Reetu | Mar 29, 2023 |

UPI Payment of more than Rs.2000 to attract upto 1% charges

The National Payments Corporation of India (NPCI) has announced that, beginning April 1, an interchange charge of up to 1.1% will be levied on retailer UPI (Unified Payments Interface) transactions made using prepaid payment instruments (PPIs)-wallets or cards.

The fee will be applied to UPI purchases of more than Rs.2,000 to online retailers, big merchants, and small physical stores. However, depending on the relevant limits, a lower interchange rate beginning at 0.5% may be imposed on certain merchant groups, according to NPCI.

P2P and P2PM transfers between bank accounts and PPI purses will not be eligible for exchange. However, PPI producers must pay the remitter bank 15 basis points as a “wallet loading service charge” for putting more than 2,000 in the prepaid wallet.

According to the NPCI circular, this interchange rate will be revised by September 30, 2023.

“Based on February 2023 annualised wallet payment transactions of 2 lakh crore, we estimate wallet loading charges could be over 100 crore across all wallet issuers (assuming 30% of wallet transactions are eligible given transaction-size rule and an estimated 60% share of UPI in wallet-loading) and will be paid to banks,” Citi Research said in a note.

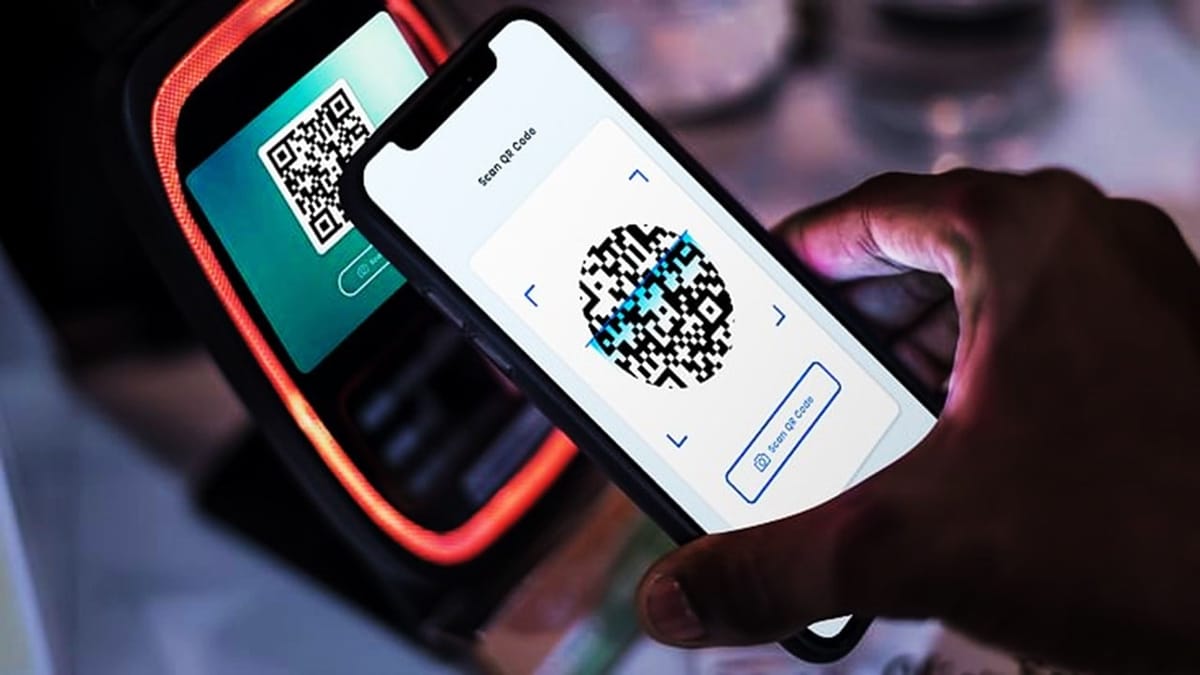

Paytm Payments Bank, India’s biggest KYC wallet provider with over 10 crore users, announced that its wallets will be accepted on all UPI QRs and online retailers, with compatibility enabled. Additionally, it will make extra interchange income on Paytm wallet transfers to retailers purchased by other payment service providers, payment processors, and payment brokers.

“The bank will pay 15 basis points for adding more than 2,000, and will earn 15 basis points when any other wallets use the bank to add more than 2,000 using UPI,” it said.

NPCI also requested UPI service providers and merchants last week to improve interoperability by clearly and conspicuously showing the UPI payment choice by September 30, 2023.

Interoperability of wallets with UPI is expected to expand the scope, role, appeal, and use cases of wallets, which can now be used on around 25 crore QR codes by February 2023, according to industry experts, adding that it will also increase payment options for customers, as they will be able to pay via UPI or cards.

“Many merchants, for example, at point-of-sale, use wallets to accept customer payments.” Interoperability will make collections much easier for them because it will enable retailers to take pocket payments regardless of the wallet used by the consumer,” said Akash Sinha, Co-founder and CEO of Cashfree Payments.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"