CA Deepak Bharti | Nov 24, 2018 |

reclaiming vat on expenses uae, uae vat law pdf, vat in uae pdf, uae vat law download, vat on export in uae, vat on imports in uae, value added tax uae ppt, vat on imported goods in uae, Registration Provisions and Procedures under UAE VAT, vat deregistration uae, uae vat registration online, vat registration uae, fta, vat group registration uae, vat in tally uae, how to check vat registration, vat filing in uae, UAE VAT : Registration Provisions and Procedures, Registration Procedure under UAE VAT

UAE VAT : Registration Provisions and Procedures |Being registered under the VAT law means that a business is acknowledged by the government, as a supplier of Goods and Services and is authorized to collect VAT from customers and remit the same to the government. Only VAT registered businesses will be allowed to do the following:

Apart from the above, all registered businesses have to align their business reporting structure in line with the compliance requirements such as accurate and updated books of accounts, tax paid documents such as Tax invoice, credit notes, debit notes, records to all inward supplies and outward supplies etc. are required to be maintained.

Therefore, understanding the fundamentals of VAT will be one of the important steps for your VAT preparation and obtaining VAT registration will be the first step towards transiting your businesses to the VAT era.

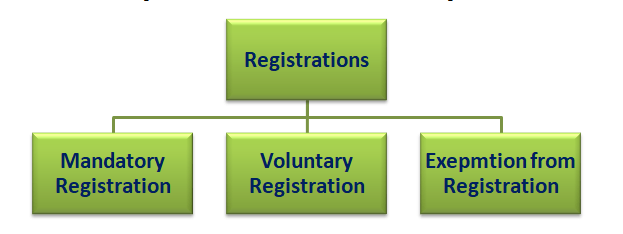

Are all businesses liable to register under VAT No, only those businesses crossing the defined annual aggregate turnover threshold are liable to register under VAT. Based on the registration threshold, a business will either be mandated to register or as an option, a business can apply for registration or can seek exemption from VAT registration, in case it is engaged only on supply of Zero rated supplies.

On this basis, VAT registration in UAE can be classified into the following:

Every Person, who has a Place of Residence in the State or an Implementing State and is not already registered for Tax, shall register in the following situations:

Registration of a business with the tax authorities implies obtaining a unique registration code, which shall be known as the Tax Registration Number (TRN), from the concerned tax authorities so that all the data relating to a business entity can be aggregated and correlated. In any tax system, this is the most fundamental requirement for identification of the business for tax purposes and for having any compliance verification mechanism.

Now let us understand the very essential ingredients of liability for registration:

Place of Residence: The place where a Person has a Place of Establishment or Fixed Establishment, in accordance with the provisions of the Decree-Law.

Place of Establishment: The place where a Business is legally established in a country pursuant to the decision of its establishment, or in which significant management decisions are taken and central management functions are conducted.

Fixed Establishment: Any fixed place of business, other than the Place of Establishment, in which the Person conducts his business regularly or permanently and where sufficient human and technology resources exist to enable the Person to supply or acquire Goods or Services, including the Persons branches.

Example:

| Type of Supplies | Turnover in AED | Qualifying Turnover for Calculation Threshold Limit |

| Taxable Supplies (Sale in UAE) | 375,000 | 375,000 |

| Exports (Zero-Rated Supplies) | 125,000 | 125,000 |

| Exempt Supplies | 50,000 | – |

| Imports | 100,000 | 100,000 |

| Reverse Charge Supplies | 25,000 | 25,000 |

The turnover for VAT registration is AED 625,000 which has exceeded the mandatory registration threshold of AED 375,000. Thus, required to register under UAE VAT mandatorily.

In case of failure of a person to apply for registration when he becomes liable to do, the following will be consequences:

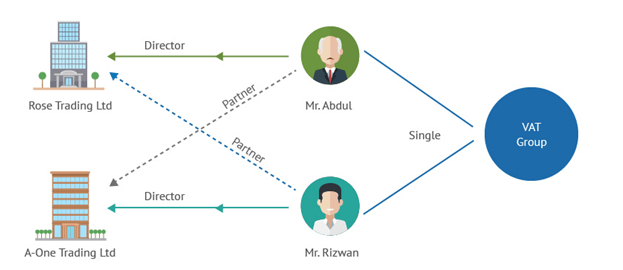

In UAE VAT, any person conducting a business is not allowed to have more than one Tax Registration Number (TRN), unless otherwise prescribed in the UAE Executive Regulation. Thus, even if you are operating via branches in more than one Emirate, only one VAT registration is required. With the similar objective, if two or more persons are related or associated parties in the businesses, they are allowed to apply for VAT group registration.

