Tax audit, as the name implies, is an inspection or review of the accounts of any business or profession carried out by taxpayers from an income tax standpoint.

Reetu | Aug 21, 2023 |

Turnover Limit for Tax Audit Applicability for FY 2022-23

Tax Audit Applicability: Tax audit, as the name implies, is an inspection or review of the accounts of any business or profession carried out by taxpayers from an income tax standpoint. It simplifies the process of calculating income for the purpose of submitting income tax returns.

If a taxpayer’s sales, turnover, or gross revenues surpass Rs.1 crore in a fiscal year, he or she is obligated to have a tax audit performed. However, in some other cases, a taxpayer may be forced to have their accounts audited.

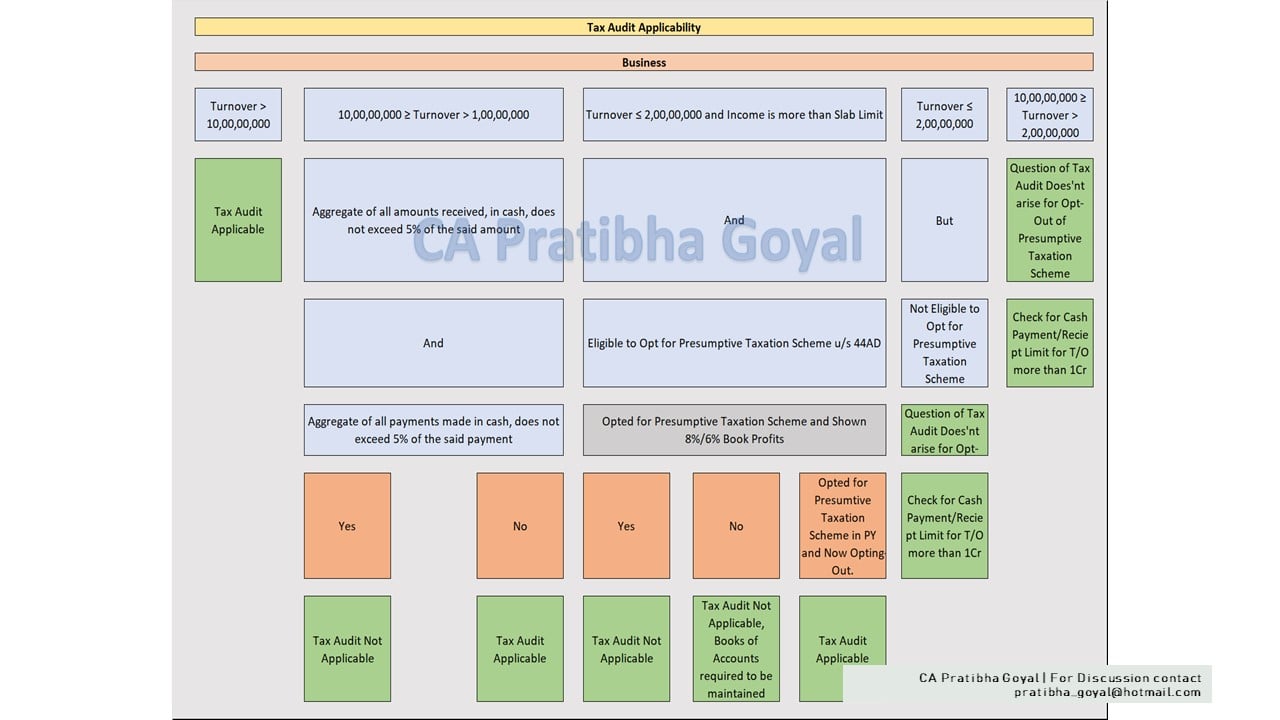

Case 1: If Turnover > 10,00,00,000

Tax Audit Applicable.

Case 2. Turnover Range: 10,00,00,000 ≥ Turnover > 1,00,00,000

The below given conditions needs to be satisfied:

The aggregate of all amounts received, in cash, does not exceed 5% of the said amount.

