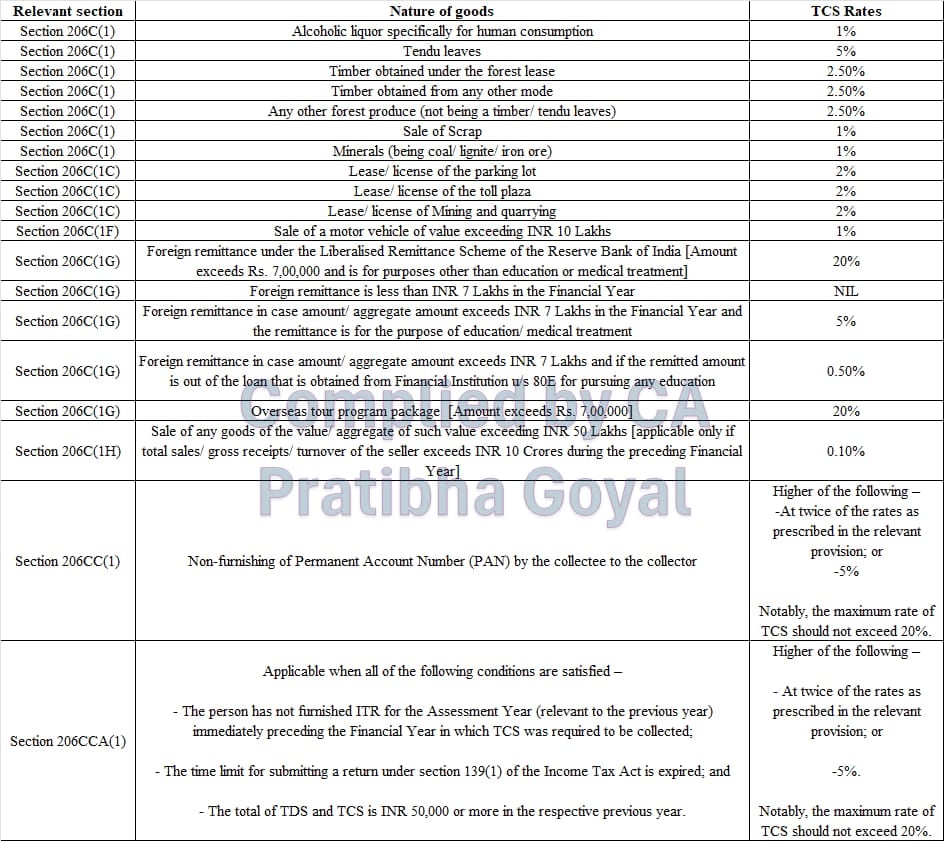

TCS Rate Chart For Assessment year 2025-26 or Financial Year 2024-25

The Article contains the TCS Rate Chart for Assessment year 2025-26 or Financial Year 2024-25. Refer TCS chart for AY 2025-26 in pdf download, the TCS rate chart for FY 2024-25 pdf, the TCS rate chart FY 2024-25, the TCS rates for FY 2024-25, TCS rate chart pdf for your compliance.

Basic Steps Involved in TCS Compliance

- Collection at Source under Section 206(c).

- Deposit of Tax Collected at Source on the Government’s Treasury within the stipulated time.

- Submission of TCS Return within stipulated time.

- Tag Or Add Challan to the TCS Statement.

- Download of TCS Certificate From Traces.

Provision for TCS

Profits and gains from the business of trading, grants of lease or license, and sale of the motor vehicle under section 206C as Income tax collected at source i.e. TCS.

Every person, being a seller shall at the time of debiting the amount payable by the buyer to the account of the buyer or at the time of receipt of such amount from the said buyer, whichever is earlier, collect from the buyer of such amount as income tax.

TCS shall not be collected if the buyer declares that the purchase of goods shall be utilized for the purpose of manufacturing, processing or producing articles or things.

TIME OF DEPOSIT TCS

| Taxpayer | Date of Deposit |

| Is the office of the Govt. and tax is paid without the production of income tax challan. | On the same day on which tax is deducted |

| Is the office of the Govt. and tax is paid with the production of income tax challan. | On or before 7 days from the end of the month in which tax is collected. |

| Tax is collected by a person other than the office of the Government | On or before 7 days from the end of the month in which tax is collected. |

