The deadline for depositing Advance Tax for financial year 2022-23 is March 15, 2023. Income Tax Department is constantly reminding taxpayers to deposit advance tax. Yet,

Reetu | Mar 13, 2023 |

Taxpayers fear due to IT Department message regarding payment of Advance Tax; Tax expert advice to department

The deadline for depositing the fourth installment of Advance Tax for the financial year 2022-23 is March 15, 2023. The Income Tax Department is constantly reminding taxpayers to deposit advance tax. Yet, the tax Department has delivered such messages to some taxpayers, with the wording expressing a strong dissatisfaction. Tax professionals say that the tax department’s rhetoric is instilling dread in taxpayers. This tax department letter is also becoming popular on social media.

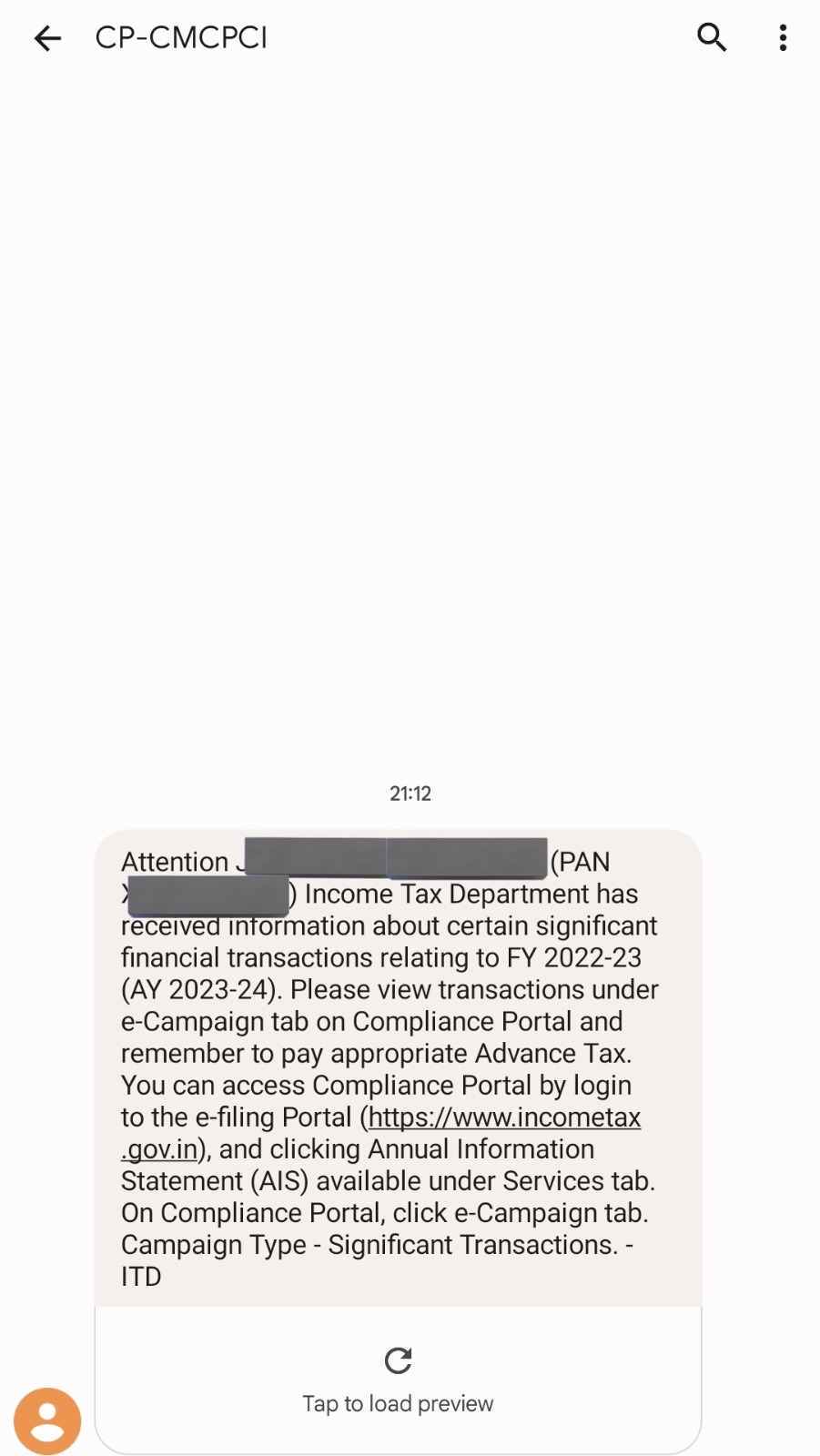

The Income Tax Department has notified taxpayers that they must deposit advance tax. The Income Tax Department warns taxpayers, “The Income Tax Department has received information about some key financial transactions for the financial year 2022-23 (Assessment Year 2023-24).”

You can view these transactions by going to the Compliance Portal’s e-campaign tab and carefully depositing the complete advance tax.” By clicking on the Information Statement, you can gain access to the Compliance Portal (AIS). Click the E-Campaign tab in the Compliance Portal. Following that, in the campaign type, select Substantial Transaction.

According to Ved Jain, former president of ICAI, the Income Tax Department is reminding taxpayers to pay advance tax by March 15, 2023. It is a wonderful thing to send a message to taxpayers. Nonetheless, the message’s content has instilled anxiety and apprehension among taxpayers. The statement from the Income Tax Department makes taxpayers feel as if they have done something wrong.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"