Studycafe | Nov 11, 2013 |

Who is Liable to Deduct Tax at Source (TDS):

TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons Who are Liable to Deduct Tax at Source (TDS) or collecting tax. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates.

TDS is treated as pre-paid taxes as it is paid in advance to the government. It is the duty of the person who paid to someone for his service, goods etc. These payments are specified by the act like salary payment, interest on securities, contract payment, dividends etc. Who deduct TDS of payee is called deductor and whose tax is deducted called deductee. The following persons are liable to deduct TDS and deposit to government on behalf of deductee.

Income Tax Act require specified persons to deduct tax on particular types of payments being made by them. The list of such persons requiring to make TDS is contained in TDS provision listed here.

Who is Liable to Deduct Tax at Source (TDS)

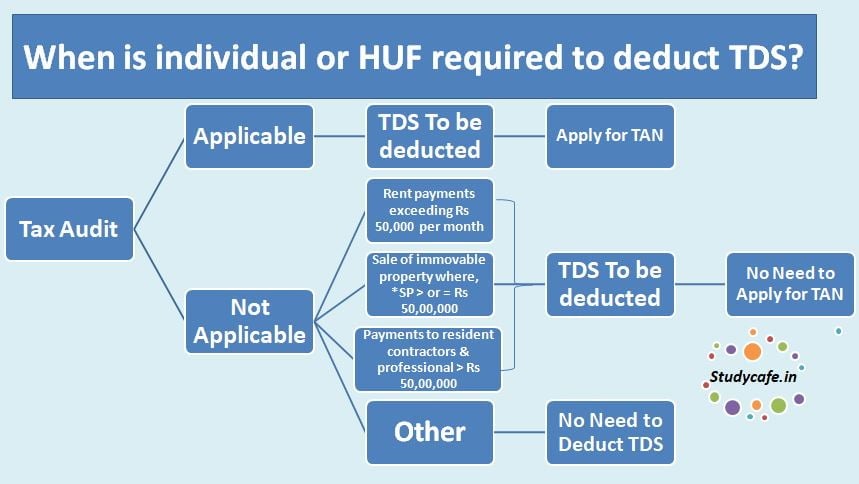

An Individuals or an H.U.F. is not liable to deduct TDS on such payment except where the individual or H.U.F. is carrying on a business/profession where accounts are required to be audited u/s 44AB, in the immediately preceding financial year.

However, in case of rent payments made by individuals and HUF exceeding Rs 50,000 per month, are required to deduct TDS @ 5% even if the individual or HUF is not liable for a tax audit. Also, such Individuals and HUF liable to deduct TDS @ 5% need not apply for TAN.

An Individuals or an H.U.F. is liable to deduct TDS in case of sale of immovable property (excluding rural agricultural land), where, consideration is Rs 50,00,000 or more. Taxpayer requires to deduct TDS @ 1%.

An Individuals or an H.U.F. is liable to deduct TDS in case of PAYMENTS TO RESIDENT CONTRACTORS AND PROFESSIONAL exceeding Rs 50,00,000 during the year. Taxpayer requires to deduct TDS @ 5%.

A person is liable to get its accounts audited u/s 44AB if during the relevant financial year its gross sales, turnover or gross receipts exceeds Rs. 1 Crore applicable form A.y 2013-14 (Rs.60 lacs for A.Y.2012-13) in case of a business, or Rs. 50 lacs from Assessment year 2017-18 (Rs. 25 lacs from A.Y. 2013-2014 to 2016-17) in case of a profession.

The Tax Audit Threshold has been increased to 5 Crores, from existing 1 Crore for person carrying bussiness. This facility comes with 2 conditions:

♦ Cash reciepts is not more than 5% of aggregate cash reciepts;

♦ Cash Payment is not more than 5% of aggregate cash payments.

Persons who are liable to deduct TDS as per above stated conditions must apply for allotment of TAX DEDUCTION AND COLLECTION ACCOUNT NUMBER (TAN) in form No. 49B within one month from the end of the month in which tax was deducted. TAN is mandatory to mention on all transaction related to TDS like TDS certificate, TDS Returns and other related documents. There is penalty of Rs. 10,000 on failure to apply TAN.

1.) On declaration furnished by payee on Form 15G or 15H as the case may be

2.) On certificate issued by ITO

3.) Payment to Government/RBI/Statutory Corporation etc.

4.) Exempt Incomes

5.) Interest Payment by Offshore Banking Unites

6.) Payment to New Pension System Trust

7.) Notified payment to Notified Institutions/Associations

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"