The Registrar of Companies under Ministry of Corporate Affairs has imposed Penalty of Rs.300000 for Non-Maintenance of Registered Office.

Reetu | May 26, 2023 |

Penalty of Rs.300000 imposed by MCA for Non-Maintenance of Registered Office

The Registrar of Companies under Ministry of Corporate Affairs in matter of M/s. SRRM Courier and Cargo Private Limited has imposed Penalty of Rs.300000 for Non-Maintenance of Registered Office.

SRRM Courier Private Limited (U63040GJ2014PLC081585) (herein after referred to as “company”) is a registered company with this office under the provisions of the Companies Act, 1956/2013 having its registered office at 309, K10 Atlantis Sarabhai Compound, Vadodara. Gujarat-39111, India.

While adjudging quantum of penalty under section 12(B) of the Act, the Adjudicating Officer shall have due regard to the following factors, namely;

a. The amount of disproportionate gain or unfair advantage, whenever quantifiable, made as a result of default.

b. The amount of loss caused to an investor or group of investors as a result the default.

c. The repetitive nature of default.

With regard to the above factors to be considered while determining the quantum of penalty, it is noted that the disproportionate gain or unfair advantage made by the noticee or loss caused to the investor as a result of the delay on the part of the notice to redress the investor grievance are not available on the record. Further, it may also be added that it is difficult to quantify the unfair advantage made by the notice or the loss caused to the investors in a default of this nature.

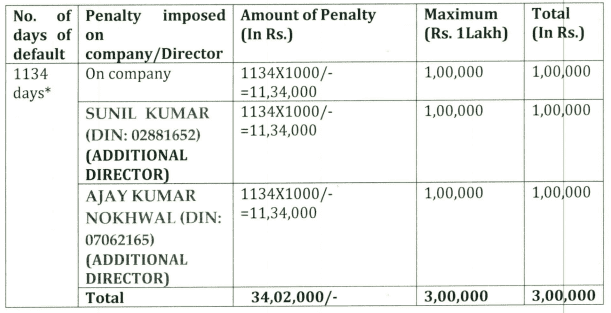

Having considered the facts and circumstances of the case and after taking into accounts the factors above, the undersigned has reasonable cause to believe that the company and its officers have failed to maintained its registered office as per the requirement of Section 12(1) of the Companies Act, 2013 i.e, 28.12.2017 to 04.02.2021. I hereby imposed a penalty on company and Directors as per table below for violation of section 12(I) of the Companies Act, 2013. I am of the opinion that penalty is commensurate with the aforesaid failure committed by the Noticees:

The noticee shall pay the amount of penalty individually for the company and its directors (out of own pocket) by way of e-payment (available on Ministry website) under “Pay miscellaneous fees” category in MCA fee and payment Services within 90 (ninety) days of this order and the Challan/SRN generated after payment of penalty through online mode shall be forwarded to this office.

Appeal if any against this order may be filed in writing with the Regional Director, North Western Region, Ministry of Corporate Affairs, ROC BHAVAN, OPP. RUPAL PARK, NR. ANKUR BUS STAND, NARANAPURA, AHMEDABAD (GUIARAT)-380013 within a period of sixty days from the date of receipt of this order, in Form ADJ setting forth the grounds of appeal and shall be accompanied by the certified copy of this order. [Section 454 of the Companies Act, 2013 read with the Companies (Adjudicating of Penalties) Rules, 20t4 as amended by Companies (Adjudication of Penalties) Amendment Rules, 2019].

Please note that as per the provisions of Section 454(8) (i) of the Companies Act, 2013, where company does not pay the penalty imposed by the Adjudicating Officer or the Regional Director within a period of Ninety days (90 days) from the date of the receipt of the copy of order, the company shall be punishable with fine which shall not be less than twenty five thousand rupees but which may extend to five lakhs rupees. Further as per of Section 454(8) (ii) of the Companies Act,2013, where an officer of a company who in default does not pay the penalty within a period of Ninety days (90days) from the date of receipt of the copy of the order, such officer shall be punishable with imprisonment which may extend to six months or with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees, or with both.

For Official Order Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"