TDS return getting processed with demand despite Income Tax Relief Circular: Issue now resolved

CA Pratibha Goyal | May 18, 2024 |

TDS return getting processed with demand despite Income Tax Relief Circular: Issue now resolved

Income Tax India, vide circular Number 6/2024 in case of Deductee/ collectee having PAN status as ‘Inoperative’ due to Non-Linking of PAN and Aadhaar, attracts higher TDS/TCS rates. As per the Circular, the transactions entered into upto 31.03.2024 with inoperative PANs, deductors/ collectors shall have no liability to deduct TDS/TCS at higher rate if PAN becomes operative (With Linkage of PAN and Aadhaar) on or before 31.05.2024.

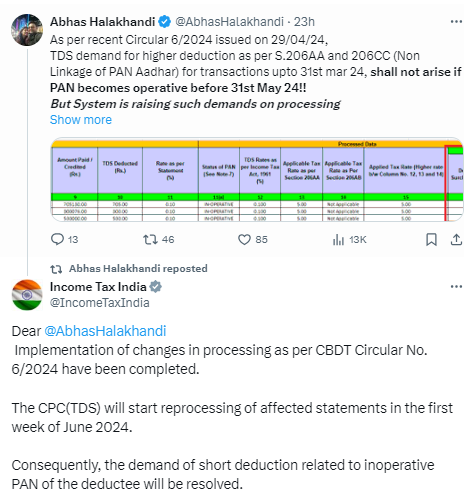

However, in spite of the relief circular, the system was raising demands on processing TDS returns in cases of inoperative PANs. Various professionals has raised this issue on Twitter, which has now been resolved, as tweeted by the Income Tax Department.

Income Tax India, wrote on it’s Twitter handle:

Implementation of changes in processing as per CBDT Circular No. 6/2024 have been completed. The CPC(TDS) will start reprocessing of affected statements in the first week of June 2024. Consequently, the demand of short deduction related to inoperative PAN of the deductee will be resolved.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"