs = 19 Lakhs, no obligation to take registration.

(iii) Is any taxable person (PAN Based) is having Rs. 25 Lakhs business turnover and such business in “Individual Status” as per Individual PAN Based he has to take registration for such business and income from immovable property belongs to (HUF PAN BASED) and turnover on immovable property of Rs. 6 lakhs, there is no obligation to take GST registration under HUF capacity.

14. Conditions for claiming of Input Tax Credit by the service provider:

As per section 17(5) of the GST Act, 2017, for the following procurement, he is not eligible for input tax credit, even if used in the course or furtherance of business.

(a) Works contract services when supplied for construction of immovable property, other than plant and machinery.

(b) Goods or Services or both received by a taxable person for construction of an immovable property on his own account, other than plant and machinery, even used in the course or furtherance of business. He is eligible to claim ITC on repairs and maintenance to building or immovable property if the same have not been capitalized in the books of account.

15. Service Code for Real Estate Services: Chapter, Heading : 9972

| 997211 | Rental or Leasing services involving owned or leased property. |

| 997212 | Rental or Leasing services involving own or eased non-residential property. |

16. Rate of Tax applicable: @18%

Tags : gst on real estate pdf, gst on commercial property in india, gst on real estate 2019, gst rate on under construction property, input tax credit under gst for real estate, gst update on real estate

For Regular Updates Join : https://t.me/Studycafe

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"