All About Filing ITR-1 at Income Tax Portal 2.0 All About Filing ITR-1 at Income Tax Portal 2.0, Income Tax Portal, Income Tax, Income Tax Return, ITR, , ITR 1, how to file income tax return, PAN, Permanent Account Number, Aadhar Authentication, link aadhar, HOW TO FILE ITR-1 AT INCOME TAX PORTAL 2.0

Deepak Gupta | Jun 9, 2021 |

All About Filing ITR-1 at Income Tax Portal 2.0 | How to file ITR-1 at Income Tax Portal 2.0

This article discusses all about Filing Income Tax Return 1 [ITR-1] also known as Sahaj at Income Tax Portal 2.0. Some of the General Requirement for Filing ITR are given below:

For Filing the ITR, the status of your PAN should be active and you should be registered at Income Tax Portal.

Please note that as per section 139AA in case of failure to link PAN with the Aadhaar number the Permanent Account Number [PAN] allotted to the person shall be made inoperative. As of now the due date for linking PAN & Aadhar is 30th June 2021.

You May Also Like: What will happen if you Don’t Link your PAN with Aadhar?

One can do manual Verification as well, where we need to sign ITR & send it to Bangalore. But in these COVID times, E-Verification is the Better option. Valid mobile number should be linked with the Aadhaar / e-Filing portal / your bank / NSDL / CDSL for e-Verification.

For Filing the ITR you need to download a JSON-based offline utility. You can use third-party software as well. ITR-1 can be filed online also.

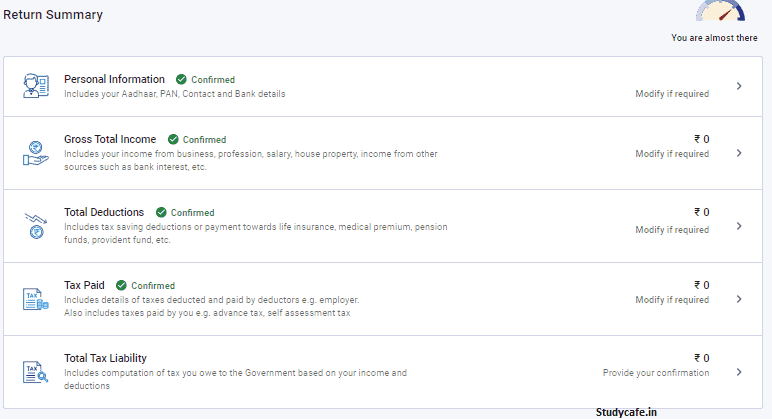

Your personal Information will be Auto Populated. You can edit it if you want.

Personal Information

Section under which ITR will be Filed

Bank Account Details for ITR

1. Minimum of one account should be selected for refund credit.

2. In the case of Refund, multiple accounts are selected for refund credit, then the refund will be credited to one of the accounts decided by CPC after processing the return.

3. Please ensure that at least one preferred bank account is pre-validated.

Most of the Gross Total Income will be prefilled. Linked with Form 26 AS. Still you need to review the pre-filled information and verify your income source details from salary/pension, house property, and other sources (such as interest income, family pension, etc.).

Gross Total Income

You will also be required to enter the remaining / additional details including your exempt income if any.

Exempt income

This Tab includes tax-saving deductions or payments under section 80C or 80D etc. like life insurance, medical premium, pension funds, provident fund, etc.

In the Tax Paid section, you need to verify taxes paid by you in the previous year. Tax details include TDS from Salary / Other than Salary as furnished by Payer, TCS, Advance Tax, and Self-Assessment Tax.

Verification of Taxes Paid

In case you have Tax Liability, you can choose Pay Now or Pay Later Option.

Verify your Income Tax Computation & Tax Liability

As discussed above you can file your ITR through online or Offline Mode. In the case of Offline mode, these steps are performed in Offline Utility and JSON is generated which is uploaded on Income Tax Portal.

After verifying all the data you may proceed for Verification. It is mandatory to verify your return, and e-Verification (recommended option – e-Verify Now) is the easiest way to verify your ITR – it is quick, paperless, and safer than sending a signed physical ITR-V to CPC by post.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"