The Minister of State Shri Pankaj Chaudhary in the Ministry of Finance in a written reply to a question raised in Lok Sabha said, "More than 2800 Groups raided by Income Tax upto Jan 2023."

Reetu | Apr 7, 2023 |

More than 2800 Groups raided by Income Tax upto Jan 2023

The Minister of State Shri Pankaj Chaudhary in the Ministry of Finance in a written reply to a question raised in Lok Sabha said, “More than 2800 Groups raided by Income Tax upto Jan 2023.”

The Income-tax Act, 1961 [the Act] has no expression such as ‘raid’. The premises of the persons searched under the provisions of the Act, for suspected and identified large-scale tax evasion, are usually spread across multiple states/geographies. Accordingly, these searches and the amount of unaccounted money seized therein, cannot be attributed to any particular state(s).

On the basis of the evidence gathered during search operation and the subsequent investigation, tax assessments are finalized and a tax demand is raised. However, the income assessed and the tax thereupon get crystallised conclusively only when appeals, if any, preferred before CIT(A), ITAT, Hon’ble High Court and Hon’ble Supreme Court are decided. Further, the penalty(ies) proceedings under the Act are initiated, in applicable cases & these proceedings are also subject to a similar appellate procedure.

However, the disclosure of information in respect of specific assessees is prohibited except as per the provisions of section 138 of the Act.

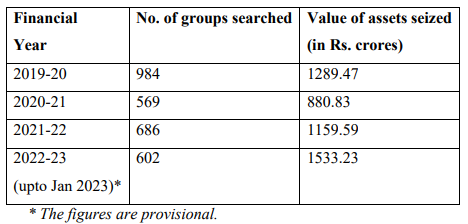

Details with respect to searches conducted in the country in the last three financial years are as follows:

Other data is not maintained centrally.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"