The Income Tax Department clarifies that Taxpayer will get notice by department under e-Verification Scheme if mis-match between ITR and AIS continues.

Reetu | Mar 14, 2023 |

Taxpayer to get notice under e-Verification Scheme if mis-match between ITR and AIS continues

The Income Tax Department clarifies that Taxpayer will get notice by department under e-Verification Scheme if mis-match between ITR and AIS continues.

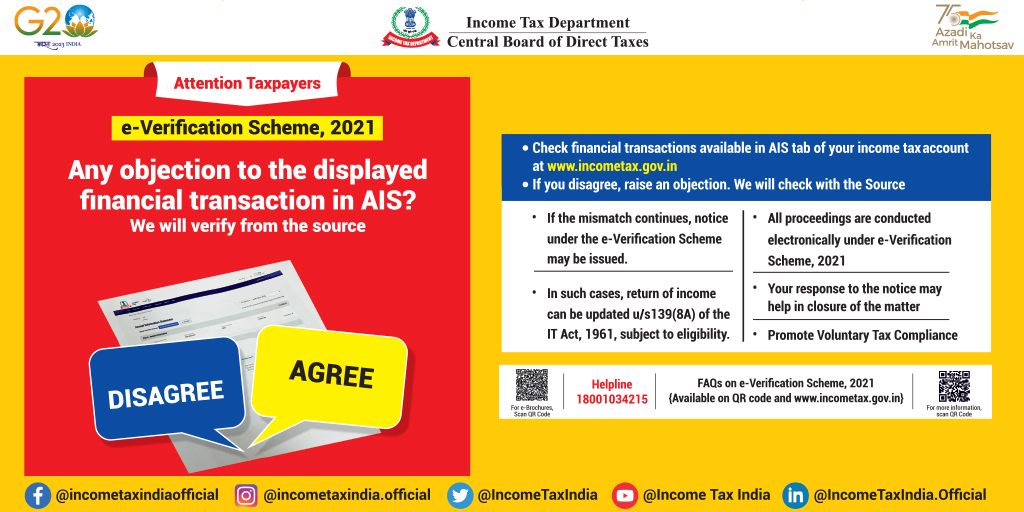

Taxpayers are advised to Check their financial transactions available in AIS tab of income tax account at official website of income tax and if they are not satisfied or agreed with financial transaction displayed in AIS, they can raise objection. The Department will check with the source.

If the mismatch continues, notice under the e-Verification Scheme may be issued. In such cases, return of income can be updated u/s139(8A) of the Income tax Act, 1961, subject to eligibility.

All proceedings are conducted electronically under e-Verification Scheme 2021. Your response to the notice may help in closure of the matter and Promote Voluntary Tax Compliance.

The Department also released Frequently Asked Questions on e-Verification Scheme 2021 as a lots of various question arised in the mind of taxpayers out of this e-Verification Scheme.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"