The Income Tax Department is taking necessary steps to make sure the deduction claimed under section 80GGC of the Income Tax Act, 1961, is correct and genuine.

Nidhi | Jun 16, 2025 |

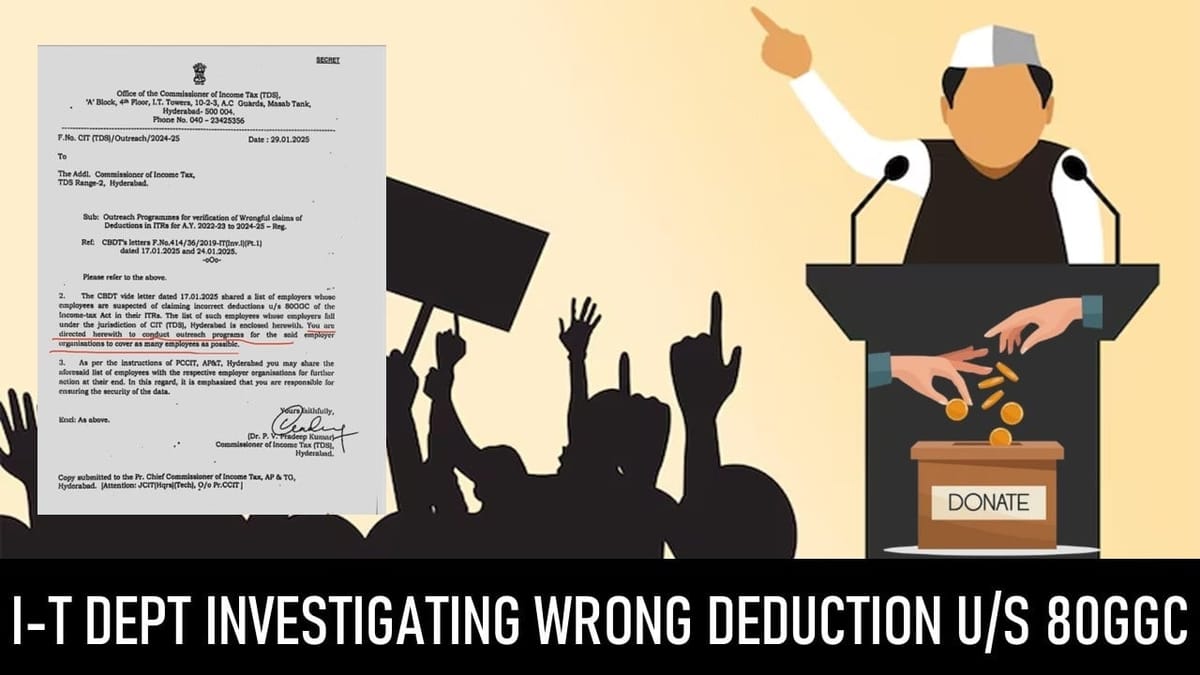

Salary Class in Trouble Over Fake 80GGC Claims: Income Tax Dept Flags Employees, Alerts Employers

The Income Tax Department is taking necessary steps to make sure the deduction claimed under section 80GGC of the Income Tax Act, 1961, is correct and genuine. In a letter issued on June 17, 2025, CBDT disclosed a list of employers whose employees are suspected of claiming invalid or wrong deductions under section 80GGC.

Section 80GGC allows individuals to claim a deduction for donations made to registered political parties or electoral trusts. The donations made under this section are 100% deductible. To claim the deduction under Section 80GGC, donations or contributions must be made through proper banking channels, such as internet banking, credit cards, debit cards, cheques, demand drafts, etc. Cash donations made under section 80GGC cannot be claimed for tax deduction.

The Income Tax Department has asked the tax officials to connect with the employers whose employees are suspected of claiming invalid deductions under Section 80GGC, by conducting outreach programs for the employer organisation. Additionally, the list of suspected employees will be shared with their employers so they can take the correct action.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"