In the significant changes, the IT department started sending out the intimation notices during the processing of ITR under “Risk Management System”.

Reetu | Aug 28, 2024 |

Tax Alert: Tax Department sending out Intimation Notices during ITR Processing for large refund/deductions

In the significant changes, there is an important update for the income tax taxpayers that now the income tax department started sending out the intimation notices while the processing of ITR.

A Chartered Accountant on Twitter shared, “The Income Tax Department is now sending out Intimation Notices during ITR processing under the “Risk Management System”. “

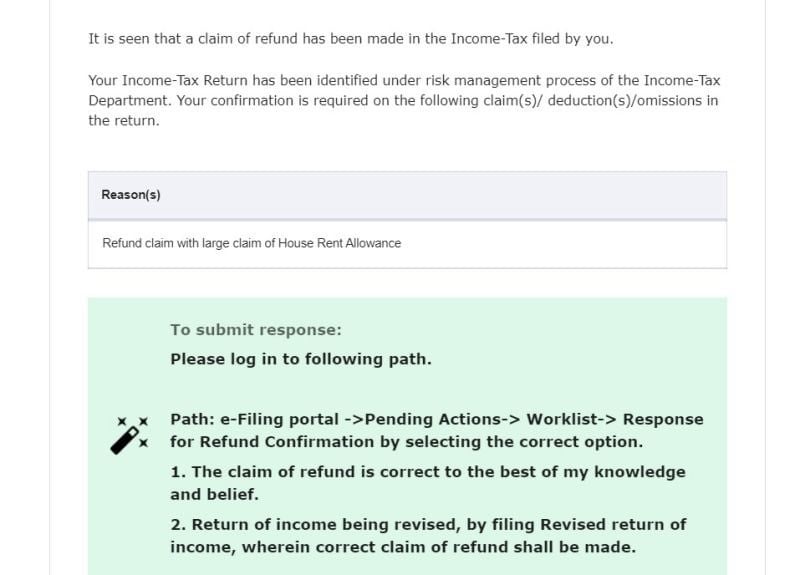

If you reported high-value transactions or requested a substantial refund, you may receive an alert. This is just a request to confirm or correct your return.

Check your worklist area on the Income Tax Portal and respond accordingly—either reaffirm your claim or file an amended ITR if needed.

This year ITR and refund processing is delayed in comparison of last year’s. Many taxpayers who filed ITR in June, are still waiting for their ITR to get processed.

During the processing of your ITR, the tax department checks for mathematical errors, internal discrepancies, and tax and interest computations before validating tax payments. After the ITR is processed, the tax department sends an intimation under section 143(1). It is worth noting, however, that the tax department performs an initial examination during the ITR processing. In the future, they may issue an income tax notice under a different section, demanding additional information.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"