Professional Tax: Gujarat Govt notifies Revised Rate of Professional Tax

Reetu | May 5, 2022 |

Professional Tax: Gujarat Govt notifies Revised Rate of Professional Tax

The Gujarat government has notified the revised professional tax rate vide Notification No. GHZ-35-PFT-2022-S.3(2)(10)-Th dated 8th April 2022.

Professional tax is payable by individuals, Hindu undivided families, and all associations/businesses/companies. However, the maximum amount that can be levied per individual in any financial year is Rs.2500. Furthermore, any professional tax paid is deducted from the payee’s overall income tax due.

The Notification is Given Below:

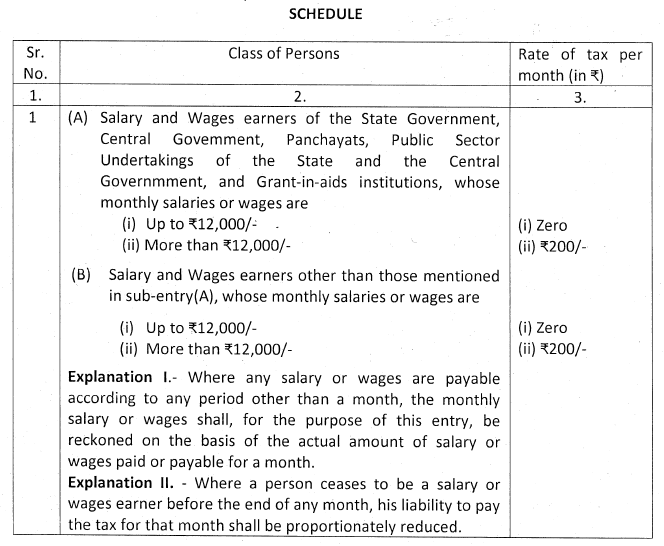

No. GHZ-35-PFT-2022-S.3(2)(10)-Th: In exercise of the powers conferred by the sub-section (2) of section 3 of the Gujarat State Tax on Professions, Traders, Callings and Employment Act, 1976 (President’s Act No. 11 of 1976) and in supersession of notification in Finance Department No.(GHN-11)-PFT-2008-S.3(2)(4)-Th dated 01.04.2008, the Government of Gujarat hereby fixes the rate of tax as specified in column 3 of the schedule appended hereto, for the class of persons mentioned in column 2 of the said Schedule.

This Notification shall deemed to have come into force with effect from the 1st day of April, 2022.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"