And

The aggregate of all payments made in cash does not exceed 5% of the said payment.

If yes, Tax Audit Not Applicable.

If No, Tax Audit Applicable.

Case 3. If Turnover ≤ 2,00,00,000 and Taxpayer is Eligible to Opt for Presumptive Taxation Scheme

Taxpayer Opted for Presumptive Taxation Scheme and Shown 8%/ 6% Book Profits

If Opted for Presumptive Taxation Scheme in Last Year and Now Opting-Out: Then, Tax Audit Applicable in the year of Opting Out, Books of Accounts required to be maintained.

Case 4. If Turnover ≤ 2,00,00,000

But

The taxpayer is Not Eligible to Opt for Presumptive Taxation Scheme

Question of Tax Audit Doesn’t arise for Opt-Out of Presumptive Taxation Scheme.

Note: Please do Check for the Cash Payment/Receipt Limit as discussed above for Turnover of More than Rs. 1,00,00,000.

Case 5. Turnover Range: 10,00,00,000 ≥ Turnover > 2,00,00,000

Question of Tax Audit Doesn’t arise for Opt-Out of Presumptive Taxation Scheme

Note: Please do Check for the Cash Payment/Receipt Limit as discussed above for Turnover of More than Rs. 1,00,00,000.

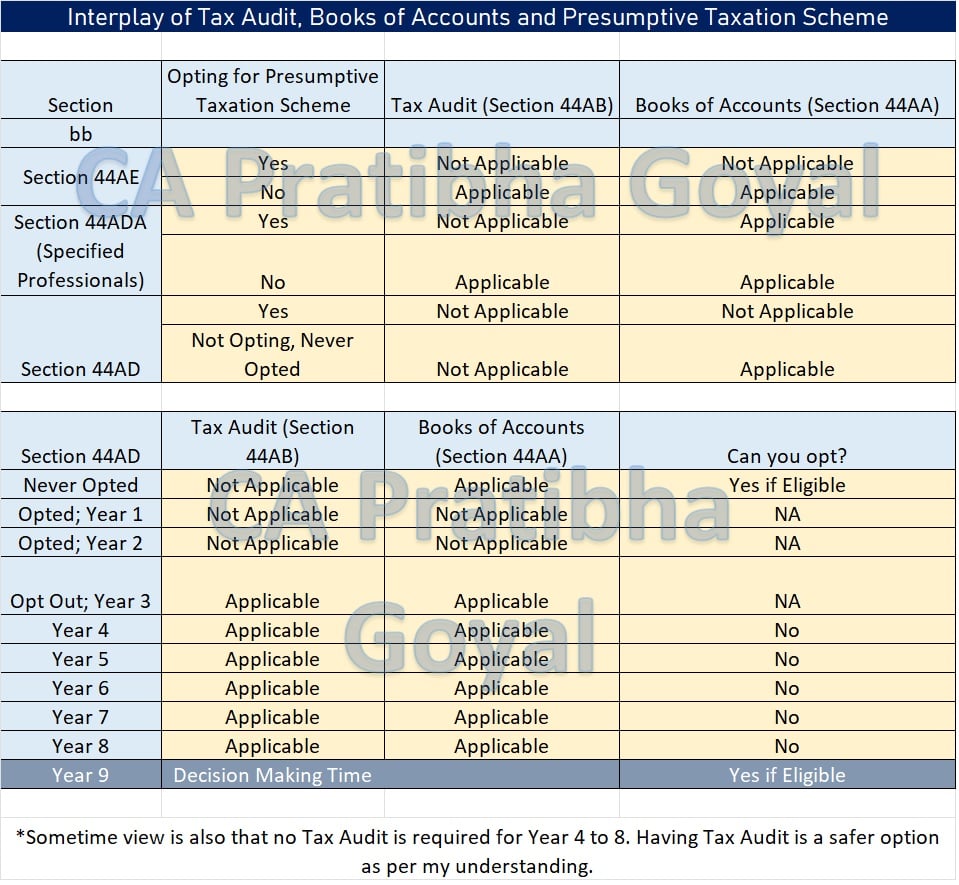

I have made another chart for understanding the Applicability of Tax Audit in case of Presumptive Taxation Scheme.

