Reetu | Mar 9, 2023 |

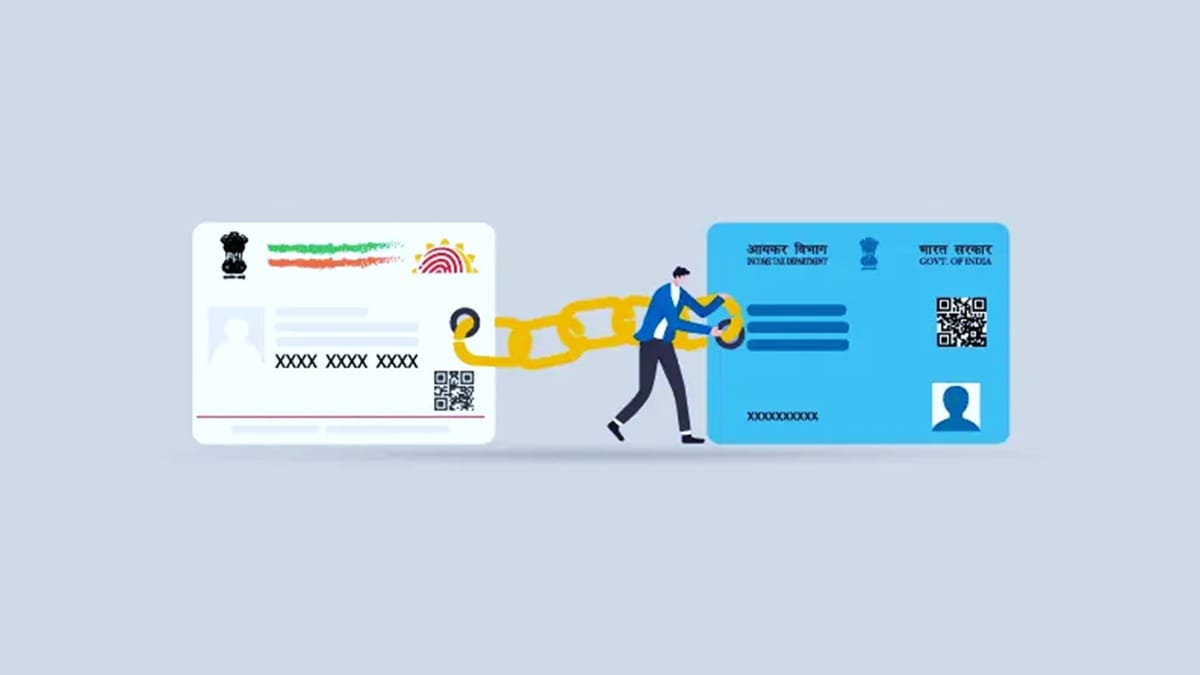

SEBI Notifies Linking of PAN with Aadhaar to be done by 31st March 2023

The Securities Exchange Board of India(SEBI) notifies Linking of PAN with Aadhaar to be done by 31st March 2023 via issuing press release.

The Press release stated, “The provisions of Income-tax Act, 1961, make it mandatory for every person who has been allotted a Permanent Account Number (PAN) to intimate his/her Aadhaar Number to the prescribed authority so that the Aadhaar and PAN can be linked. This is required to be done on or before the notified date, failing which the PAN shall become inoperative.”

The PAN assigned to a person will become inoperative if it is not linked with Aadhaar by March 31, 2023, in accordance with Central Board of Direct Taxes (CBDT) Circular No. 7 of 2022, dated March 30, 2022, and will be subject to all penalties under the Income-tax Act, 1961 for failure to furnish, notify, or quote the PAN.

Since PAN is the key identification number and part of KYC requirements for all transactions in the securities market, all SEBI registered entities and Market Infrastructure Institutions (MIIs) are required to ensure valid KYC for all participants.

Prior to March 31, 2023, all current investors must ensure that their PAN and Aadhaar numbers are linked in order to conduct continuous and seamless securities market transactions and to avoid the negative effects of non-compliance with the aforementioned CBDT circular, which could result in restrictions on the purchase and sale of securities as well as other transactions until the PAN and Aadhaar numbers are linked.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"