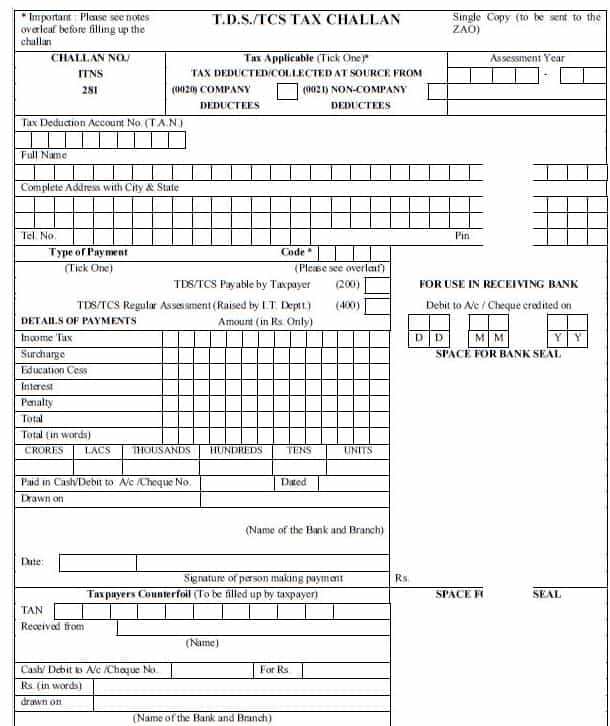

How to Make TCS Payment?

- TCS should be deposited in Challan No. 281.

- TCS will have to deposit through Internet banking.

- Indicate accurate TAN in the challan.

- Minor Head of Challan – 200: TCS payable by a taxpayer.

- Minor Head of Challan – 400: TCS Regular assessment raised by the Income Tax Department.

- Amount of TCS, Interest, Late filing fee, penalty etc, should be separately shown while filing the challan.

- Note down BSR code, Challan serial number, Date of payment, and amount of challan. This will help you in case the challan is misplaced.

TCS Return form

TCS Return has to be submitted quarterly in Form No. 27EQ.

Due Date for Submission of the TCS Return form is given below:

| Quarter | Period | Due Date |

| 1st Quarter | 1st April to 30th June | 15th July |

| 2nd Quarter | 1st July to 30th September | 15th Oct |

| 3rd Quarter | 1st October to 31st December | 15th Jan |

| 4th Quarter | 1st January to 31st March | 15th May |

How to Furnish Return of TCS

- In case where deductor or collector is an office of Govt. or Principal officer of a company or is a person who is required to get his account audited u/s 44AB in the immediately preceding financial year or when the numbers of collectees are more than 20, then TCS quarterly return shall be submitted electronically.

- Other than the above, any other collector can submit the TCS return either in paper format or electronically.

- Electronic returns can be uploaded with a Digital signature or verification of form 27A electronically

- Electronic return will be uploaded in the FVU file

- FVU file can be generated through e-TCS RPU (return prepare utility) which is available in

- https://www.tin-nsdl.com/services/etds-etcs/etds-rpu.html

- In every quarter download the latest e-TCS RPU

- In e-TCS return details of challan paid [ i.e. TCS amount, Interest, Fee, Other/penalty, BSR code, Challan serial No., Date of challan, Minor head], details of deductee/collectee has to fill like section under which payment made, PAN, Name, Date of payment, Date deposit of TCS, amount paid, amount of TCS, Rate of TCS etc,.

Process of TCS return by the Income tax department through Traces

- After uploading of TCS return, the IT department will process the return.

- The collector has to register on the Traces site and create a User ID and Password

- After uploading the return, the TCS return can be processed without default. If the TCS return is processed with default, that means there is some error in the return and there may be a demand for short deduction, interest, late filing fee or penalty.

- To know details of the process with defaults, the justification report has to be downloaded.

- If there is a demand for short deduction or interest or late filing fee, then the collector has to deposit the demand under minor head 400 showing separately TCS, Interest, late fee or other penalties and add this challan to the respective quarterly statement.

- After the Tag/add of challan, again TCS correction return has to be uploaded.

- When the TCS return is processed without default, that means the TCS return process is completed. Thereafter TCS certificate has to be downloaded.

Certificate of TCS or TCS Certificate

Form 27D is the TCS Certificate. Same is issued within 15 Days of furnishing the TCS Return.

Time limit for issuing TCS certificate

| For the Quarter ending | Form No 27D |

| Jun-30 | Jul-30 |

| Sep-30 | Oct-30 |

| Dec-31 | Jan-30 |

| Mar-31 | May-30 |

CONSEQUENCE ON DEFAULT IN TCS PROVISIONS

| Failure to collect tax at source and paid. [Sec 206C (7)] | Tax with interest @ 1% per month |

| Failure to furnish TCS return within stipulated time [U/S 234E] | Rs. 200 per day and shall not exceed the amount of tax deducted/collected. |

| Penalty for failure to furnish quarterly TCS return [271H] | Rs. 10000/- to Rs. 100000/- |

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"