Tax Audit Utility for FY 2022-23/ AY 2023-24 available on Income Tax Portal

CA Pratibha Goyal | Jul 12, 2023 |

Tax Audit Utility for FY 2022-23/ AY 2023-24 available on Income Tax Portal

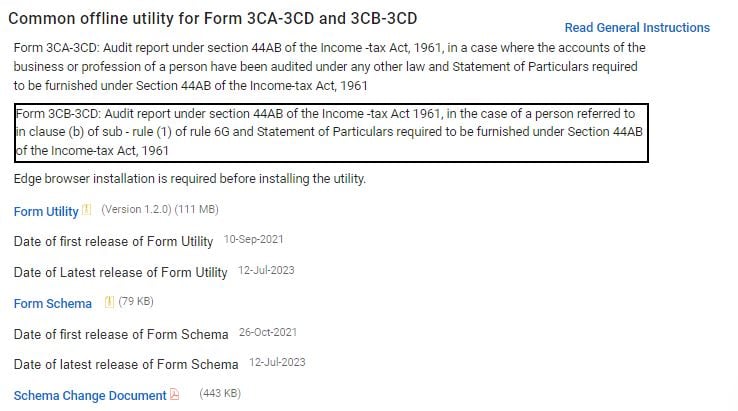

Income Tax Portal has made available Tax Audit Utility for FY 2022-23/ AY 2023-24.

Form 3CA-3CD: Audit report under section 44AB of the Income -tax Act, 1961, in a case where the accounts of the business or profession of a person have been audited under any other law and Statement of Particulars required to be furnished under Section 44AB of the Income-tax Act, 1961

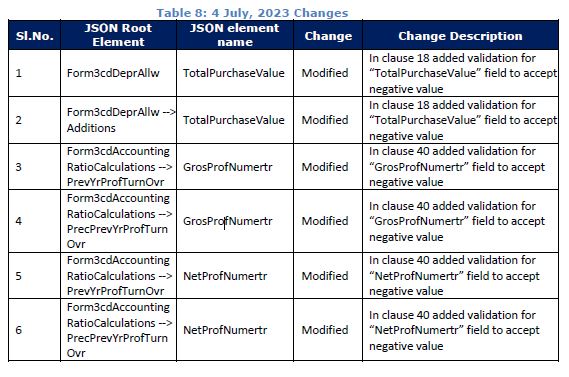

Schema changes as on 4 July, 2023

Form 3CB-3CD: Audit report under section 44AB of the Income -tax Act 1961, in the case of a person referred to in clause (b) of sub – rule (1) of rule 6G and Statement of Particulars required to be furnished under Section 44AB of the Income-tax Act, 1961

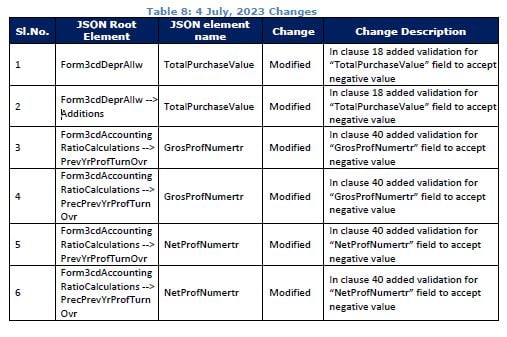

Schema changes as on 4 July, 2023

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"