Reetu | Jul 28, 2023 |

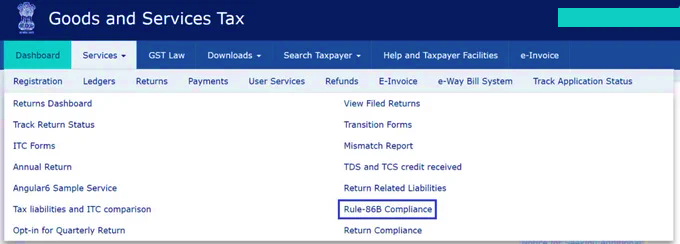

GST Portal Update: GSTN introduced New Tab for Rule 86B w.r.t. Electronic Credit Ledger

The Goods and Services Tax Network(GSTN) has issued an update regarding the introduction of the New Tab Rule for 86B which limits the use of amount accessible in the Electronic Credit Ledger.

The Input Tax Credit (“ITC”) accessible in a registered person’s Electronic Credit Ledger is subject to a 99% restriction under this rule. This requires 1% of the production liability to be paid in cash.

The limitation applies when the value of taxable supply in a month, excluding exempt and zero-rated supply, reaches Rs.50 lakh Rupees.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"