Studycafe | Nov 22, 2019 |

Restriction in Input tax credit availment : New Rule 36(4) of CGST Rule, 2017

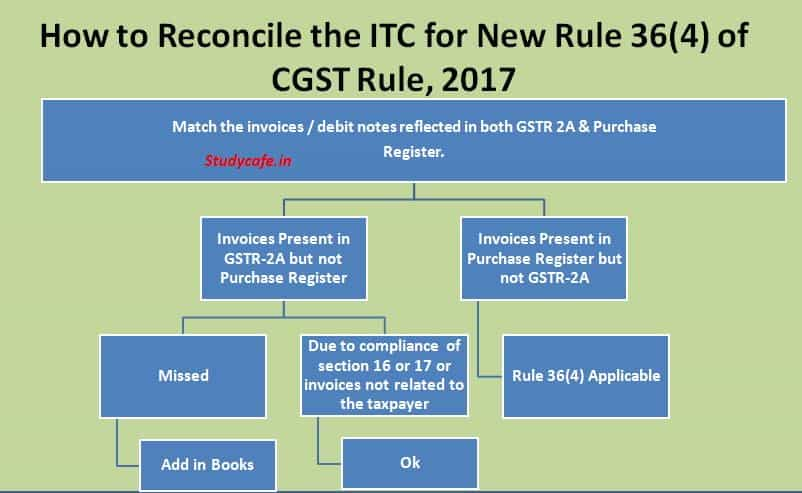

As per New Rule 36(4) of CGST Rule, 2017 Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers in their GSTR-1 under section 37(1), shall not exceed 20 per cent of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under section 37(1).

Rule 36(4) is given below for reference:

36(4) Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37, shall not exceed 20 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.

You May Also Refer : 20% ITC restrictions : Understanding Circular No. 123/2019 dated 11.11.2019

• However, concerns were raised in the Notification no. 49/ 2019, dated 09.10.19, over the method of calculating this 20% amount, the cut-off date and also whether it was to be calculated supplier-wise or on a consolidated basis. Therefore, the circular clarifies all these aspects.

• The restriction is not imposed through the common portal and it is the responsibility of the taxpayer that credit is availed in terms of the said rule and therefore, the availment of restricted ITC should be done only on self-assessment basis by the tax payers.

• The 20% cap on the eligible Input Tax Credit will not be calculated supplier-wise and not on on a consolidated basis.

• The provisions is applicable from 9th October, 2019.

You May Also Refer : Consequences if 20% ITC RULE 36 (4) is not followed

Monthly reconciliation not a easy job :

It is not an easy job to reconcile GSTR-2A and Books on monthly basis in the very short time frame that is provided to the tax payer. Also GSTR-2A is a dynamic form. It changes when invoices are corrected , added or omitted. This makes the reconciliation process even more difficult.

You May Also Refer : Calculation of Input tax credit as per new GST Rule 36(4)

Ineligible credit reflected in GSTR-2A :

It is not hundred percent guaranteed that all the credits reflecting in GSTR-2A are eligible. It may contain ineligible and even incorrect credits which can be reconciled only after deep scruitney of books.

For computing the eligible credit, the following may be considered as ineligible credit:

a) Credit restricted u/s 17(5) or Blocked Credits.

b) Inwards Supplies used exclusively in providing the exempt supply.

c) Inward Supplies partly used for exempt supply.

d) Inward Supplies partly used for non-business purpose.

You May Also Refer : Changes in GST ITC Availment Conditions

You May Also Refer : Clarification On Restriction in availment of ITC w.r.t CGST Rule 36(4) issued by CBIC

Please use the below mentioned example to understand the above mentioned formula

| Particulars | ITC as Per Books | ITC as per GSTR-2A | Eligible ITC | Ineligible ITC |

| Case -1 | 100 | 60 | 72 | 28 |

| Case – 2 | 100 | 90 | 100 | 0 |

Disclaimer : The Above Formula and method is based on understanding of Author and is subject to reconciliation of GSTR-2A and Books.

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

For Regular Updates Join : https://t.me/Studycafe

Tags : GST, Rule 36(4), 20% ITC Restriction

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"