Reetu | Oct 6, 2021 |

Resumption of Blocking of E-Way Bill (EWB) generation facility

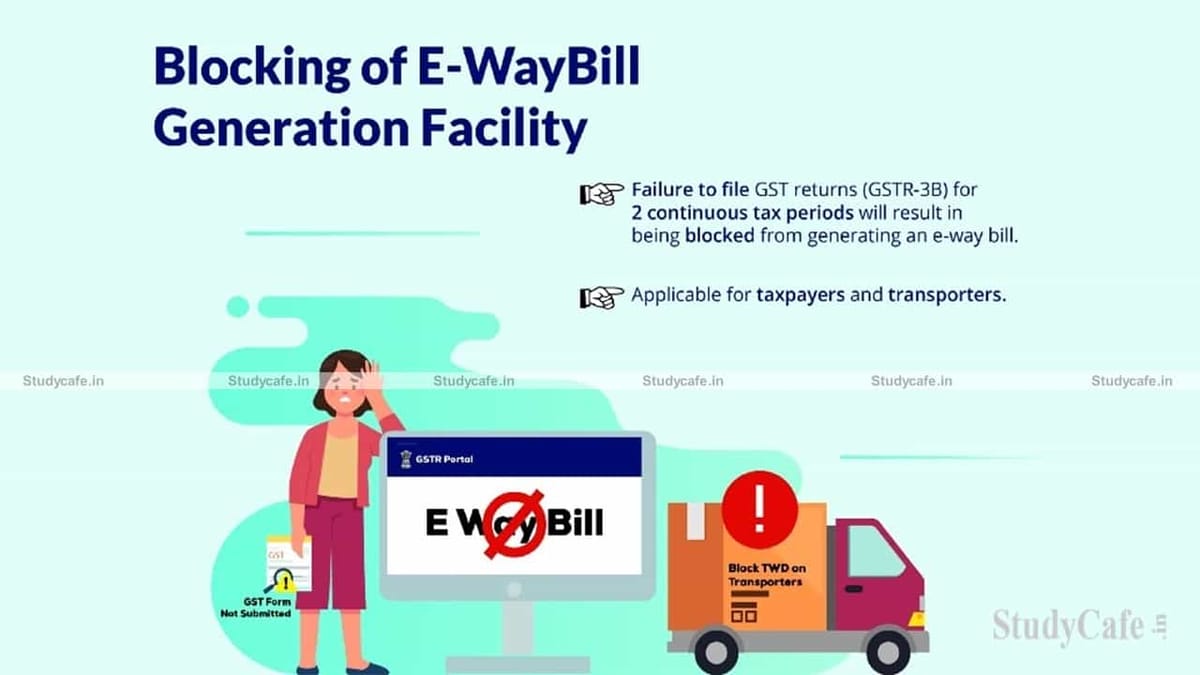

The government temporarily halted the blocking of E-way bill generating, because of the Covid epidemic. The E Way Bill generating facility of a person is subject to be prohibited under Rule 138 E (a) and (b) of the CGST Rules, 2017 if the person fails to file their return in Form GSTR-3B / statement in CMP-08 for two consecutive tax periods or more, whether Monthly or Quarterly.

The blocking of the EWB generation facility has been restored for all taxpayers on the EWB portal. From August 2021 onwards, the System will monitor the status of returns filed in Form GSTR-3B or statements filed in Form GST CMP-08 on a regular basis, as was done before the epidemic, and block the generation of EWBs according to the rules.

To continue to use the EWB Portal’s EWB generation service, you should file your pending GSTR 3B returns/ CMP-08 Statements on a regular basis.

Click on the following link for further information about blocking and unblocking EWB:

https://tutorial.gst.gov.in/userguide/returns/index.htm#t=FAQs_unblockingewaybill.htm

Note: Please ignore this update if you are not registered on the EWB portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"