Deepak Gupta | May 29, 2021 |

Updated GST Return Due Dates as announced in GST Council Meeting

Due Date for GST Compliances and GST Returns were Further Extended in this GST Council Meeting. This Article Tries to compile the Due Dates for Filing Various Returns.

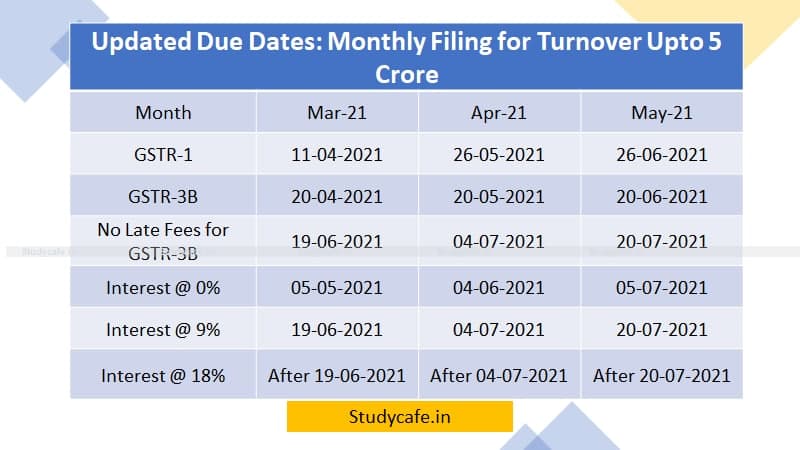

For Taxpayers who have not Opted for QRMP

| Period | Mar-21 | Apr-21 | May-21 |

| GSTR-1 | 11-04-2021 | 26-05-2021 | 26-06-2021 |

| GSTR-3B | 20-04-2021 | 20-05-2021 | 20-06-2021 |

| No Late Fees | 19-06-2021 | 04-07-2021 | 20-07-2021 |

| Interest @ 0% | 05-05-2021 | 04-06-2021 | 05-07-2021 |

| Interest @ 9% | 19-06-2021 | 04-07-2021 | 20-07-2021 |

| Interest @ 18% | After 19-06-2021 | After 04-07-2021 | After 20-07-2021 |

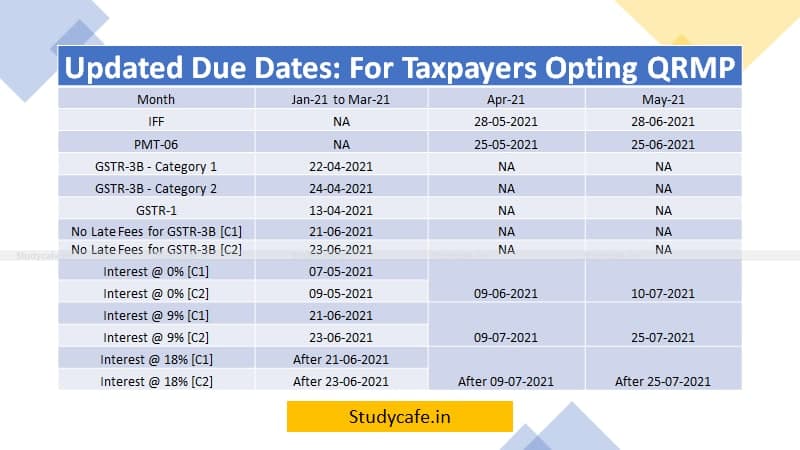

For Taxpayers who have Opted for QRMP

| Period | Jan-21 to Mar-21 | Apr-21 | May-21 |

| IFF | NA | 28-05-2021 | 28-06-2021 |

| PMT-06 | NA | 25-05-2021 | 25-06-2021 |

| GSTR-3B – Category 1 | 22-04-2021 | NA | NA |

| GSTR-3B – Category 2 | 24-04-2021 | NA | NA |

| GSTR-1 | 13-04-2021 | NA | NA |

| No Late Fees for GSTR-3B [C1] | 21-06-2021 | NA | NA |

| No Late Fees for GSTR-3B [C2] | 23-06-2021 | NA | NA |

| Interest @ 0% [C1] | 07-05-2021 | 09-06-2021 | 10-07-2021 |

| Interest @ 0% [C2] | 09-05-2021 | ||

| Interest @ 9% [C1] | 21-06-2021 | 09-07-2021 | 25-07-2021 |

| Interest @ 9% [C2] | 23-06-2021 | ||

| Interest @ 18% [C1] | After 21-06-2021 | After 09-07-2021 | After 25-07-2021 |

