Reetu | Aug 23, 2022 |

Tax Practitioners Representation on RCM levy on Residential Property and GTA Declaration

The Maharashtra Tax Practitioners’ Association(MTPA) has made representation on RCM levy on Residential Property and GTA Declaration and Appeal Related.

Maharashtra Tax Practitioners’ Association (MTPA, formerly known as The Western Maharashtra Tax Practitioners’ Association), was formed in 1950 with the object to assist the professionals and resolve common problem faced by the tax professional. MTPA represents Tax Consultants, Advocates, Chartered Accountants & Cost Accountants who are practicing in taxation, corporate and other allied laws. Association’s primary objective is, to help the member to get acquaint with changes in various laws as well to help the government, by representing, issues faced by taxpayer as well as professionals.

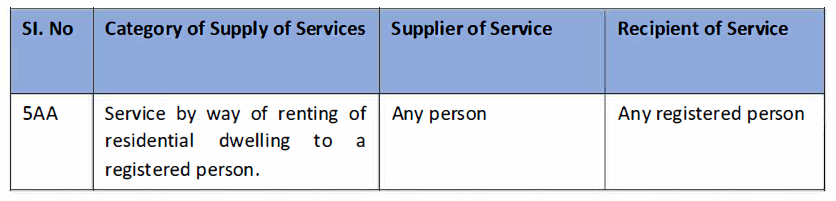

Vide Notification No. 05/2022 – CT Rate dated 13th July 2022, government has levied RCM on Renting of Residential Dwelling. Below is relevant Entry added in RCM category:

(i) In this regard, there is lot of confusion and uncertainty, across the country, on below issues relating to said RCM Entry.

(ii) We request you to kindly issue suitable clarification in this regard, on urgent basis to avoid unnecessary litigation and to ensure proper compliance of law

1. LEGAL PROVISION: As per Rule 108(3) of CGST Rules 2017:

A ‘certified copy of the decision or order’ appealed against shall be submitted within seven days of filing the appeal.

where the said copy is submitted after seven days, the date of filing of the appeal shall be the date of the submission of such copy

2. HARDSHIP FACED:

Appellate authority, after submission on appeal on GST Portal. However, what is meaning of certified copy of order is not provided in said rules. Whether it is to be certified by officer or taxpayer is not mentioned. Due to this different practice is adopted across India.

Also with the advent of technology and requirement of law, now a days, adjudicating authorities are sending notices on Email / Uploaded on Portal. Sometimes said notices are digitally signed. In such case, signed Hard copy of Order is not provided to taxpayer.

It is observed that, Appellate authorities are rejecting the appeal, in case of Certified copies of order from authorities is not submitted by taxpayer, (whereas self-certified copy of order is submitted).

This is resulting into Big Hard ship on Taxpayer for his no mistake.

Just for this small issue, which is also due to ambiguity in provision and change in methodology of sending notices on Email/Portal, Taxpayer is required approach High Court for Relief. Below are few instances, where high court has given relief to taxpayer on the issue of “Certified Copy of Order”

3. RECOMMENDATION:

Since now a days authorities are providing Copies of Order on email/Portal, it is recommended that,

(i) Kindly remove said requirement of submission of Certified copy of Order.

OR

(ii) Else, Certified Copy is to be defined to include Certified by Taxpayer.

We are moving towards, Ease of Doing Business. Such ambiguous requirement cause hindrance to Ease of Doing Business and access to appeal mechanism for justice. Therefore, we request to kindly make suitable amendment in regulation or issue circular, on the line with above mentioned recommendation.

To Read Full Representation Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"