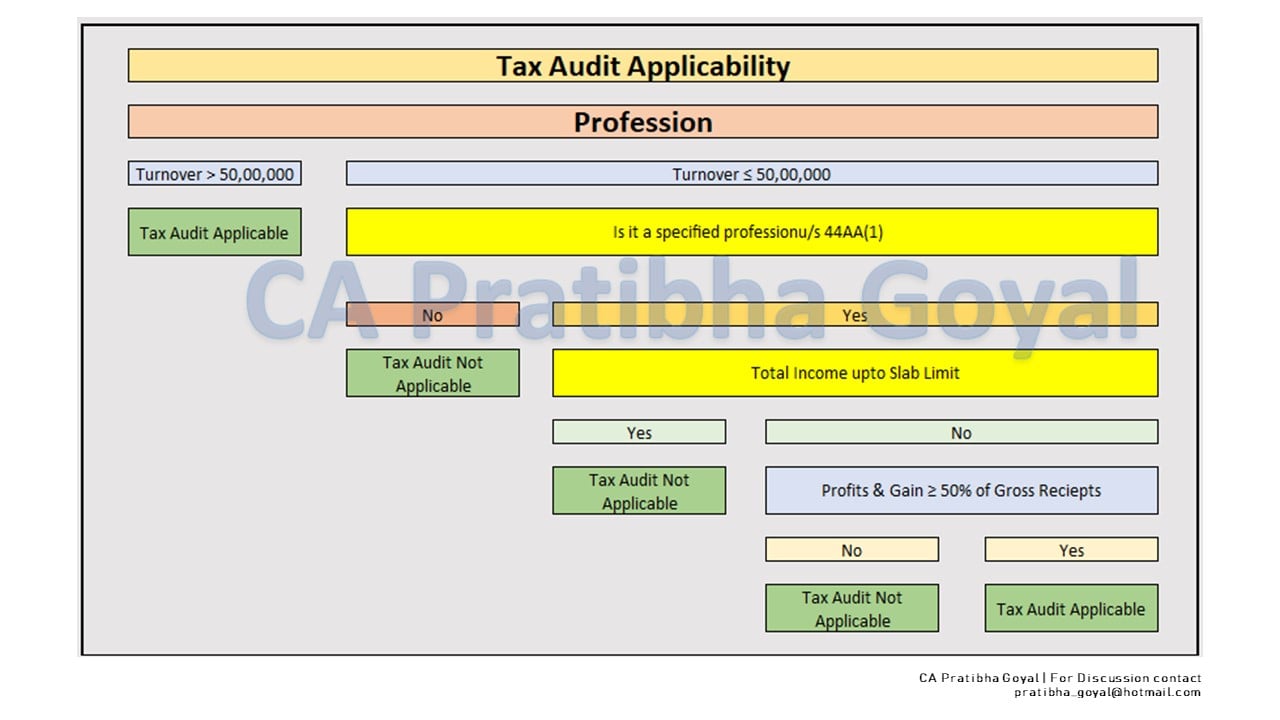

Case 1: If Turnover > 50,00,000

Tax Audit Applicable.

Case 2: If Turnover ≤ 50,00,000

And

Profits & Gain ≥ 50% of Gross Receipts

If Yes, Tax Audit Not Applicable.

If No, then check that, if Total Income is upto Slab Limit.

Then:

If Total Income is upto Slab Limit, then Tax Audit Not Applicable.

If Total Income is not upto Slab Limit, then Tax Audit Applicable.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"