| Interest @ 18% [C2] | After 23-06-2021 |

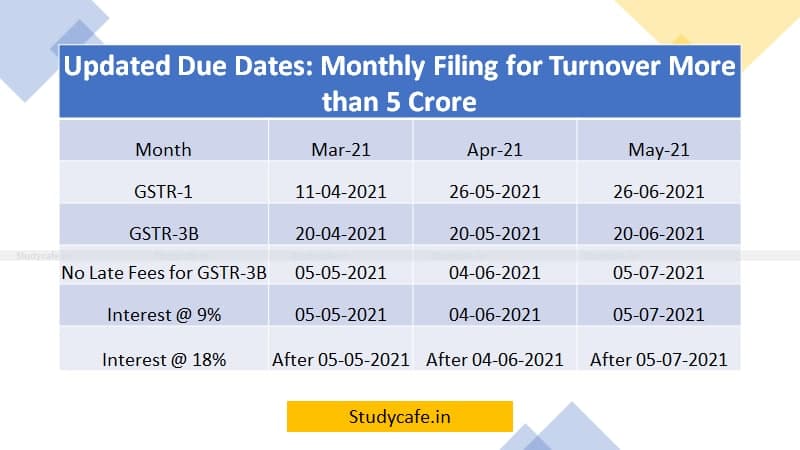

Updated GST Return Due Dates as announced in GST Council Meeting

| Period | Mar-21 | Apr-21 | May-21 |

| GSTR-1 | 11-04-2021 | 26-05-2021 | 26-06-2021 |

| GSTR-3B | 20-04-2021 | 20-05-2021 | 20-06-2021 |

| No Late Fees for GSTR-3B | 05-05-2021 | 04-06-2021 | 05-07-2021 |

| Interest @ 9% | 05-05-2021 | 04-06-2021 | 05-07-2021 |

| Interest @ 18% | After 05-05-2021 | After 04-06-2021 | After 05-07-2021 |

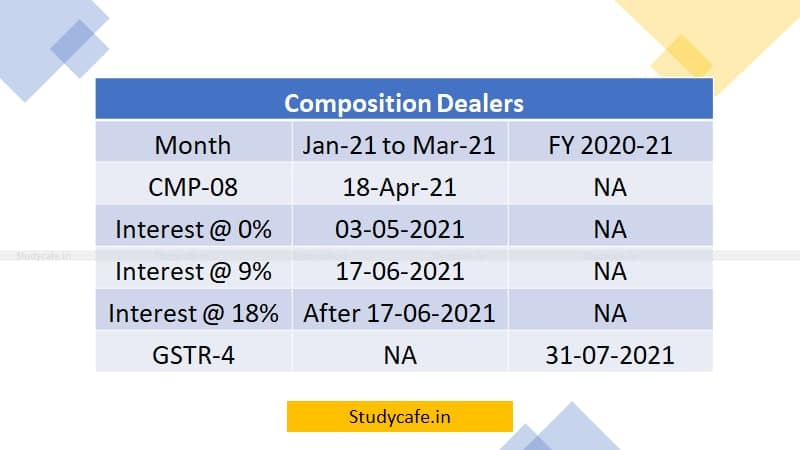

| Period | Jan-21 to Mar-21 | FY 2020-21 |

| CMP-08 | 18-Apr-21 | NA |

| Interest @ 0% | 03-05-2021 | NA |

| Interest @ 9% | 17-06-2021 | NA |

| Interest @ 18% | After 17-06-2021 | NA |

| GSTR-4 | NA | 31-07-2021 |

Updated GST Return Due Dates as announced in GST Council Meeting

1. Extension of due date of filing ITC-04 for QE March 2021 to 30.06.2021.

2. Cumulative application of rule 36(4) for availing Input Tax Credit [ITC] for tax periods April, May and June, 2021 in the return for the period June, 2021.

3. Time limit for completion of various actions, by any authority or by any person, under the GST Act, which falls during the period from 15th April, 2021 to 29th June, 2021, to be extended upto 30th June, 2021, subject to some exceptions. It has been clarified that wherever the timelines for actions have been extended by the Hon’ble Supreme Court, the same would apply.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"