TCS Rate Chart FY 2023-24, AY 2024-25

CA Pratibha Goyal | Mar 26, 2023 |

TCS Rate Chart FY 2023-24, AY 2024-25

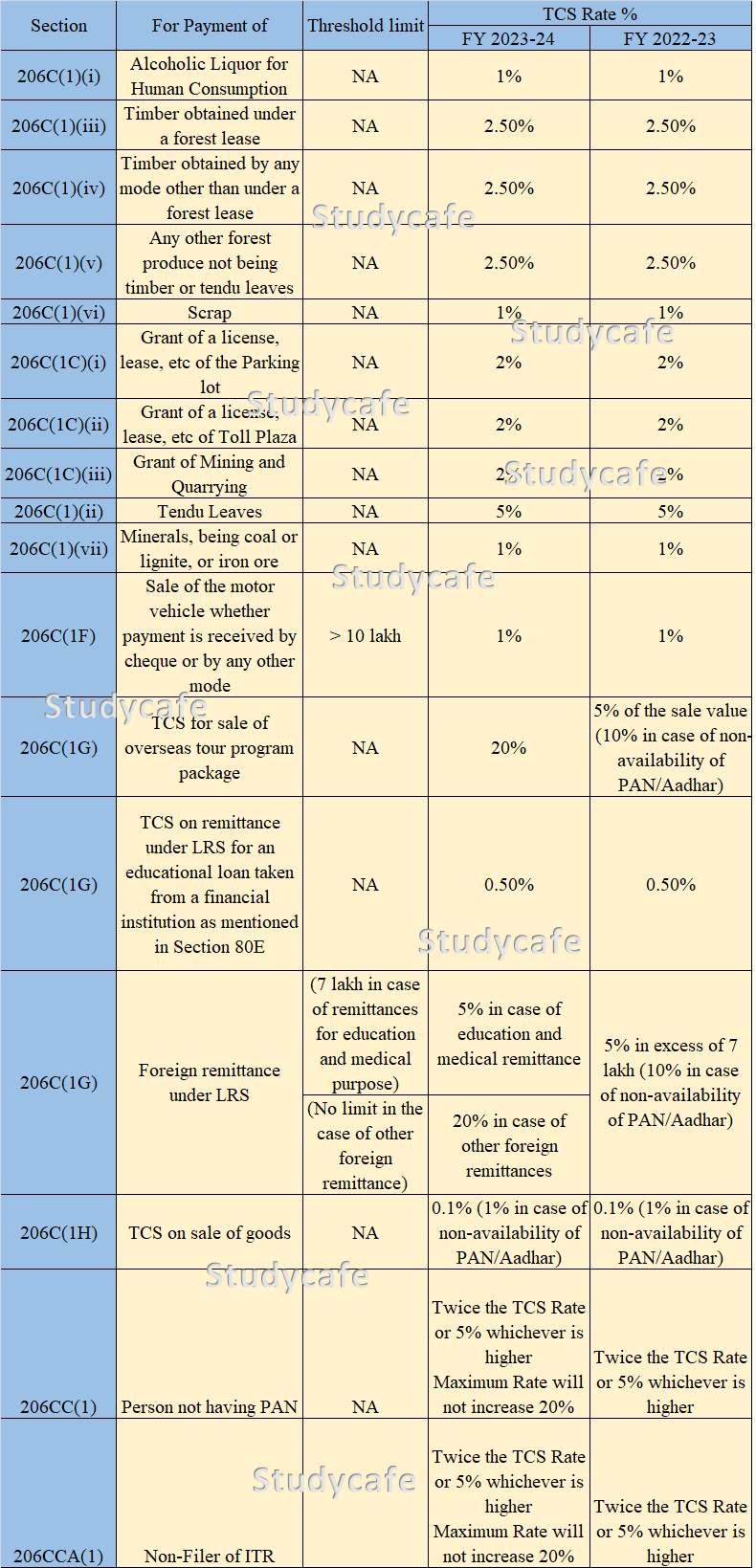

Every seller selling specified goods is required to collect Tax collected at source (TCS) from the buyer at the prescribed rate. We have tried to compile the rates in below mentioned chart.

You May Also Refer: TDS Rate Chart FY 2023-24, AY 2024-25

| Section | For Payment of | Threshold limit | TCS Rate % | |

| FY 2023-24 | FY 2022-23 | |||

| 206C(1)(i) | Alcoholic Liquor for Human Consumption | NA | 1% | 1% |

| 206C(1)(iii) | Timber obtained under a forest lease | NA | 2.50% | 2.50% |

| 206C(1)(iv) | Timber obtained by any mode other than under a forest lease | NA | 2.50% | 2.50% |

| 206C(1)(v) | Any other forest produce not being timber or tendu leaves | NA | 2.50% | 2.50% |

| 206C(1)(vi) | Scrap | NA | 1% | 1% |

| 206C(1C)(i) | Grant of a license, lease, etc of the Parking lot | NA | 2% | 2% |

| 206C(1C)(ii) | Grant of a license, lease, etc of Toll Plaza | NA | 2% | 2% |

| 206C(1C)(iii) | Grant of Mining and Quarrying | NA | 2% | 2% |

| 206C(1)(ii) | Tendu Leaves | NA | 5% | 5% |

| 206C(1)(vii) | Minerals, being coal or lignite, or iron ore | NA | 1% | 1% |

| 206C(1F) | Sale of the motor vehicle whether payment is received by cheque or by any other mode | > 10 lakh | 1% | 1% |

| 206C(1G) | TCS for sale of overseas tour program package | NA | 20% | 5% of the sale value (10% in case of non-availability of PAN/Aadhar) |

| 206C(1G) | TCS on remittance under LRS for an educational loan taken from a financial institution as mentioned in Section 80E | NA | 0.50% | 0.50% |

| 206C(1G) | Foreign remittance under LRS | (7 lakh in case of remittances for education and medical purpose) | 5% in case of education and medical remittance | 5% in excess of 7 lakh (10% in case of non-availability of PAN/Aadhar) |

| (No limit in the case of other foreign remittance) | 20% in case of other foreign remittances | |||

| 206C(1H) | TCS on sale of goods | NA | 0.1% (1% in case of non-availability of PAN/Aadhar) | 0.1% (1% in case of non-availability of PAN/Aadhar) |

| 206CC(1) | Person not having PAN | NA | Twice the TCS Rate or 5% whichever is higher Maximum Rate will not increase 20% | Twice the TCS Rate or 5% whichever is higher |

| 206CCA(1) | Non-Filer of ITR | Twice the TCS Rate or 5% whichever is higher Maximum Rate will not increase 20% | Twice the TCS Rate or 5% whichever is higher | |

Disclaimer: This list is Exhaustive and not inclusive. I have made every effort to ensure that this chart is error-free, still, the Author is not responsible for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon. Further, no portion of our article or newsletter should be used for any purpose(s) unless authorized in writing and we reserve a legal right for any infringement on the usage of our article or newsletter without prior permission.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"