The VAT Law has provided an option for persons conducting business to apply for registration as a tax group. Persons can apply for Tax registration as a Tax group if all of the following conditions are fulfilled:

It is relevant to note that only legal persons are entitled to take registration as tax group. Natural person cannot become member of a Tax group.

Example-1- ABC LLC has a place of establishment in Dubai and has three more companies in the group having presence across different places in UAE although in association with different Arab shareholders/owners. Instead of having to obtain separate registrations for all such entities, they could opt for single registration for all companies in the group as Tax Group. Such tax group shall be treated as one registrant in the eyes of the Law i.e. any transactions amongst such persons shall be out of the ambit of VAT applicability. This would give them an advantageous position where such persons could reduce their compliance and cash flow burdens.

Example-2 Mr Abdul is a Director in Rose Trading Ltd and a Partner in A-One Trading Ltd. Mr Rizwan, is a Director of A-One Trading Ltd. Also, Mr. Rizwan is a Partner in Rose Trading Ltd. Therefore, Mr Abdul and Mr. Rizwan will be treated as related parties and will be eligible to apply for VAT Group Registration provided the conditions are fulfilled.

Two or more Persons shall be considered Related Parties if they are associated in economic, financial and regulatory aspects, taking into account the following:

A. Economic practices, which shall include at least one of the following:

B. Financial practices, which shall include at least one of the following:

C. Regulatory practices, which shall include any of the following:

The following are the benefits of VAT Group Registration for the business:

Step-1: Creating and using your e-Services account

When you arrive at the FTA website (https://eservices.tax.gov.ae/en-us/loginreturnurl=%2fen-us%2fuser%2fdashboard), you will notice in the top right hand corner of the screen you have the option to either Sign up to the e-Services account service, or Login to an existing e-Services account.

Create an e-Services account (new users)

Sign up To create an account, simply click on the Sign up button on the home page. To sign up, you must enter a working email address and a unique password of 6-20 characters that includes at least: one number; one letter; and one special character (i.e. @, #, $, %, & and *). You must confirm that you are a genuine applicant by completing the CAPTCHA or alphanumeric verification test that you will see. Finally, you will be asked to select a security question and provide an answer and a hint in order to recover your password in case you forget it.

Verify your e-Services account

You will receive an email at your registered email address asking you to verify your email address. Please verify your email address within 24 hours of requesting to create the e-Services account, otherwise the verification link will expire and you will have to re-register. Once you have successfully verified your email address, your e-Services account will be created and you will be invited to Login for the first time.

Services available in your e-Services account

There are a number of dedicated services available to you through your e-Services account. Currently, you will be able to access the following:

Registering a Tax Group

A Tax Group shall select one of its registered members to act as the representative member of this Tax Group. Only the representative member of a prospective Tax group can apply to form a Tax group. In order to do so, the representative member must already be in possession of a Tax Registration Number (TRN) for VAT, or submit a VAT registration application at the time of applying to form a Tax Group.

Each of the prospective members of the Tax group must:

To submit an online application to register for VAT if you are the representative member, please follow these steps:

It is recommended that you save your progress as you complete the form. Click on the Save as draft button at the bottom of the screen. You will be logged out of the system after 10 minutes of inactivity.

The Authority should make a decision regarding any application submitted for registration of two or more Persons as a Tax Group within the period of 20 business days starting with the day on which it was received by the Authority.

