Reetu | Jan 13, 2023 |

10 NBFCs and 1 ARC surrenders Certificate of Registration to RBI

Ten non-banking financial companies (NBFC) and one asset reconstruction company (ARC) have surrendered the Reserve Bank of India‘s certificate of registration (CoR). The RBI exercised powers granted to it by section 45-IA (6) of the RBI Act.

Telecom Investments India Private Limited, Srinivasa Finance Corporation Private Limited, and Parkin Marketing Pvt. Ltd. are among the ten Non-Banking Financial Companies (NBFC) that surrendered their registration certificates.

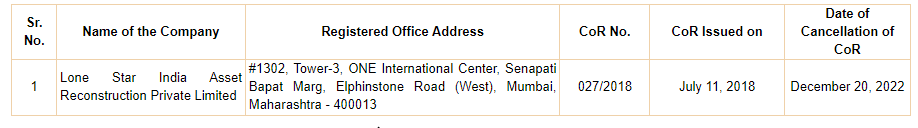

Lone Star India Asset Reconstruction Private Limited also surrendered its registration certificate, according to the RBI.

Three of the ten NBFCs are from Maharashtra and West Bengal, while the remaining four are from Telangana, Karnataka, New Delhi, and Gujarat. The ARC, which surrendered its registration, is also from Maharashtra.

While seven NBFCs surrendered their CoR due to their decision to exit the non-banking financial institution (NBFI) business, the remaining three cited ceasing of operations due to amalgamation, dissolution, merger, and voluntary strike-off, according to a release from the RBI.

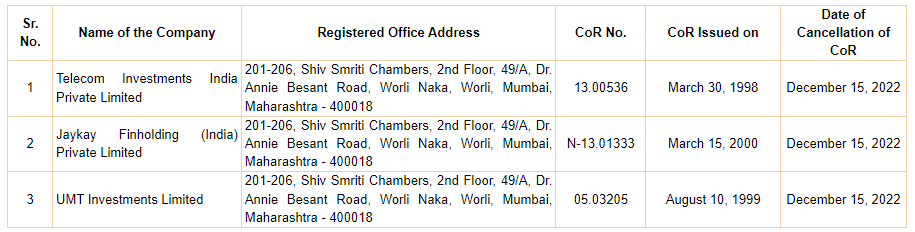

List of NBFCs and ARC who surrendered their CoR as follows:

i) Due to exit from Non-Banking Financial Institution (NBFI) business:

ii) Due to NBFC ceasing to be a legal entity due to amalgamation/ merger/dissolution/ voluntary strike-off, etc.:

iii) Due to exit from securitisation/ asset reconstruction business:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"