Direct Tax Collections as on 10.11.2024 as released by Income tax Department

Anisha Kumari | Nov 12, 2024 |

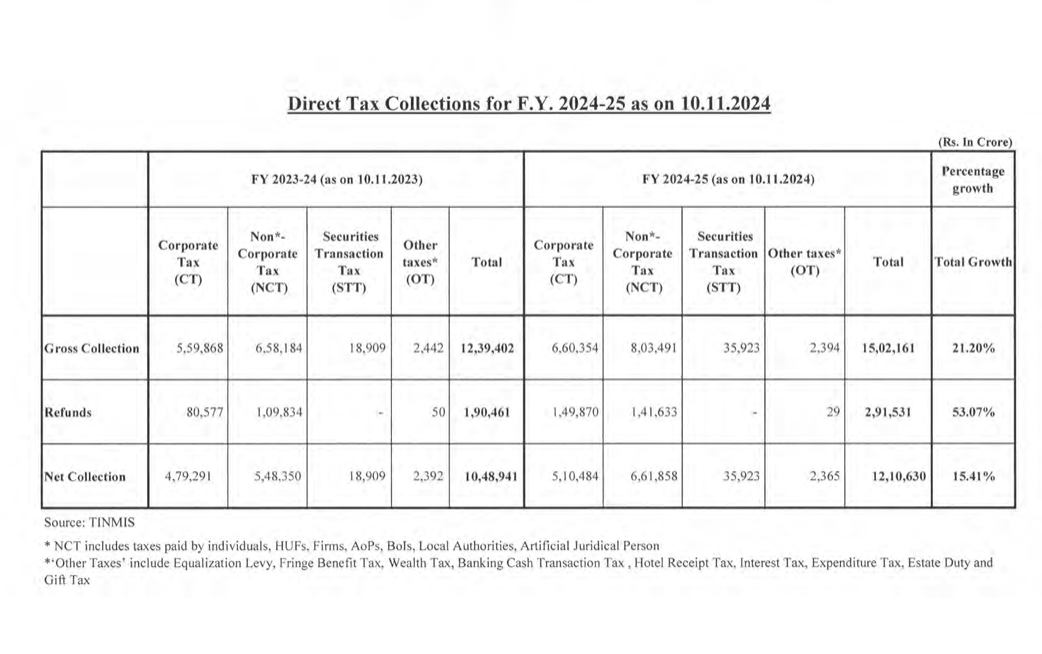

Rise in Non-Corporate Tax Collections Reflects Changing Tax Dynamics in India

Tax collection at the India level for the financial year 2024-25 has revealed an interesting trend: while corporations traditionally contributed the majority of the nation’s tax revenue, this pattern has now shifted. Individual and non-corporate taxes currently make up a larger proportion of total tax collections. In fact, non-corporate tax collections are 29.61% higher than corporate tax collections. This marks a significant increase from last year, when non-corporate tax collections were 14.41% greater than those of corporate taxes. Just a few years ago, corporate tax collections exceeded those from non-corporate taxpayers, indicating a visible shift in the tax burden distribution.

This trend also aligns with an overall increase in securities transaction tax (STT) collections. The rise in STT collections remains steady even after the implementation of additional taxes on dividends and capital gains. For many, this layered taxation imposing levies on both dividends and gains further increases the tax burden on investors.

This pattern in tax collection coincides with a broader economic trend. Declining profit margins among NIFTY-listed companies indicate a potential slowdown, which could signal a recession in India’s manufacturing and service sectors. As corporate profits shrink, the increasing contribution of personal income earners to direct taxes reflects a shifting tax burden.

Direct Tax Collections

Economic observers have raised concerns about this trend, as a continued reliance on non-corporate taxpayers could highlight challenges in corporate profitability and, by extension, the overall economy. With the tax burden on individual taxpayers and the non-corporate sector steadily increasing, questions about the sustainability of India’s economic growth and the resilience of its key sectors are becoming more pressing.

The underlying data suggest a broad-based trend that may prompt policymakers to reassess the balance of tax contributions between corporates and non-corporate entities, especially if recessionary signals continue to emerge from the manufacturing and service sectors.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"