It's that time of year once more! With the new financial year already started, it is essential to make correct decision about which tax system to use for the year: old or new.

Reetu | Apr 28, 2023 |

Tax Savings Analysis: Which Income Tax Regime should you choose?

It’s that time of year once more! With the new financial year already started, it is essential to make the correct decision about which tax system to use for the year: the old or the new. The new income tax regime for individual taxpayers, which was introduced in the 2020 Budget, has been an option for the past three years.

So, which option should you go with this financial year? Let’s compare the old and new tax regimes to see which one is best for you.

The old tax regime was in place prior to the implementation of the new tax regime in 2020. Individuals were taxed on their income according to the Income Tax Act of 1961 under the previous regime.

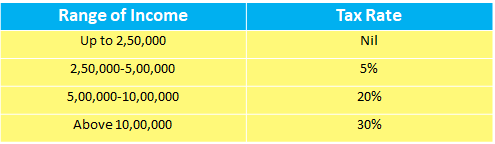

The tax rate for individuals with income up to Rs.2.5 lakhs was nil, and the tax rate increased in progressive slabs thereafter, up to a maximum of 30%.

Individuals could also take use of numerous deductions and exemptions, such as Section 80C, 80D, and so on, to reduce their taxable income.

The new tax regime went into effect in 2020, with the goal of delivering tax benefits to people prepared to waive certain exemptions and deductions. Individuals can choose to pay lower tax rates under the new regime, but they must renounce certain exemptions and deductions.

Depending on the taxpayer’s income, the new tax rates range from 5% to 25%. Individuals who adopt the new tax regime must forfeit exemptions and deductions provided under Sections 80C, 80D, and so on.

Furthermore, they are not eligible for the tax benefits of the house rent allowance or the transportation allowance. Individuals earning income from share trading and other capital gains will also profit from the new tax structure. Individuals might choose to remain under the old tax regime if they want to take advantage of exemptions and deductions.

The choice between the old and new tax regimes should be based on the taxpayer’s unique demands and circumstances. Taxpayers must evaluate their tax savings options and determine which one is best for them. Before making a decision, examine factors such as age, total income, current investments, and so on. For taxpayers that have a lot of deductions and tax exemptions available to them, the old tax regime is advised.

This is due to the fact that the old regime allowed for larger deductions and exemptions. The new regime is advised for taxpayers with a higher income who do not have many deductions and wish to take advantage of the lower tax rates. Finally, the decision is determined by the individual’s financial circumstances.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"