CA Pratibha Goyal | Jul 18, 2023 |

Summary Note on Circulars 192 to 199 issued by CBIC on 17th July 2023

Circular No. 192/04/2023-GST Dated the 17th July 2023

No Interest Application where the available balance of IGST credit in the ECrL is lower than the amount of IGST credit balance, If the total balance of input tax credit in the electronic credit ledger of the registered person under the heads of (IGST + CGST + SGST) > than such wrongly availed IGST credit, at all times, till the time of reversal of the said wrongly availed IGST credit.

Since the amount of input tax credit available in the electronic credit ledger, under any of the heads of IGST, CGST, or SGST, can be utilized for payment of liability of IGST, it is the total input tax credit available in the electronic credit ledger, under the heads of IGST, CGST, and SGST taken together, that has to be considered for calculation of interest under rule 88B of CGST Rules.

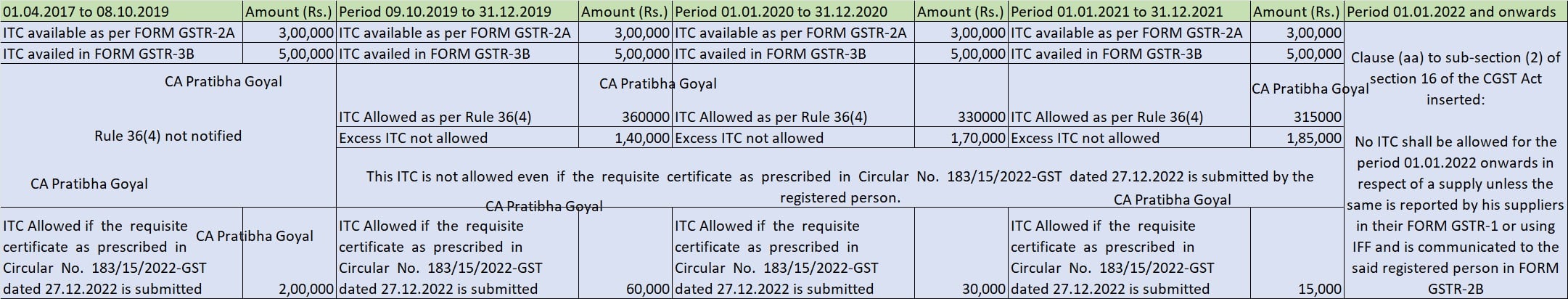

Circular No. 193/05/2023-GST Dated the 17th July 2023

Clarification to deal with the difference in Input Tax Credit (ITC) availed in FORM GSTR-3B as compared to that detailed in FORM GSTR-2A for the period 01.04.2019 to 31.12.2021.

Provisions of Circular No. 183/15/2022 would be extended.

Limits to be seen as:

a. W.e.f. 09.10.2019 GSTR-2A + 20%

b. w.e.f 01.01.2020 GSTR-2A + 10%

c. w.e.f. 01.01.2021 GSTR-2A + 5%

d. w.e.f. 01.01.2022 ONLY GSTR-2A

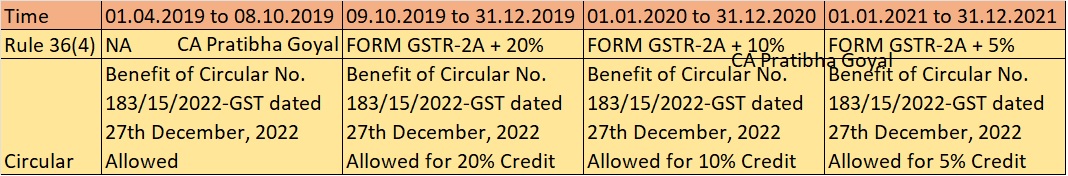

Circular No. 194/06/2023-GST Dated the 17th July 2023

Clarification on TCS liability under Sec 52 of the CGST Act, 2017 in case of multiple E-commerce Operators in one transaction.

In the case of the ONDC Network or similar other arrangements, there can be multiple ECOs in a single transaction – one providing an interface to the buyer and the other providing an interface to the seller.

When supplier-side ECO of himself is not the supplier in the said supply:

a. Buyer > Buyer-side ECO > Supplier-side ECO > Supplier

b. Collection of TCS, is to be done by the supplier-side ECO who finally releases the payment to the supplier for a particular supply made by the said supplier through him.

