ROC imposes Hefty penalty for Non-Filing of Annual Accounts of Company; Check Penalty Amount

Reetu | Oct 31, 2022 |

ROC imposes Hefty penalty for Non-Filing of Annual Accounts of Company; Check Penalty Amount

The Registrar of Companies has imposed penalty in violation of section 92 for Non-Filing of the Annual Accounts of the Company in the matter of Topfun Technologies Private Limited.

Topfun Technologies Private Limited [herein after known as the Company] CIN: U72900GA2020PTC014241 is a registered company with the office of the Registrar of Companies, Goa, Daman and Diu and having its registered address as No. 201, Shanta Building, 18th June Road, Panjim, North Goa, Goa, 403001, India as per records maintained by this office in online registry.

The Show Cause Notices (SCN) under Sections 92(5) and 137(3) of the Companies Act, 2013 were issued vide letter no. ROCGDD/2022/Nonfiling/Topfun/ 589-594 dated 28.07.2022 to Company and its Directors, Shri Nausad (DIN:09338158), Shri Satyapal Khaliya (DIN: 08769452), Shri Abhishek Kumar Gupta (DIN:08671554), Shri Ved Prakash (DIN:09336143), Shri Ankur Singh (DIN:08671553). The Noticee’s to SCN were called upon to show the case for non-filing of Annual Return(s) and Financial Statement(s) pursuant to Section 92 and Section 137 of the Act respectively. No response to Show Cause Notice dated 28.07.2022 was received from the Company and its Directors.

The Company has not filed Annual Return(s) and Financial Statement(s) pursuant to sub-section (4) of Section 92 and sub-section (1) of Section 137 of the Act respectively for the financial year ending 31.03.2021, thereby attracting penal provisions under sub-section (5) of Section 92 and subsection (3) of Section 137 of the Act respectively. The offense is of serious nature since the non-filing of Annual Accounts by the Company put itself out of reach of stakeholders/ regulatory authorities and others concerned.

The object of filing the annual return of the company with the Public Domain is in the public interest, to enable the investors, public and whosoever interested in the company can access the fundamental information about the company and its management. Non-filing of this statutory return will result in denial of information to public about the company.

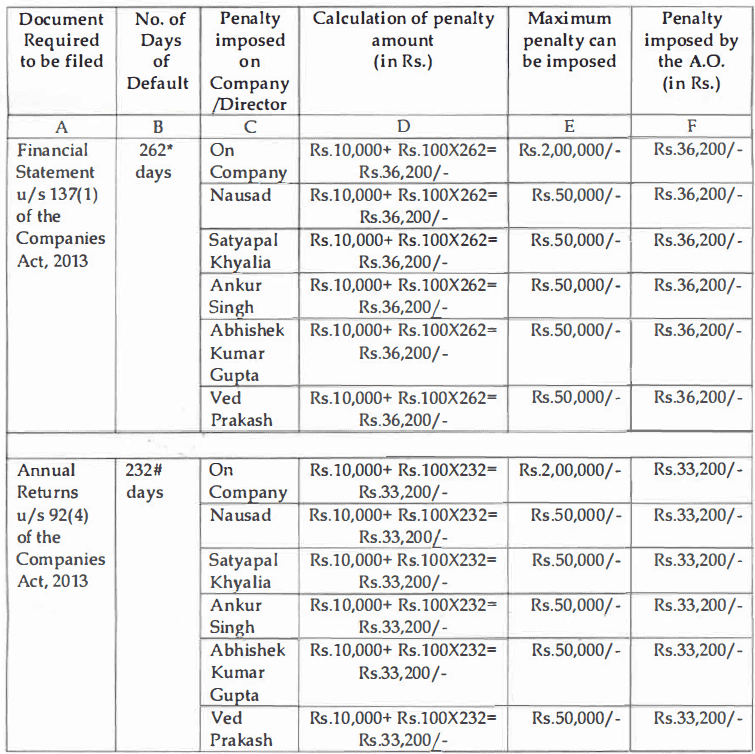

Having considered the facts and circumstances of the case, and after taking into account the factors above, the A.O. do hereby impose penalty on Company and Directors as per table below for violation of Section 92 and Section 137 of the Companies Act, 2013 for Financial Year ending 31.03.2021. The A.O. is of the opinion that penalty is commensurate with the aforesaid default committed by the Noticee’s.

The company and its the Directors are hereby directed to pay the penalty amount as per column ‘F’ of the above table and also directed to rectify the default immediately from the date of receipt of copy of this Order.

The Penalty imposed hereinabove shall be paid through the Ministry of Corporate Affairs portal only.

For Official Order Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"