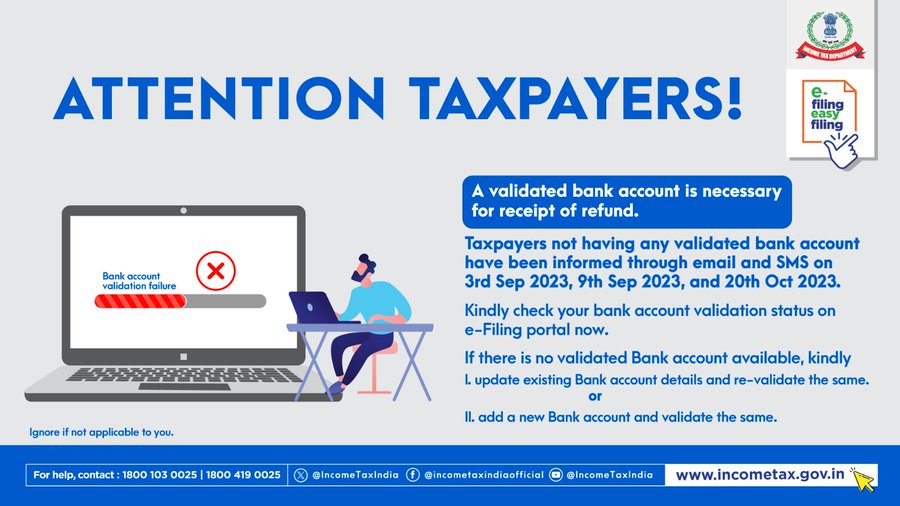

The Income Tax Department has issued a reminder to taxpayers to validate their bank account for receipt of refunds.

Priyanka Kumari | Oct 30, 2023 |

Tax Refund: Taxpayers must Validate Bank Account for Receipt of Refunds

The Income Tax Department has issued a reminder to taxpayers to validate their bank account for receipt of refunds via a tweet on his Twitter account.

All the taxpayers who do not have any validated bank account have been informed through email and SMS.

Kindly check your bank a/c validation status on the e-filing portal.

Here are the steps for validation:

For Updating existing bank a/c:

1. First visit the official website

2. Login to you account

3. After that go to Profile

4. Choose Bank Account

5. Click on Revalidate

6. Update Bank Account Details such as a/c No., IFSC, a/c type, etc.

7. Finally click on Validate.

For Adding a new bank a/c:

1. First visit the official website

2. Login to your account

3. After that go to Profile

4. Click on My Bank Account

5. Then click on Add Bank Account

6. Finally click on Validate.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"