Reetu | Feb 1, 2023 |

2nd Highest Gross GST Collection in January 2023; Crosses Rs.1.50 Lakh Crore Mark for third time in FY 2022-23

The Gross GST collection collected in January 2023 until 5:00 PM on January 31, 2023 is Rs 1,55,922 crore, of which CGST is Rs 28,963 crore, SGST is Rs 36,730 crore, IGST is Rs 79,599 crore (including Rs 37,118 crore collected on import of goods), and cess is Rs 10,630 crore (including Rs 768 crore collected on import of goods).

As part of the normal settlement, the government transferred Rs 38,507 crore from IGST to CGST and Rs 32,624 crore to SGST. After regular settlement, the total income of the Centre and the States in the month of January 2023 is Rs 67,470 crore for CGST and Rs 69,354 crore for SGST.

The current financial year’s revenues are 24% greater than the same period previous year. Revenues from imports of products are 29% higher this period, and revenues from domestic transactions (including imports of services) are 22% higher than the same period last year.

GST revenue has surpassed Rs 1.50 lakh crore for the third time in the current financial year. The GST collection in January 2023 was the second highest, trailing only the collection in April 2022. In December 2022, 8.3 crore e-way bills were generated, the most so far, and much more than the 7.9 crore e-way bills generated in November 2022.

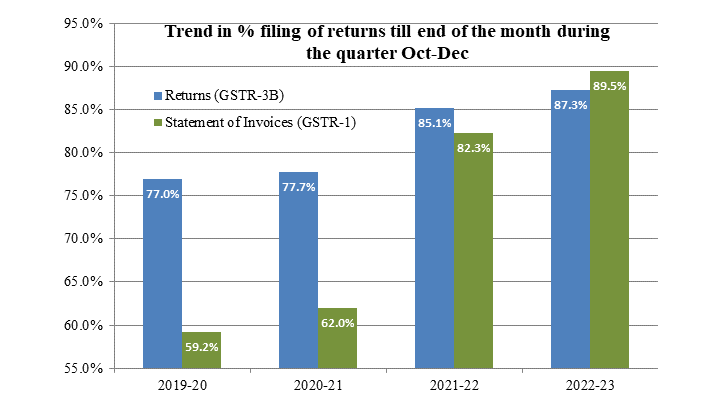

Various efforts have been made over the last year to broaden the tax base and improve compliance. The percentage of GST returns (GSTR-3B) and statement of invoices (GSTR-1) filed till the end of the month has increased dramatically throughout the years. The graph below depicts the trend in return filing in the October-December quarter over the last few years. Total 2.42 crore GST returns were filed in the quarter Oct-Dec 2022, as compared to 2.19 crore in the same quarter last year.

This is due to different policy modifications implemented during the year to improve compliance.

The chart below shows trends in monthly gross GST revenues during the current year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"