TDS/TCS Return E-filling and Depositing Due Dates For FY 2021-22

CA Pratibha Goyal | Mar 23, 2021 |

TDS/TCS Return E-filling Due Dates For FY 2021-22

Depositing TDS/TCS and E-Filling TDS/TCS Return is important compliance as per the Income Tax Act. This Article Deals with the due date for timely deposit of TDS & TCS and Due date of filing TDS/TCS Return. Additionally, we shall also provide a due date for issuing TDS/TCS Certificates.

You May Also Refer:

TDS Rate applicable for Financial Year 2021-22

TCS Rate applicable for Financial Year 2021-22

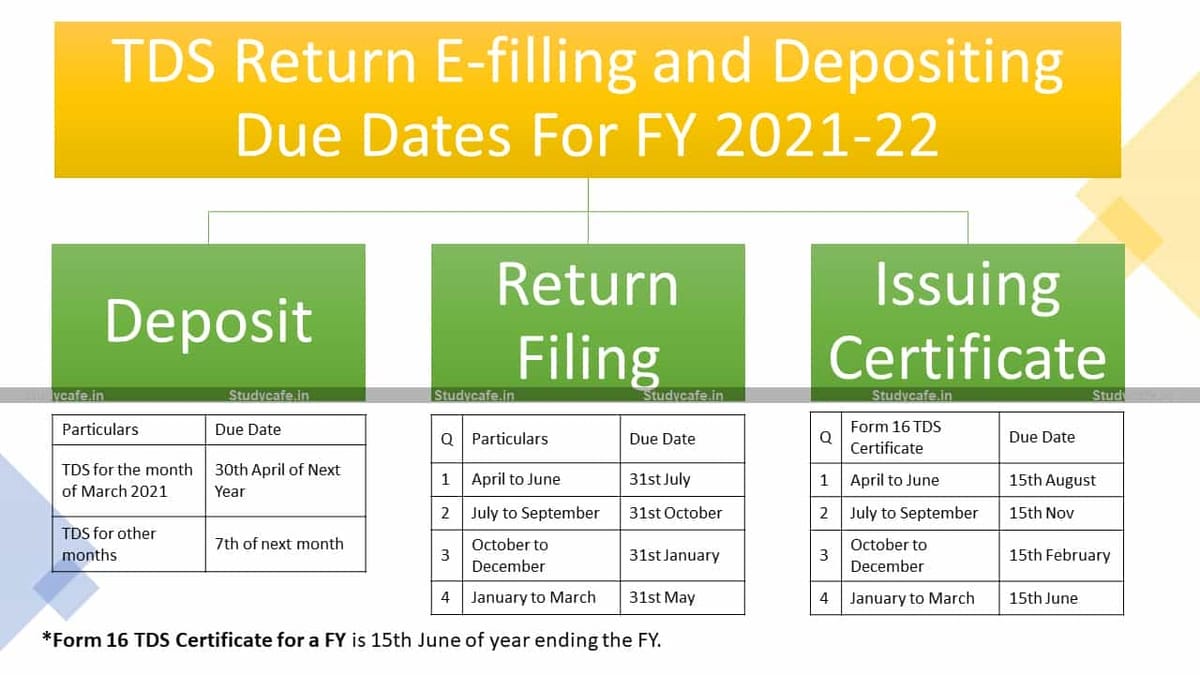

| S. No. | Particulars | Due Date |

| 1. | Tax Deposited without Challan | Same Day |

| 2. | Tax Deposited with Challan | 7th of next month |

| S. No. | Particulars | Due Date |

| 1. | TDS for the month of March 2021 | 30th April of Next Year |

| 2. | TDS for other months | 7th of next month |

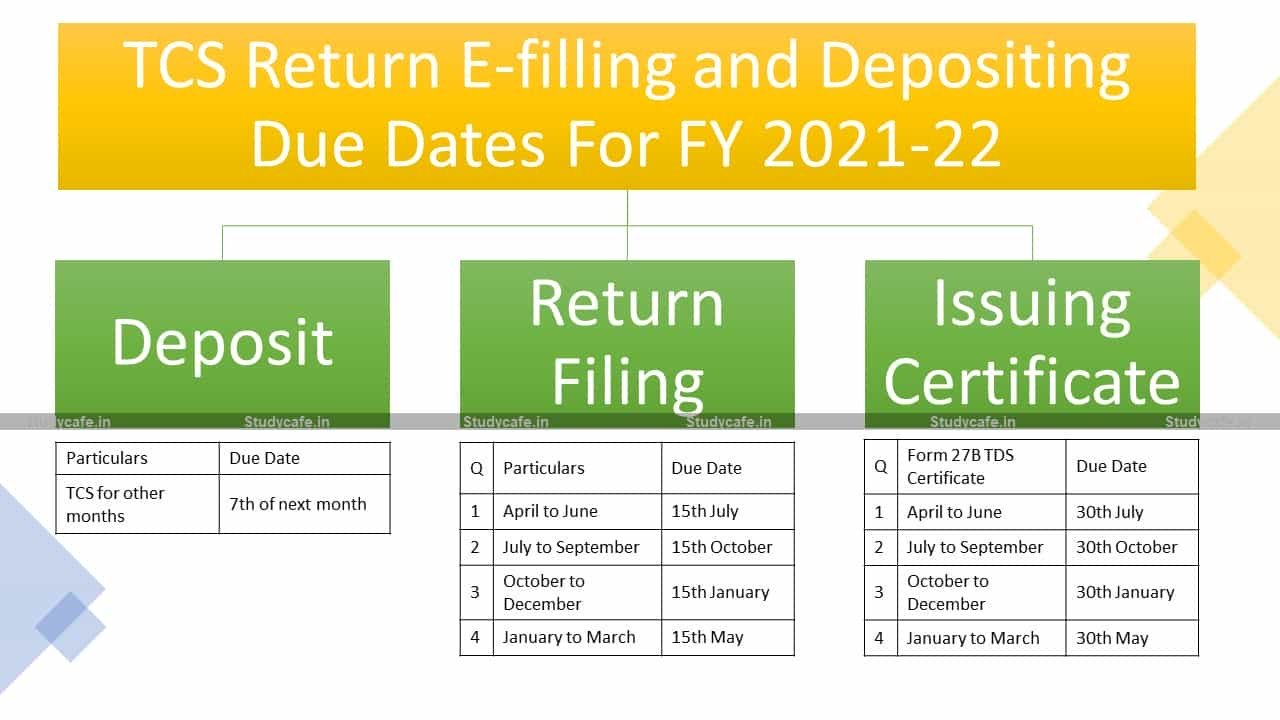

| S. No. | Particulars | Due Date |

| 1. | Tax Deposited without Challan | Same Day |

| 2. | Tax Deposited with Challan | 7th of next month |

7th of next month

| Quarter | Particulars | Due Date |

| 1 | April to June | 31st July |

| 2 | July to September | 31st October |

| 3 | October to December | 31st January |

| 4 | January to March | 31st May |

| Quarter | Particulars | Due Date |

| 1 | April to June | 15th July |

| 2 | July to September | 15th October |

| 3 | October to December | 15th January |

| 4 | January to March | 15th May |

Form 16A TDS Certificate should be issued with 15 Days of filing of TDS Return.

The Due Dates are as follows:

| Quarter | Particulars | Due Date |

| 1 | April to June | 15th August |

