Reetu | Aug 11, 2023 |

Know Minimum Professional Fee recommended by ICAI on Income Tax Returns Filing

Following the end of the Income Tax Returns (ITR) filing period, there have been comments on social media over the fees charged by Chartered Accountants (CAs).

Certain individuals have stated that the experts charge minimal prices, while others have explained that the pricing structure is dependent on the client’s circumstances and the difficulty of the duties required.

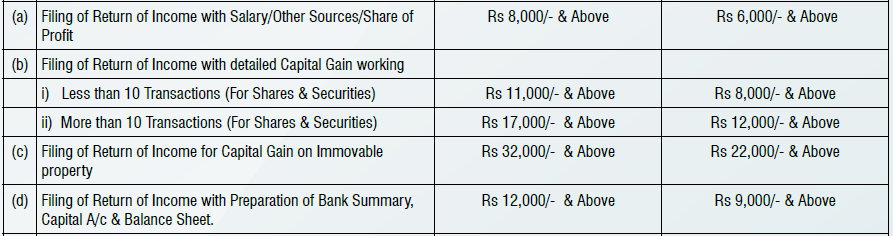

However, it is important to understand the Institute of Chartered Accountants of India’s (ICAI) minimal cost for ITR filing. The Institute of Chartered Accountants of India’s (ICAI) Committee for Capacity Building of Members in Practise (CCBMP) has specified the minimum suggested scale of remuneration for professional assignments performed by CA Institute members.

Fees for Filing of Return of Income

The fees indicated above are meant to help Small and Medium Practitioners. Professionals can also charge fees that surpass this rate based on their skill, customer base, and the scope of the activities to be completed.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"