The Central Board of Direct Taxes (CBDT) has notified changes in Form 3CD.

CA Pratibha Goyal | Mar 7, 2024 |

7 Changes made in Tax Audit Report Form 3CD

Recently, CBDT notified changes in Form 3CD. [Read Notification]. This Article discusses the 7 changes that have been made in the Income Tax Audit Report Form [Form 3CD].

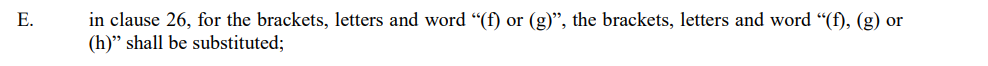

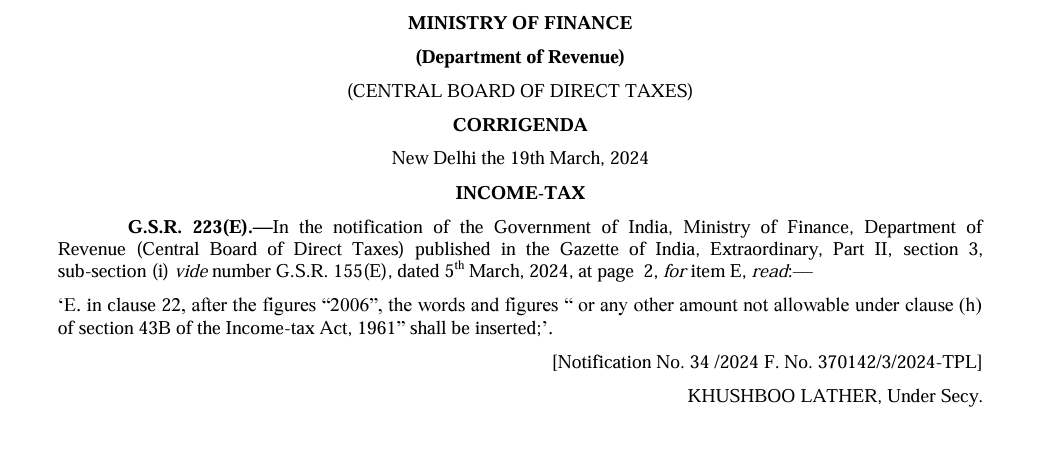

1. Clause 26 [Clause (h) added for MSME Late Payment rule reporting for Disallowance u/s 43B], in respect of sum referred to in specified clauses of section 43B, to include reporting requirement in respect of compliance u/s 43B(h) relating to the amount payable to micro and small enterprises; [Omitted by Corrigendum G.S.R. 223(E), dated 19-3-2024]

2. Clause 22 has been amended to add Disallowance u/s 43B(h) [Added by Corrigendum G.S.R. 223(E), dated 19-3-2024]

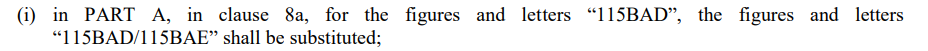

3. Clause 8A has been amended relating to whether an assessee has opted for special provisions u/s 115BA/115BAA/115BAB/115BAC/

4. Clause 12 has been amended relating to whether the profit and loss account includes profit computed on a presumptive basis, to include reference to section 44ADA

5. Clause 18 relating to particulars of depreciation, sub-clause (ca) has been substituted to require adjustment to the WDV under the different provisos to section 115BAA/115BAC/115BAD for specified assessment years;

6. Clause 19 relating to amounts admissible under different sections, to include reference to section 35ABA and any other relevant section;

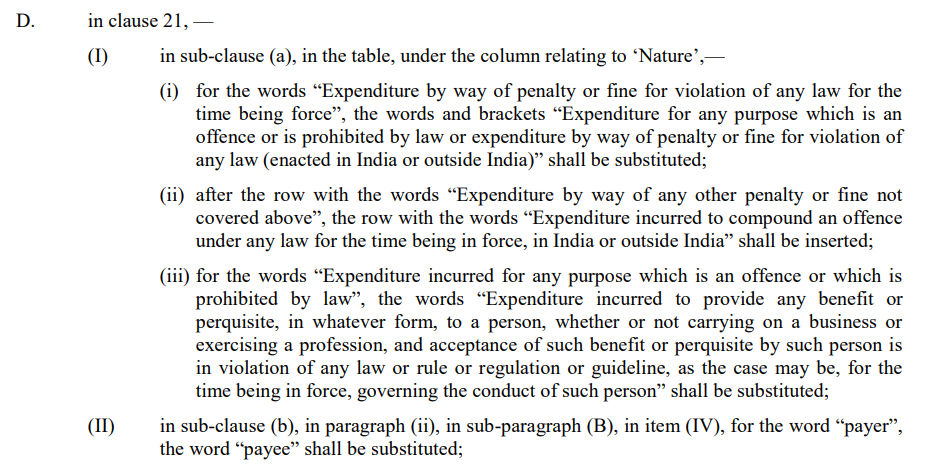

7. Clause 21 relating to details of amounts debited to profit and loss account, being in the nature of capital, personal and advertisement expenditure etc., to include reference to expenditures for any purpose which is an offence or which is prohibited by law or expenditure to compound an offence etc.;

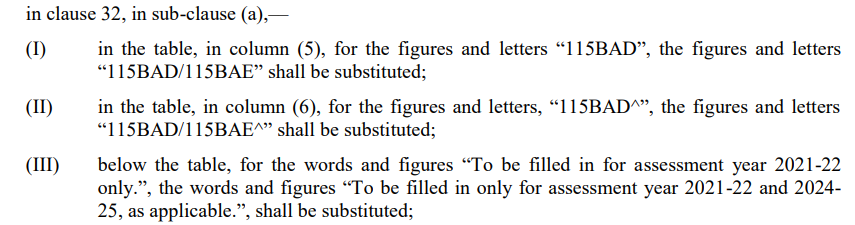

8. Clause 32(a) relating to details of brought forward loss/depreciation, to include reference to losses/allowances not allowed under section 115BAE and amount adjusted by way of withdrawal of additional depreciation on account of opting for taxation under section 115BAE.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"