Where a request to form a new Tax Group is approved, the Tax Group registration shall be in effect according to the following:

Ground of Rejection by Authority

The Authority may refuse the application for registration as a Tax Group, in any of the following cases:

Amending details/information in a Tax group

Only the representative member of a registered Tax group can apply to amend the Tax group. This can only be done once a Tax group application has been approved by the FTA. The representative member must login into the e-Services account where the website facilitates making the following amendments to your Tax group registration:

As the representative member, when you attempt to add new member(s) to the Tax group, please ensure that each of them must:

Once logged into the e-Services account, click on the Tax group amendment button on the Dashboard within the Tax group box as shown. After clicking on Tax group amendment button, the options to add a member, remove a member and amend details of the registered Tax group will be displayed to you.

Adding members to a registered Tax group from the Tax Group Amendment Form

When you are viewing the Tax Group Amendment form, you will be able to add a member to the Tax group. If the member you intend to add to the Tax group is already registered, please select the Yes button for the field Is this member registered for VAT Provide the TRN/TIN of the member and click on the Verify button as shown. If the TRN/TIN is valid, the legal name (both English and Arabic) of the member will be automatically populated on the form. Proceed to complete the other fields in the form. If a member you intend to add to the Tax group is not already registered with the FTA, please select the No button for the field Is the Member already registered with the FTA for VAT Click on the Add a member button and the form to add a member will be displayed on your screen. Proceed to complete all the fields in the form and save the amends made by you by clicking on the Save button.

Removing members from a registered Tax Group in the Tax Group Amendment Form

When you are viewing the Tax Group Amendment form, you will be able to view a table which will list all members of the registered Tax group along with specific details of the group member. Click on the delete icon for the member you wish to remove from the Tax group as shown. You will then be prompted to confirm if you are sure you want to remove that member. Click on the OK button if you would like to proceed and the Confirm and Remove form will be displayed on your screen. Submit the amends made by you by clicking on the Confirm and Remove button. You will then return to the webpage which was displayed after you had clicked on the Tax group amendment button.

Amending Tax Group details in the Tax Group Amendment Form

When you are viewing the Tax Group Amendment form, you will be able to view specific details of the registered Tax group, which will be displayed below the table which lists the members of the Tax group. All of the fields in this form will be pre-populated and displayed. You can amend the fields that you wish you to change. Save the amends made by you by clicking on the Save as draft button to save the Tax group amendment form with the new details.

There could be situations where a person, though not mandatorily required to register, may be willing to register. The purpose of voluntary registration could be to recover input tax credits so that cascading effect of taxes does not take place.

Conditions to be satisfied for Voluntary Registration:

Where a Person has applied for voluntary registration in accordance with the provisions of the Decree-Law, the Authority shall register a Person with effect from the first day of the month following the month in which the application is made, or from such earlier date as may be requested by the Person and agreed by the Authority.

* For the purpose of voluntary registration, the phrase Taxable Expenses means expenses which are subject to the standard rate tax and which are incurred in the State by a Person who has a Place of Residence in the State. This requires assessment by the person intending to apply for registration to carry out assessment of all his expenses as to whether it is taxable or not.

A Registrant shall apply to the Authority for Tax Deregistration in any of the following cases:

A registrant has to mandatorily apply for tax de-registration if he stops making taxable supplies or the value of such supplies is less than the voluntary threshold limit in the preceding 12 months. However, if his anticipated supply or expenditure in the coming 30 days is expected to reach voluntary registration threshold, he may choose not to deregister himself.

A person who has obtained voluntary registration is not permitted to apply for deregistration within 12 months of the date of registration.

It is pertinent to note that a registrant cannot be deregistered unless he has:

Deregistration in case of Group Registration:

The Authority must deregister a Tax Group if the following conditions are met:

The representative member of a Tax Group shall notify the Authority if any member of the Tax Group is no longer eligible to be part of the Tax Group, within 20 business days of the ceasing to be eligible.

Where the Authority decided to either deregister a Tax Group or amend a Tax Group registration, it shall give Notification of that decision and its effective date to the representative member within 10 business days of making such decision.

**************************************************************

Disclaimer

All rights reserved. No part of this Article may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the author.

About Author

About Author

Author of this article is CA Deepak Bharti who is member of ICAI. Currently he is working as partner in M/s N A V & Co. Chartered Accountants, handling the Corporate Compliance and Legal Department. He can be reached [email protected]. Suggestions/comments are most welcome.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"