The Central Board of Indirect Taxes and Customs (CBIC) has released Instructions for Monetary Limits in Government Litigation Appeals via issuing Notifications.

Reetu | Nov 6, 2023 |

CBIC released Instructions for Monetary Limits in Government Litigation Appeals

The Central Board of Indirect Taxes and Customs (CBIC) has released Instructions for Monetary Limits in Government Litigation Appeals via issuing Notifications.

The Notification Stated:

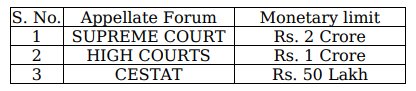

In exercise of the powers conferred by Section 131BA of the Customs Act, 1962 and in partial modification of earlier instruction issued from F. No. 390/Misc./163/2010-JC dated 17.08.2011, the Central Board of Indirect Taxes and Customs (hereinafter referred to as the Board) fixes the following monetary limits below which appeal shall not be filed in the CESTAT, High Court and the Supreme Court:

Adverse judgments relating to the following should be contested irrespective of the amount involved:

a) Where the constitutional validity of the provisions of an Act or Rule is under challenge;

b) Where Notification/ Instruction/ Order or Circular has been held illegal or ultra vires;

c) Classification and refund issues which are of legal and/ or recurring nature.

Withdrawal process in respect of pending cases in above forums, as per the above revised limits, will follow the current practice that is being followed for the withdrawal of cases from the Supreme Court, High Courts, and CESTAT.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"