| 2 | July to September | 15th November |

| 3 | October to December | 15th February |

| 4 | January to March | 15th June |

Form 16A TDS Certificate for the complete Financial Year should be issued within 15 days from the date of filing of TDS Return for the Quarter of January to March. Therefore the Due date for issuing the Form 16 TDS Certificate for a Financial Year is 15th June.

Form 27B TDS Certificate should be issued with 15 Days of filing of TCS Return.

The Due Dates are as follows:

| Quarter | Particulars | Due Date |

| 1 | April to June | 30th July |

| 2 | July to September | 30th October |

| 3 | October to December | 30th January |

| 4 | January to March | 30th May |

For example, say that you have to deduct a TDS amount is Rs 5000 and the due date of the deduction is 11th January. Say you deduct TDS on 25th May and Pay TDS on 2nd November. Then the interest you owe is Rs. 700/- [(Rs 5000 x 1% p.m. x 5 months) + (Rs 5000 x 1.5% p.m. x 6 months)].

For example, let the due date of TDS payment by 7th June and you have deducted TDS on 11th May. Say you have not deposited TDS by 7th June. Then you will be required to pay interest starting from 11th May and not 7th June.

Penalty (Sec 234E): Deductor will be liable to pay the way of fee of Rs. 200 per day till the failure to pay TDS continues. However, the penalty should not exceed the total amount of TDS deducted for which statement was required to be filed.

Penalty (Sec 271H): Assessing officer may direct a person who fails to file the statement of TDS within due date to pay a penalty minimum of Rs.10,000 which may be extended to Rs. 1,00,000.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"