Breaking: MCA to de-flag DINs of disqualified directors which were flagged since November 1, 2016

Deepak Gupta | Nov 10, 2021 |

Breaking: MCA to de-flag DINs of disqualified directors which were flagged since November 1, 2016

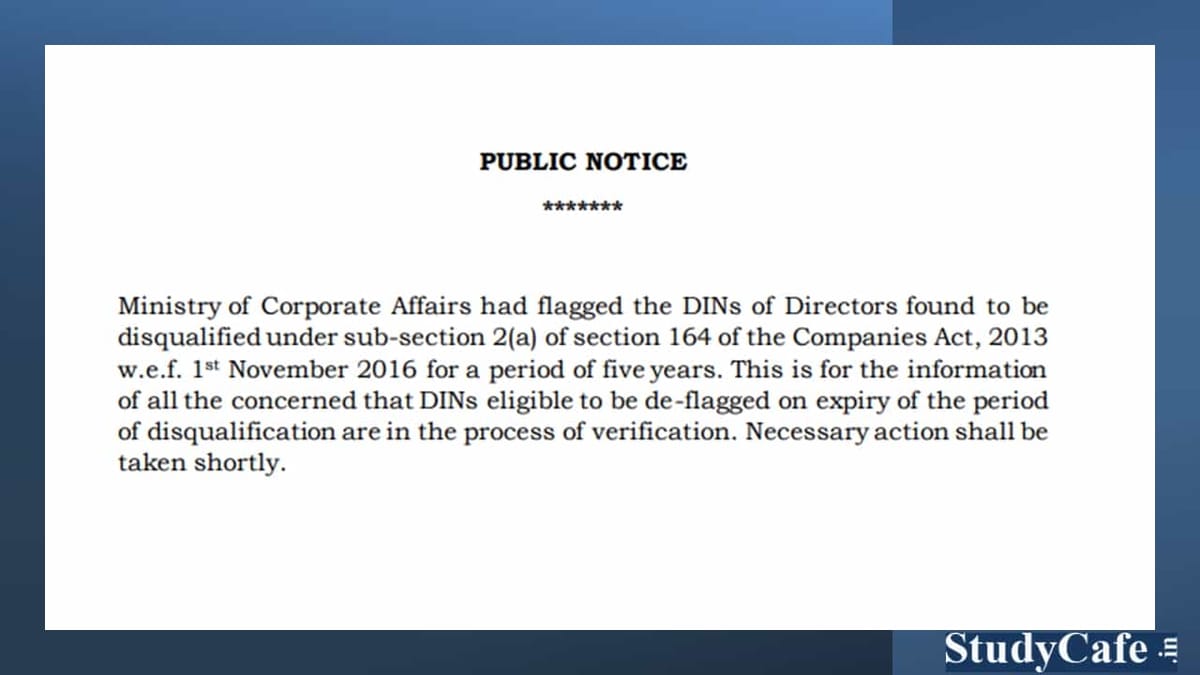

Ministry of Corporate Affairs [MCA] had flagged the DINs of Directors found to be disqualified under subsection 2(a) of section 164 of the Companies Act, 2013 w.e.f. 1st November 2016 for a period of five years. This is for the information of all the concerned that DINs eligible to be de-flagged on expiry of the period of disqualification are in the process of verification. Necessary action shall be taken shortly.

As per clause (a) of Section 164(2) a Director who has not filed financial statements or annual returns for any continuous period of three financial years; will be Disqualified for the period of 5 Years. DINs of such directors were flagged by MCA.

Now that the period of 5 years is over, DINs of disqualified directors which were flagged since November 1, 2016, will be de-flagged.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"