The Supplier-side ECO is himself the supplier of the said supply.

a. Buyer > Buyer-side ECO > Supplier (also an ECO)

b. TCS is to be collected by the Buyer-side ECO while making payment to the supplier for the particular supply being made through it.

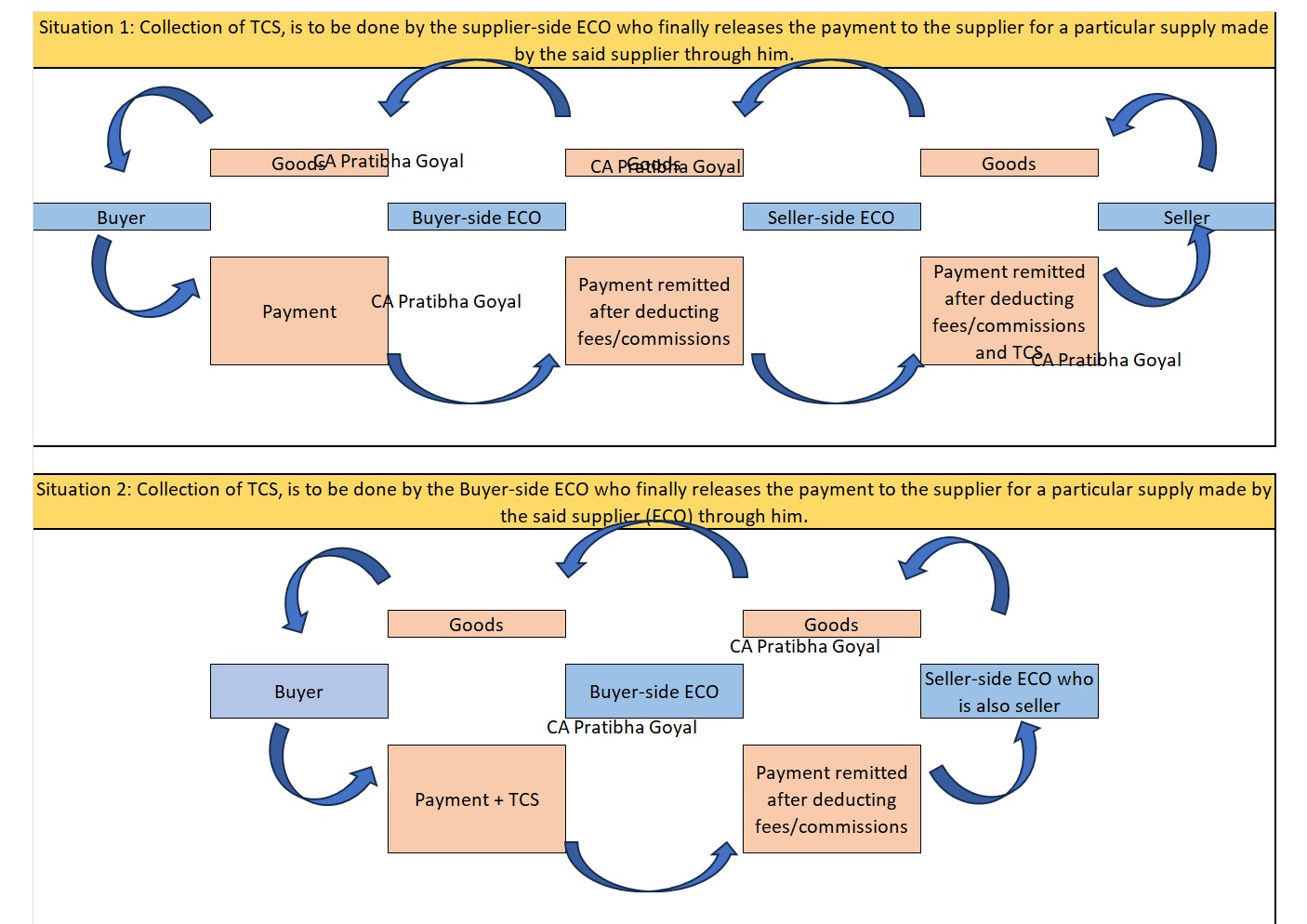

Circular No. 195/07/2023-GST Dated the 17th July 2023

Clarification on availability of ITC in respect of warranty replacement of parts and repair services during the warranty period.

