Priyanka Kumari | Dec 12, 2023 |

Stationery items commonly used by school and college attract concessional GST: MOF in Rajya Sabha

The Ministry of State Shri Pankaj Chaudhary in the Ministry of Finance in a written reply to a question raised in Rajya Sabha said, “Stationery items commonly used by schools and colleges attract concessional GST”.

Shri Abdul Wahab asked these questions in Rajya Sabha:

Will the Minister of Finance be pleased to state:

(a) whether it is a fact that stationery items that is mostly used by school and college going students are kept under higher GST slabs;

(b) if so, the reason and rational for keeping these items under higher GST;

(c) whether it is also a fact that, GST for taking online education that has largely democratised Indian education system, is under 18 percent slab;

(d) if so, the reason and rational for keeping such higher GST on online education; and

(e) whether Government will consider bringing down the GST for both stationery items and online education in the interest of our aspiring students?

The Ministry of State replied:

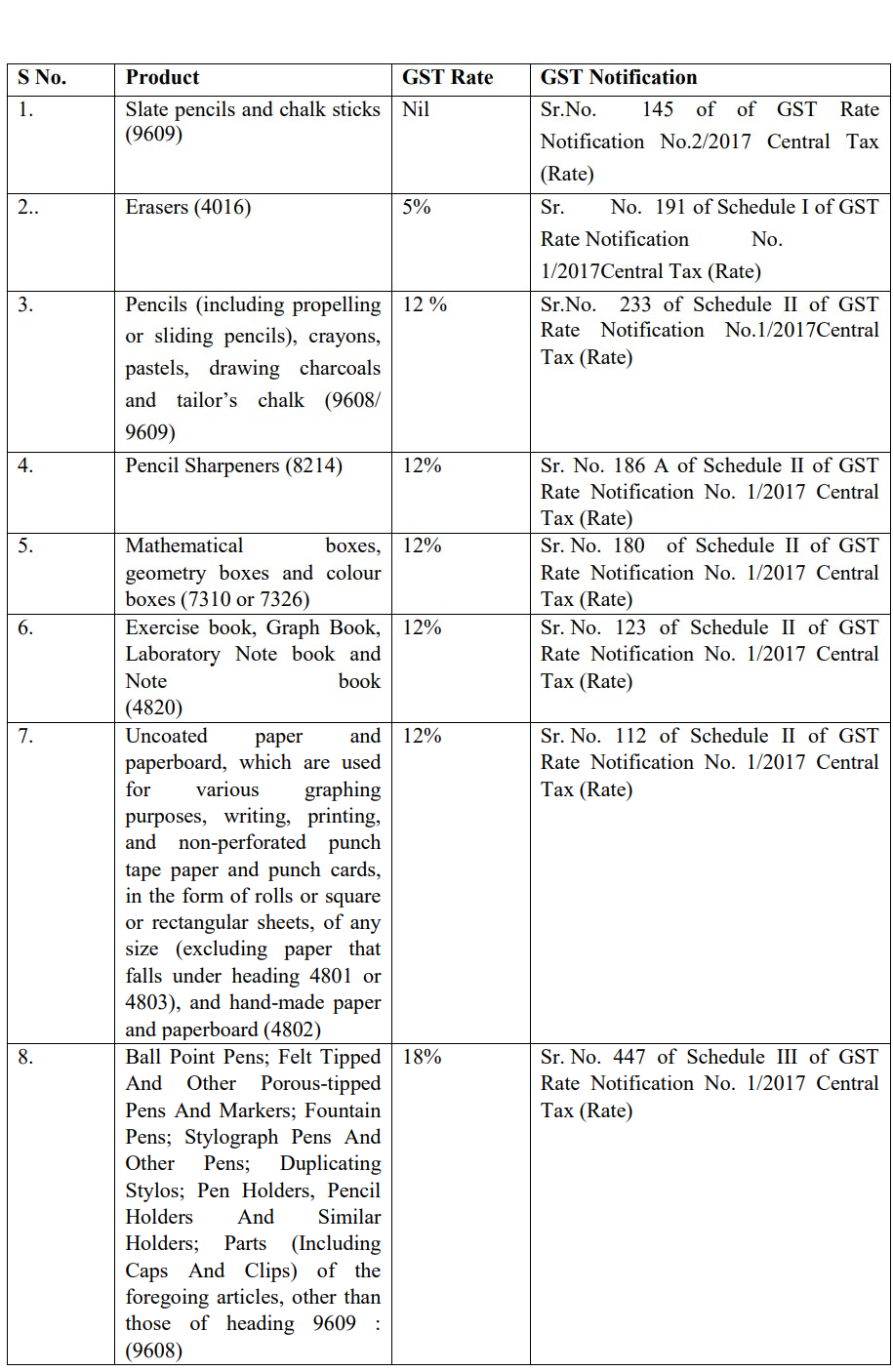

(a) and (b): GST on stationery items commonly used by school and college-going students attract concessional rates ranging from NIL to 12%, except pens which attract 18% GST.

(c) and (d): Services, including online education, provided by an educational institution, i.e. an institution providing services by way of, – (i) pre-school education and education up to higher secondary school or equivalent; (ii) education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force; (iii) education as a part of an approved vocational education course provided to its students, faculty and staff are exempt from GST.

(e): There is no such proposal. The GST rates and exemptions are notified on the recommendations of the GST Council, which is a constitutional body comprising members from Union and State Governments.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"