The Income Tax Department has issued an update regarding Tax Audit for Financial 2022-23 on their official income tax portal.

Reetu | Jul 7, 2023 |

Income Tax Portal Update for Tax Audit FY 2022-23

The Income Tax Department has issued an update regarding Tax Audit for Financial 2022-23 on their official income tax portal.

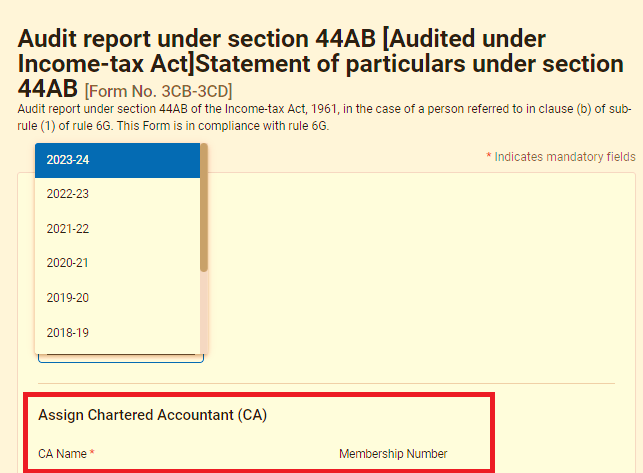

The IT department has made an option live on the income tax portal, where you can now assign a Chartered Accountant for Form 3CA/3CB-3CD for AY 2023-24.

Tax Audit Report in the event of a taxpayer with business or professional income who is obligated to have his or her accounts audited under another Act (other than the Income Tax Act).

Tax Audit Report for a taxpayer with business or professional income who is not required to have his or her accounts audited under any other Act (other than the Income Tax Act).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"