Replacement/Repair by Original Manufacturer under Warranty

The value of the original supply of goods (provided along with warranty) by the manufacturer to the customer includes the likely cost of replacement of parts and/or repair services to be incurred during the warranty period, on which tax would have already been paid at the time of original supply of goods. Where the manufacturer provides replacement of parts and/ or repair services during the warranty period, without separately charging any consideration at the time of such replacement/ repair services, no further GST is chargeable.

If any additional consideration is charged by the manufacturer from the customer, either for the replacement of any part or for any service, then GST will be payable on such supply with respect to such additional consideration.

These supplies are not exempt supply and accordingly, the manufacturer, who provides replacement of parts and/ or repair services to the customer during the warranty period, is not required to reverse the Input Tax Credit (ITC).

Replacement/Repair by Distributor

Tax Invoice Raised to Manufacturer by Distributor: GST would be payable by the dealer on the said supply by him to the distributor/manufacturer and the distributor /manufacturer would be entitled to avail the input tax credit of the same.

If Only the exchange of parts i.e., Collect from the Manufacturer and given to the Customer, then no GST is payable on such replacement of parts by the manufacturer.

Credit Note issued by Manufacturer: The manufacturer issues a credit note for the stock used by the dealer, then ITC is required to be Reversal by the dealer, and GST liability reduction of the Manufacturer will be subject to sec 34(2)

Extended Warranty

Product rate would vary from the goods, but if the extended warranty is purchased at the time of product supply, then the extended warranty becomes part of the value of the composite supply, the principal supply being the supply of goods, and GST would be payable accordingly.

Extended warranty obtained subsequent to original purchase under a different contract GST would be payable depending on the nature of the contract.

Circular No. 196/08/2023-GST Dated the 17th July 2023

Clarification on the taxability of share capital held in the subsidiary company by the parent company

Securities are considered neither goods nor services in terms of the definition of goods under clause (52) of section 2 of the CGST Act and the definition of services under clause (102) of the said section. Further, securities include ‘shares’ as per the definition of securities under clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956.

This implies that the securities held by the holding company in the subsidiary company are neither goods nor services.

Further, the purchase or sale of shares or securities, in itself is neither a supply of goods nor a supply of services. For a transaction/activity to be treated as a supply of services, there must be a supply as defined under section 7 of the CGST Act. It cannot be said that a service is being provided by the holding company to the subsidiary company, solely on the basis that there is a SAC entry ‘997171’ in the scheme of classification of services mentioning; “the services provided by holding companies, i.e. holding securities of (or other equity interests in) companies and enterprises for the purpose of owning a controlling interest.”, unless there is a supply of services by the holding company to the subsidiary company in accordance with section 7 of CGST Act.

Therefore, the activity of holding of shares of the subsidiary company by the holding company per se cannot be treated as a supply of services by a holding company to the said subsidiary company and cannot be taxed under GST.

Circular No. 197/09/2023-GST Dated the 17th July 2023

Clarification on refund-related issues

Refund of accumulated input tax credit u/s 54(3) for a tax period from January 2022 onwards shall be on the basis of the credit available as per FORM GSTR-2B.

However, in cases where refund claims for a tax period from January 2022 onwards have already been disposed on the Basis of GSTR-2A by the proper officer before the issuance of this circular, the same shall not be reopened because of the clarification being issued by this circular.

Following changes are made in Undertaking in FORM GST RFD 01

“Undertaking in relation to sections 16(2)(c) and section 42(2)” wherever mentioned in the column “Declaration/ Statement/ Undertaking/ Certificates to be filled online” may be read as “Undertaking in relation to sections 16(2)(c)”.

“Copy of GSTR-2A of the relevant period” wherever required as supporting documents to be additionally uploaded stands removed/deleted.

“Self-certified copies of invoices entered in Annexure-B whose details are not found in GSTR-2A of the relevant period” wherever required as supporting documents to be additionally uploaded stands removed/deleted.

Manner of calculation of Adjusted Total Turnover for rule 89(4)

The value of goods exported out of India to be included while calculating “adjusted total turnover” will be the same as being determined as per the Explanation inserted in sub-rule (4) of rule 89 of CGST Rules vide Notification No. 14/2022- CT dated 05.07.2022.

Admissibility of refund where an exporter applies for refund subsequent to compliance of the provisions of sub-rule (1) of rule 96A

When goods are actually exported or as the case may be, payment is realized in case of export of services, even if it is beyond the time frames as prescribed in sub-rule (1) of rule 96A, the benefit of zero-rated supplies cannot be denied to the concerned exporters.

Accordingly, it is clarified that in such cases, on actual export of the goods or as the case may be, on the realization of payment in case of export of services, the said exporters would be entitled to a refund of unutilized input tax credit in terms of sub-section (3) of section 54 of the CGST Act, if otherwise admissible.

It is also clarified that in such cases subsequent to export of the goods or realization of payment in case of export of services, as the case may be, the said exporters would be entitled to claim refund of the integrated tax so paid earlier on account of goods not being exported, or as the case be, the payment not being realized for export of services, within the time frame prescribed in clause (a) or (b), as the case may be, of sub-rule (1) of rule 96A. It is further being clarified that no refund of the interest paid in compliance of sub-rule (1) of rule 96A shall be admissible.

It may further be noted that the refund application in the said scenario may be made under the category “Excess payment of tax”. However, till the time the refund application cannot be filed under the category “Excess payment of tax” due to non-availability of the facility on the portal to file refund of IGST paid in compliance with the provisions of sub-rule (1) of rule 96A of CGST Rules as ”Excess payment of tax”, the applicant may file the refund application under the category “Any Other” on the portal.

Circular No. 198/10/2023-GST Dated the 17th July 2023

Clarification on issues pertaining to e-invoice

Government Departments or establishments/ Government agencies/ local authorities/ PSUs, registered solely for the purpose of deduction of tax at source as per provisions of section 51 of the CGST Act, are to be treated as registered persons under the GST law as per provisions of clause (94) of section 2 of CGST Act.

Accordingly, the registered person, whose turnover exceeds the prescribed threshold for generation of e-invoicing, is required to issue e-invoices for the supplies made to such Government Departments or establishments/ Government agencies/ local authorities/ PSUs, etc under rule 48(4) of CGST Rules.

Circular No. 199/11/2023-GST Dated the 17th July 2023

Clarification regarding taxability of services provided by an office of an organisation in one State to the office of that organisation in another State, both being distinct persons

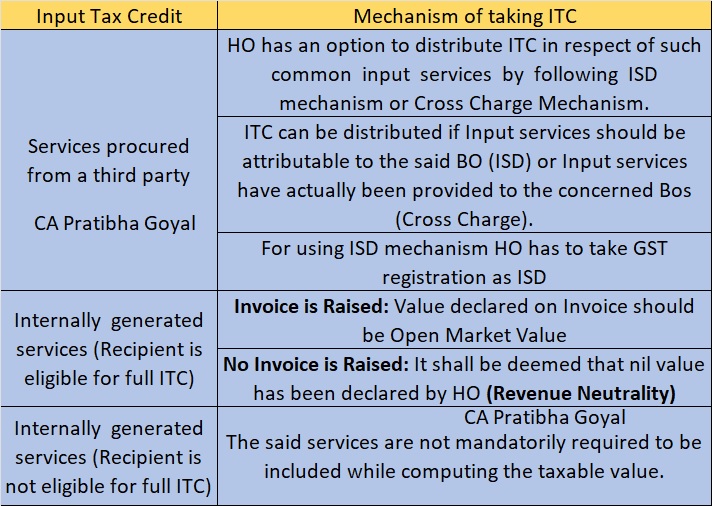

Services procured from a third party:

Head Office (HO) has an option to

in respect of common input services procured from a third party by HO but attributable to the said BOs and the BOs can then avail ITC of the same.

Internally generated services

Where full input tax credit is available to a BO:

Tax Invoice is issued

The value declared on the invoice by HO to the said BO in respect of a supply of services shall be deemed to be the open market value of such services, irrespective of the fact whether the cost of any particular component of such services, like employee cost etc., has been included or not in the value of the services in the invoice.

Tax Invoice is not issued

Further, in such cases where full input tax credit is available to the recipient, if HO has not issued a tax invoice to the BO in respect of any particular services being rendered by HO to the said BO, the value of such services may be deemed to be declared as Nil by HO to BO, and may be deemed as open market value in terms of second proviso to rule 28 of CGST Rules.

Cost of Salary

In respect of internally generated services provided by the HO to BOs, the cost of salary of employees of the HO, involved in providing the said services to the BOs, is not mandatorily required to be included while computing the taxable value of the supply of such services, even in cases where full input tax credit is not available to the concerned BO.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"